Stock markets are in bubble territory: Uday Kotak

In December 2017, when all and sundry were bullish about stocks, Uday Kotak, the self-made 9x Billionaire, had sent the chilling warning that stock markets are in “bubble territory”.

The rationale canvassed by the Billionaire was quite simple, namely, that as savers are moving money from debt to equity, there is too much money chasing stocks and valuations have become frothy.

Unfortunately, we ignored the wise counsel of the Billionaire.

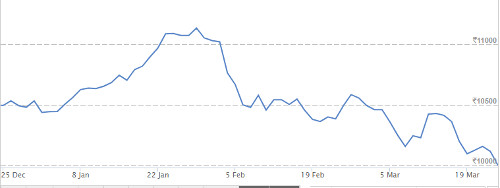

Since then, the Nifty has tumbled from the peak of 11,130 touched on 29th January 2018 to the present 9951, a loss of 10%.

Individual small-cap and mid-cap stocks have obviously lost much more in the correction.

When savers move money from debt to equity since debt is risky in rising interest rates we are in bubble territory. Savers need to be alert.

— Uday Kotak (@udaykotak) December 24, 2017

Share of Private Banks will rise from 30% to 50%

In his latest interview, Uday Kotak has predicted that there will be a shift in loan growth from PSU Banks to private banks and that the share of the private banks will increase from 70:30 to 50:50.

“On a delta basis, nearly the entire growth in the loans is happening in private sector banking whose share is growing pretty significantly. I am happy to make a statement that in the next five years, this 70:30 ratio will move towards 50:50,” the Billionaire said.

PSB 2.0 | @udaykotak To CNBC-TV18 : Assuming organic growth of private banks such that their share goes up from 30% to 50% market share pic.twitter.com/G1bji7JmtY

— CNBC-TV18 (@CNBCTV18Live) March 20, 2018

What @udaykotak has to say about the future of Indian banks.https://t.co/trMONBQCyS pic.twitter.com/MWoetdzpEi

— BloombergQuint (@BloombergQuint) March 20, 2018

The fact that PSU Banks are slowly and steadily losing share to their private counterparts is corroborated by Tamal Bandyopadhyay, an authority on the banking sector, based on RBI data.

There are 21 PSBs. So, not 1/3rd of pvt banks. And, yes, their share in banking assets has been on a steady decline. RBI data say that

— Tamal Bandyopadhyay (@TamalBandyo) March 21, 2018

Private financiers will grow at 27% CAGR

Basant Maheshwari has interpreted Uday Kotak’s pronouncements to mean that if the entire banking industry grows at 15%, private banks and NBFCs will have to grow at 27% CAGR in order to close the gap with their PSU counterparts.

Reading between the lines from this @udaykotak interview. A 30:70 ratio between private and public moving to a 50:50 ratio in 5 years assuming a 15% industry credit growth means a 27% CAGR for private financiers. Smaller companies in niche segments can grow faster ! https://t.co/CgZQNlSM6x

— Basant Maheshwari (@BMTheEquityDesk) March 21, 2018

No doubt, a growth rate of 27% is indeed scorching and will generate several mega multibaggers.

Basant hinted that smaller companies in niche segments can grow faster.

It is obvious that Basant is referring to his all-time favourite stocks PNB Housing Finance and Can Fin Home Finance.

Basant has made it clear on umpteen occasions that he is “super, super bullish” about these stocks.

He has also predicted that one of the HFCs will quote in “five figures” in the foreseeable future.

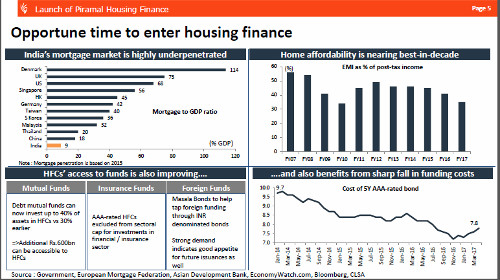

It is also relevant to note that Billionaire Ajay Piramal, who is reverentially referred to as the “Warren Buffett of India” also opined that the time is opportune for housing finance stocks to prosper given the huge demand for housing and the thrust of the Government.

(Extract from presentation by Piramal Home Finance. Click for larger image)

In fact, the lure of housing finance stocks is so strong that even Ramesh Damani, who has been hitherto allergic to financial stocks, bought a massive chunk of a high-quality HFC stock.

Robust India growth story will be serviced by smaller and nimbler financial entities: Mudar Patherya

Mudar Patherya has endorsed the theory propounded by Uday Kotak and Basant Maheshwari with regard to the humongous growth prospects for private banks.

In his latest article, he has explained that the remarkable success of Au Small Finance Bank’s IPO is a signal that investors seek to distance from large public sector behemoths and would rather back smaller, faster and more dynamic entities.

Mudar has also opined that Au Small Finance Bank is a validation of how the robust India growth story will be increasingly serviced by smaller and nimbler financial entities.

Conclusion

It is obvious that if private banks and NBFCs are to grow at 27% CAGR, they will have to form a core part of our portfolio. We should take advantage of the dips to tuck into high-quality HFC stocks and also private banks and NBFC stocks and prepare for the gains to gush into our portfolios!

In my view, in addition to pvt banks, nbfc and HFC, Insurance is also a Secular growth story for decades.I am interested to keep insurance sector stocks in my long term portfolio. No recommendation but for discussion.

Yes, I agree with you on banks, NBFCs and of course insurance as pointed by you. The only problem is that all insurance, private banks and HFCs are very expensive even after recent correction.

And just to clarify on the dream budget of PC Chidambaram, he was always a Congressman. He had formed Tamil Manila Congress as a rebel faction after breaking away from Indian National Congress. The govt. he was a part of was supported by Indian National Congress from the outside. As then FM he brought about tax amnesty scheme which granted a virtual freeway to all people who declared black money. No tax was required to pay. Then later he rejoined Indian National Congress.

Nothing wrong with it. I am also lifelong supporter of Congress. I also want BJP mukt Bharat.

I am all support for you sir or madam.

So will Karnataka Bank will be again called a sitting duck multibagger 🙂

Once PSB Banks make the system tighter, Nirav Modis and Chokhis will find their friends in private banks. Mr Kotak has also said that private sector banks and have also big NPAs.