Glorious multibaggers in the Coffee Can Portfolio

It cannot be disputed that Saurabh Mukherjea‘s periodic stock recommendations have led to immense profits for us.

Some names that come readily to mind include Bajaj Finance, Asian Paints, Divi’s Lab, Dr. Lal Pathlab etc.

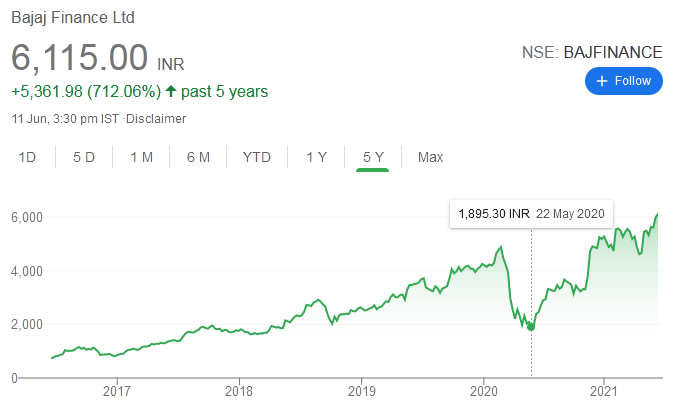

It is notable that Bajaj Finance is presently coasting at its all-time high of Rs. 6120 despite many so-called Pundits condemning the stock for its alleged steep valuations.

Saurabh had strongly recommended Bajaj Finance during the depths of the Corona crisis in May 2020 when the stock had plunged to an unbelievable level of Rs. 1800.

“Don’t get caught up in the near term forecasts, focus on long term. Bajaj Finance, HDFC Bank, Kotak Bank look incredibly ‘juicy’, attractive at this level,” he had rightly advised.

Saurabh Mukherjea says don's get caught up in the near term forecasts, focus on long term. Bajaj Finance, HDFC Bank, Kotak Bank look incredibly 'juicy', attractive at this level

Premium financials in NBFC space, auto look very attractive— avanne dubash (@avannedubash) May 11, 2020

The stock is up 240% since then.

HDFC Bank and Kotak Bank, which are proxies for the Indian economy, are also doing well and notching up hefty gains.

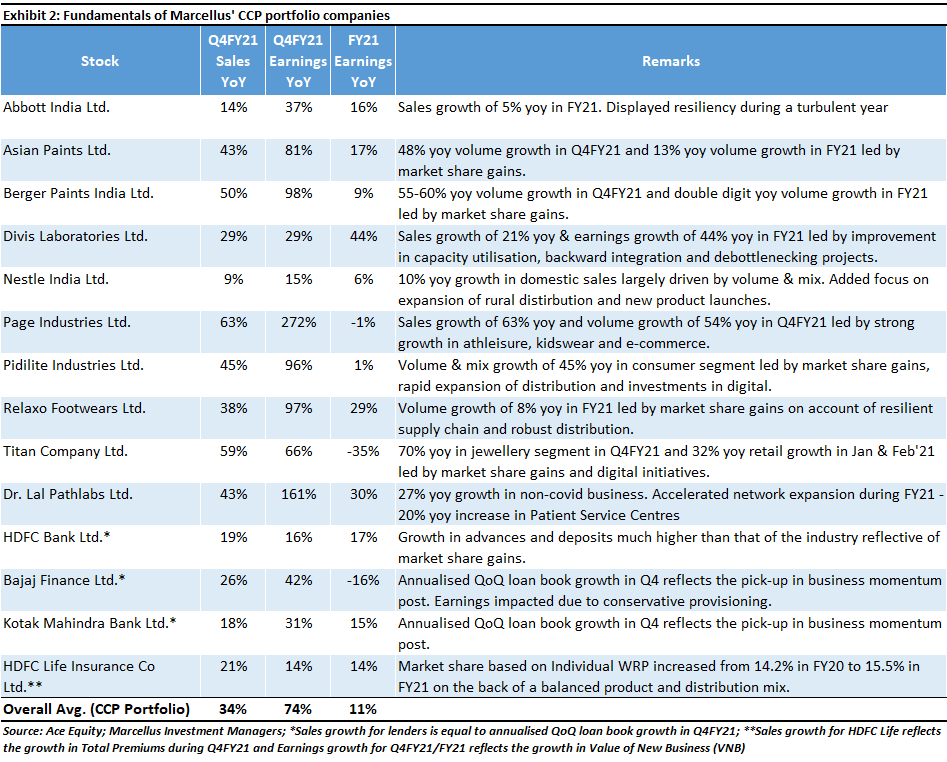

“We have got large companies where we get free cash flows compounding at 30% regularly. The free cash flow of Page Industries compounded at 35% in the last five years. Asian Paints, one of my favourite stocks, gave us free cash flow compounding at 20% in the last five years. We have had Titan giving us free cash flow compounding at 45-50% in the last five years,” Saurabh explained.

(Latest Portfolio of Marcellus’ CCP stocks)

Little Champs are on a much stronger footing now than pre-Covid-19

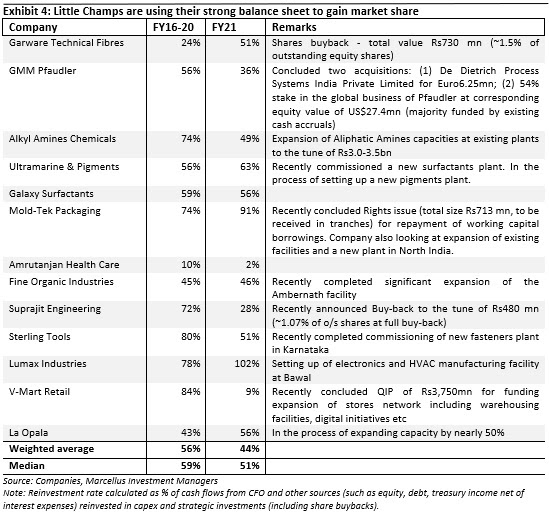

The stocks in the Little Champs portfolio are well-known for their aggressive dominance of the market place.

It is customary for these stocks to snatch market share from their weaker peers.

“The recovery in revenues and earnings have been helped by the fact that majority of the portfolio companies cater to resilient end-user industries like pharma, food, FMCG, etc. Secondly, most of our portfolio companies have witnessed market share gains against their weaker competitors“, Saurabh pointed out in his latest newsletter.

“The Little Champs are much better positioned to gain market share (courtesy their superior balance sheet strength) and much better placed to weather the near-term disruptions emanating from future Covid waves and commodity price inflation,” he added.

(Latest Portfolio of Little Champs stocks)

Galaxy Surfactants is also a dominant franchise

Saurabh has announced that Galaxy Surfactants, a mid-cap stock with a market capitalisation of 11,000 crore, is his latest pick.

“I recommend cleaning and personal care front. The behaviour is changing steeply. Over the past year or so, we have built a substantial position in Galaxy Surfactants. This is the largest manufacturer of surfactants in the country and supplies to companies like Unilever. It also has a large business which supplies chemicals which go into personal care products like lotions and skin care and so on,” he stated.

He pointed out that Galaxy is a supplier of raw materials to FMCG giants like HUL and Proctor & Gamble.

“Whether you buy cleaning products and personal care products through Unilever or P&G, ultimately the raw material is coming from Galaxy Surfactants,” he said.

“It is the neatest way to play this significant lasting upsurge in consumer behaviour where they buy more cleaning and personal care products,” he added.

Saurabh also emphasized that Galaxy also has a substantial export franchise and its PAT has been compounding at around 20-22 per cent for the last five years.

“They have a dominant franchise, strong balance sheet, clean management team and strong R&D capability. That’s what really drew us to this franchise,” he said.

It is notable that Galaxy Surfactants has already been on a multibagger trajectory. The stock is up 135% over the past 12 months and 63% over the past 6 months.

However, given the numerous virtues pointed out by Saurabh, we can confidently expect more multibagger gains to gush out of the stock!