Akash Prakash Dumps, Rakesh Jhunjhunwala Buys, Tata Communications

The stock market is a zero-sum game, Gordon Gekko rightly observed.

One man’s fortune is another man’s poverty.

Akash Prakash‘s Amansa Capital is a devoted and long-standing shareholder of Tata Communications, alias VSNL.

As of 31st March 2019, Amansa held a colossal quantity of 52,68,224 shares of Tata Comm.

Unfortunately, on 30th September, it was ill-advised to dump a consignment of 18,52,638 shares on Dalal Street.

Rakesh Jhunjhunwala, the Badshah of Dalal Street, was alerted to the situation.

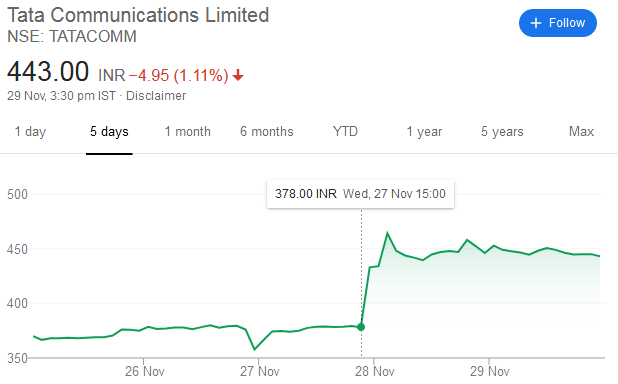

He rushed in and bought a chunk of 19,65,000 shares at the throwaway price of Rs. 370 each.

Akash Prakash got a nasty shock a few days later because the stock surged like a rocket and breached the upper circuit.

The CMP is Rs. 443 which means that Akash Prakash and Amansa have deprived themselves of handsome gains of Rs. 13.50 crore, which was delivered on a platter.

Anyway, there is no point in crying about spilt milk though Akash Prakash will be well advised to hold on tight to his remaining stock of Tata Communications.

Tata Communications

Rekha Rakesh Jhunjhunwala acquired 19.65lk shares (0.69%) at Rs 370 eachAmansa Holding sold 15.52lk shares (0.65%) at Rs 370 each

If u want to know why Tata Comm has been rallyinghttps://t.co/2s3lZgSAFt

— Darshan Mehta (@darshanvmehta1) October 1, 2019

Chandra is “God’s Gift” To The Tatas

Rakesh Jhunjhunwala is very fond of the Tata Group and of N. Chandrasekaran, its boss man.

He has described Chandrasekaran as a “God’s gift” and opined that the flagship companies of the Tata group will delight investors.

“My role model on life are the Tatas“, the Badshah gushed, in unabashed admiration.

Big Bull Rakesh Jhunjhunwala on Tatas : "My role model on life are the Tatas. And the Tata group is blessed to have N Chandrasekaran as chairman." @TataCompanies https://t.co/Qrdd6IlUNd

— Chandra R. Srikanth (@chandrarsrikant) July 24, 2018

The Badshah is also a long-standing shareholder of Tata Communications.

He bought his first tranche of 16 lakh shares in July 2013 and later increased it to 20 lakh shares.

Tata Comm: Rakesh Jhunjhunwala has picked up 16 lk shares in block deal: Srcs

— ET NOW (@ETNOWlive) July 23, 2013

As of date, he holds 39 lakh shares, after including the purchase from Akash Prakash’s Amansa Capital.

Demerger of surplus land has made Tata Comm irresistible to ace investors

The reason why ace investors are making a beeline for Tata Comm is cogently explained by Nigel D’Souza of CNBC TV18.

It appears that Tata Communications has surplus land of 770 acres in Pune, Kolkata, New Delhi and Chennai.

The land is valued at nearly Rs 10,000-14,000 crore.

The land is to be demerged to a company named ‘Hemisphere Properties’.

This will cause enormous ‘value unlocking‘ to take place.

All shareholders will receive shares in Hemisphere Properties which is conservatively (after a 60% discount) valued at between Rs 160 and Rs 170 per share.

According to an article in Bloomberg, the demerger could not take place so far because of draconian implications of Capital Gains tax.

However, this hurdle has now been removed thanks to amendments in the Income-tax law.

It was also noted that the company has reported a strong performance in the quarter ended June on the back of benefits of an internal transformation programme, growth in services segment and large order book in innovation services segment.

Its core revenue grew by nearly six percent – the most in at least 13 quarters – while operating profit margin was 19.8 percent, the highest in at least the last 17 quarters.

Tata Communications trade has worked well

CMP ( Rs.450/-) higher than the price on its Demerger record date (Rs.430/-)Additional Boost

Shares of Hemisphere Properties India (Land bank) are yet to get credited

This can fetch additional 160 to 170/shhttps://t.co/2haQLmAJvT— Nigel D'Souza (@Nigel__DSouza) November 29, 2019

Tata Communications is on verge of “multi year breakout”

According to Rakesh Bansal, an expert in fundamental and technical analysis, Tata Communications is exhibiting clear signs of a “multi-year breakout“.

Stock is

Tata Communication

Multi-year breakout

Covered on @ZeeBusiness today in afternoon show at 380-383 levels

With @kunalsaraogi @AnilSinghvi_ https://t.co/6JTKk58LPz— Rakesh Bansal (@iamrakeshbansal) November 27, 2019

The stock surged like a rocket and breached the upper circuit limit of 20% after Anil Singhvi, the charismatic editor of ZEE Business, referred to it in his programme.

Naturally, lucky investors who grabbed the stock were delirious with joy at the massive gains that effortlessly gushed into their pockets.

Mind-blowing call on Tata Comm @iamrakeshbansal @kunalsaraogi ?????? (20% up in 10Mins!!)@AnilSinghvi_ Thanks 4 having these gems on your show

— Sherlock Holmes ?? (@SherlockProbes) November 27, 2019

An outstanding call on tata Communication. You guys are amazing. It went up faster then blink of an eye. Kese karlete ho aap? @kunalsaraogi @iamrakeshbansal @AnilSinghvi_

— Patel Parth (@patelparth110) November 27, 2019

Excellent call in TATA Communication from 375 to 425 kya baat hai. Ab IndiaMart ki baari hai. Jai Ho @iamrakeshbansal

— Aashish ?? (@ATulsaan) November 27, 2019

@iamrakeshbansal @kunalsaraogi Sir booked 40 k in #Tatacomm in just 10 mins…Rocking call .rest of profit i will book at your final target..Koti koti Dhyawaad Sir..?????????? @AnilSinghvi_

— Harjeet Singh (@hsigroha) November 27, 2019

What about the dreaded AGR liability?

Tata Communication is also a helpless victim of the dreaded AGR (Adjusted Gross Revenue) liability arising from the recent judgement of the Supreme Court.

According to FICCI, the AGR ruling will lead to the “collapse of the telecom sector” and also have a cascading effect on Banks and other dependents.

Supreme Court's AGR ruling will lead to telecom sector's collapse: FICCI to FM https://t.co/WtK2dODMue

— TOI Business (@TOIBusiness) November 29, 2019

ICICI Direct has explained the implications of the AGR ruling on the fortunes of Tata Communications in the following manner:

“AGR case- company expects liability of Rs 1200 crore as on FY19

TCL said it has received a demand from Department of Telecommunication (DoT) for Rs 6633 crore, towards license fee on AGR. Out of this, Rs 5400 crore is due to accounting difference on account of accrual basis vs. actual basis. It further indicated that it has already submitted revised accounting based on actual basis. The contingent liability from AGR is ~Rs 1200 crore as on FY19 end, including interest & penalty. The company also reiterated that ILD/NLD license is separated from UASL due to differences in contracts. Consequently, the ILD/NLD that gets deduction for call charges, access charges and other income are not part of AGR unlike telcos.”

ICICI Direct recommended a ‘hold’ of the stock on the following rationale:

“Valuation & Outlook

The strong performance of the data segment is impressive. However, we would monitor innovation services (major chunk of five year growth plan) traction given it would require continuous investments keeping margin expansion under check.

We continue to maintain our HOLD rating on the stock, valuing at EV/EBITDA multiple of 6.5x for data and 2x for voice FY21E EBITDA, respectively.

We deduct Rs 1300 crore (Rs 46/share) for AGR liability to arrive at our target price of Rs 380/share.”

Motilal Oswal has also maintained a “neutral” stance on the stock on the following rationale:

“Valuation and view: We value TCOM on an SOTP basis and cut our target multiple to 6x/2x on FY21E Data/Voice EBITDA, given its slow earnings growth, allocation of Traditional and Growth EBITDA to other segments and continued high capex. Subsequently, we arrive at a TP of INR420 (prior: INR520) and maintain our Neutral stance. Additional monetization opportunity of TCOM’s surplus land parcel could provide an option value.”

If it is only for the sake “land holding”, then I think it is a short term view and may be that RJ has invested for short term fast buck. Otherwise a Company with a contingent liability of Rs. 6633 crores is definitely not a buy candidate. Particularly with Government’s and Supreme Court’s interpretation and tough stand on AGR.

Then why did akash prakas dump it?