Stellar quarter, priced-in, FY25 key!

Overview

► Hospitality industry is expected to report another robust quarter with industry RevPAR growth of ~17-18% driven by ARR. Historically, listed players have done well vs. industry due to their superior brand positioning, pricing power, S&M engine and execution skill-set. However, as the smaller / unorganized / unlisted players’ catch-up we expect the listed company’s performance to be at par with industry average. These is partly on account of higher base. Overall revenue growth to be 14-15% on account of marginally lower growth rate in F&B / other operating income similar to past few quarters trend.

► We estimate IHCL/Lemon Tree (LT)/Chalet/MHRIL to report revenue growth of ~14.9/14.6/24.3/8.2%. YoY. EBITDA is expected to grow by 17.1/8.9/34.4/(0.6)% YoY. Chalet’s Hotel business revenue/EBITDA growth would be robust ~24.4/38% YoY.

► For Lemon Tree, EBITDA to trail revenue growth on account of higher R&M costs for ~900-1000 rooms (~20% of the portfolio) which is under renovation. For MHRIL, EBITDA to trail revenue growth on account of higher S&M spend and rent costs on new rooms additions.

Outlook

► FY23 had been a healthy growth year and so shall be FY24 for the hospitality industry. Stock prices and valuations broadly captures this optimism. Sustenance of RevPAR growth in FY25 (we estimate high single-digit) is key for the current valuations and optimism to sustain. These is especially as growth starts to moderate on high base – key risk in our view.

► As per our discussion with industry leaders, during national elections there is bit of moderation in business occupancies and thus in ARR. We are unable to establish the same from data. Further, their also remains a risk of shift in IPL outside of India. During 2009 elections, IPL was held in South Africa and during 2014 it was held jointly in India & UAE. In the most recent 2019 elections, the IPL was held in India only. We guess the IPL may be held in India only. But if it is held outside India, it would be negative for Indian hospitality companies.

► Lastly, Chalet has highest salience in Mumbai city (especially in Airport cluster viz. JW Mariott and Westin Powai). With newly opened hotels of Aurika by Lemon Tree (largest in India with 670 rooms) and Ginger Santacruz (371 rooms) in recent months and upcoming Fairmont next year, we believe the occupancy and thus ARR for Chalet could be under pressure for its largest JW Marriott, Mumbai.

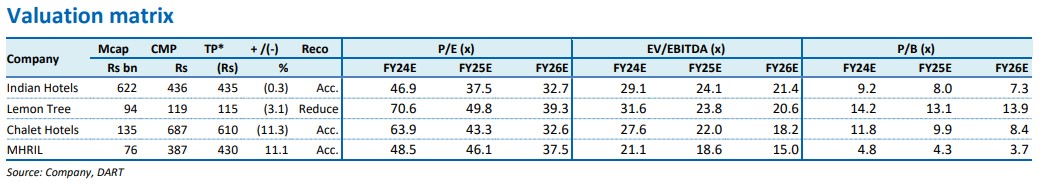

► We find MHRIL, SAMHI and EIH (not in coverage) to be better positioned from risk-reward perspective in the Hospitality space.

Click here to download Review of 4 Hotel Stocks by Dolat Captial