Business model impaired by NAMO’s surgical strike?

The common perception amongst the intelligentsia and the masses is that NAMO’s crackdown on black money by demonetizing currency notes of Rs. 500 and Rs. 1000 has seriously impaired Delta’s revenue model.

I expressed the view in my piece (see NAMO’s Surgical Strike Sinks Fav Stock Of Rakesh Jhunjhunwala and Kalpraj Dharamshi) that the high rollers who frequent the casinos to squander their stashes of cash (probably ill-gotten) would find their wings clipped after the demonetization move.

Vijay Kedia endorses this view

This view found implicit acceptance from Vijay Kedia, one of the finest investing minds of our times. When one of his followers asked him how long it would take Delta Corp to recover and whether it is a good long-term buy at present, Kedia’s reply was scathing:

I have yet to see somebody who swipes to gamble in the casino. https://t.co/zaJ4dpt8II

— Vijay Kedia (@VijayKedia1) November 17, 2016

It is implicit from Vijay Kedia’s reply that he regards Delta Corp’s business model as dead because the gamblers no longer have (unaccounted) cash to splurge on the gambling tables and they will be loath to use their accounted funds for this purpose.

The same view was expressed earlier by other knowledgeable observers:

Delta Corp lower circuit. Biz model goes out of the window with cash

— Darshan Mehta (@darshanetnow) November 9, 2016

#Delta Corp:From Casino to "Cash No" in a single night. The worst affected company of this black money move.

— Arun Mukherjee (@Arunstockguru) November 9, 2016

No commentary by Delta Corp on impact of demonetization

It is notable that while several other companies have waxed eloquent on the impact that demonetization will have on their business model, Delta Corp has maintained a studied silence.

The studied silence is surprising especially bearing in mind that the stock plunged 20% and tripped the lower circuit amidst fears that the demonetization would cripple the business model.

The issue of impact of demonetization on Delta Corp has been talked about in the press and also in Quora.

One inference that can reasonably be drawn from the silence is that the management accepts that cash ban will severely prejudice business operations.

What about the threat by Arvind Kejriwal to ban casinos?

Delta Corp faces yet another threat in the form of Arvind Kejriwal, the eccentric leader of the Aam Aadmi Party, who has vowed in the election manifesto that he will ban casinos if AAP is elected to power in Goa (see article).

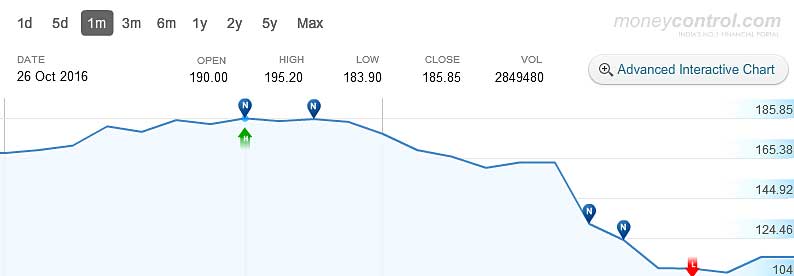

Stock is on a free-fall

The result of both threats is that Delta Corp has been on a free fall. After soaring to a high of Rs. 195 on 26th October 2016, the stock plunged to a low of Rs. 100 on 15th November 2016, losing a whopping 48% of its value in about two weeks.

Understandably, the sentiment amongst investors for the stock is very weak.

But Rakesh Jhunjhunwala turns contrarian

Today, there was great excitement on Dalal Street because Rakesh Jhunjhunwala paid one of his rare visits to its hallowed gold-paved streets. The Badshah made a beeline for the Delta Corp counter and scooped up a massive chunk of 12,50,000 shares at Rs. 106.54 each. The investment made was Rs. 13 crore.

This is Rakesh Jhunjhunwala’s fourth visit to the Delta Corp counter. His previous visits are as follows:

| Date | Stock Bought | Rate (Rs) |

| 02.02.2015 | 12,50,000 | 89.12 |

| 02.02.2015 | 12,50,000 | 91.75 |

| 20.08.2015 | 35,00,000 | 70.56 |

However, the above is only a tip of the iceberg of Rakesh Jhunjhunwala’s investment in Delta Corp. As of 30th September 2016, he holds 115,00,000 shares in his own name and 110,00,000 shares in the name of his wife, Rekha Jhunjhunwala.

The total investment of 2,25,00,000 shares is worth Rs. 250 crore.

Investment in Delta Corp is very petty compared to the size of the portfolio

Rakesh Jhunjhunwala’s action is quite intriguing. His total portfolio value is about Rs. 10,000 crore (give or take a few thousand crore). The investment in Delta Corp of about Rs. 250 – 300 crore is barely 3% of the portfolio.

The incremental investment of Rs. 13 crore made by Rakesh Jhunjhunwala today is barely 5% of the investment already present in Delta Corp. As a percentage of the total portfolio, it is not even equal to the petty cash.

Why the Badshah would take the trouble to come to Dalal Street for such a petty amount is mystifying.

Penchant for investing trifling sums in stocks

One of Rakesh Jhunjhunwala’s quirks is that he has a penchant for investing petty amounts in stocks.

In December 2012, he invested a princely sum of Rs. 1.25 crore in a company called Compucon Software. Later, in January 2015, he bought stock in a micro-cap called Man Infra by investing Rs. 10.80 crore. There are several other instances which even I have not bothered to document because they appear to be non-serious investments.

Needless to say, these are meaningless investments because even if they become ten-baggers, they will not move the needle in Rakesh Jhunjhunwala’s portfolio.

Conclusion

It is not possible to confidently decipher Rakesh Jhunjhunwala’s objective in making the incremental investment in Delta Corp. It is possible that he does not believe that the threats posed to Delta Corp’s business model by demonetisation and Arvind Kejriwal’s election manifesto are life-threatening. Maybe, he is taking advantage of the crash in the stock price to slowly load up on the stock. On the other hand, he may be playing a trading gamble that the stock is oversold and could see a small bounce in the near future. Hopefully, we will know which of the two is correct in due course of time!

Now RJ has made novice investors confused – to buy or not to buy.

He is an expert, who can challenge the one and the only RJ….

Delta corp is overvalued in the present scenario.out has to be very long term for getting meaningful returns .

RJ is on the board of the company and as good as a part owner. He had to BUY to give confidence to the shareholders. A smart move by RJ. BUT, but for small investors to BUY now would be downright stupid. As Arjun rightly said, this is pocket change for RJ and he can afford to lose this money. This stock has ONLY reached this level because of RJ’s investment in it. It is a DUD stock. All it has two and half casinos pan India ( OK, may be three and half) . Never invest in any stock which comes under the radar of the Indian govt and their silly and ever changing policies.

I sold off 70% of my holding in view of the recent developments. Needless to say I am not bullish on Delta’s prospects over the medium term.

I want to know your opinion ro point of view, on who bought or still want to buy (BSE: 524470) Syncom Formulations!

Is it right time to buy this stock?….. and what is the strategy who bought this stock at very high price?

Thanking You

Perhaps RJ sold good chunk of his holding in Delta Corp after currency demonetisation and covered it now.

what happened to Arjun..keeping silent like urjit patel.

Where are u r sir… No post since long time