Pharma stocks are at 5 year lows, time is ripe to buy them

It is well known that Pharma stocks are presently in the doldrums and quoting at throwaway valuations.

This is because the domestic pharma sales growth has dipped to a two-year low in October.

According to a report in Bloomberg, Pharma sales grew at only 5.1 percent in October compared with 11.9 percent in September and 12.5 percent a year ago.

There is also a contraction in volumes by 2.7 percent in the month, with prices rising 5.2 percent and 2.5 percent growth from new introductions.

This sorry state of affairs has caused the stocks of Pharma companies to plunge.

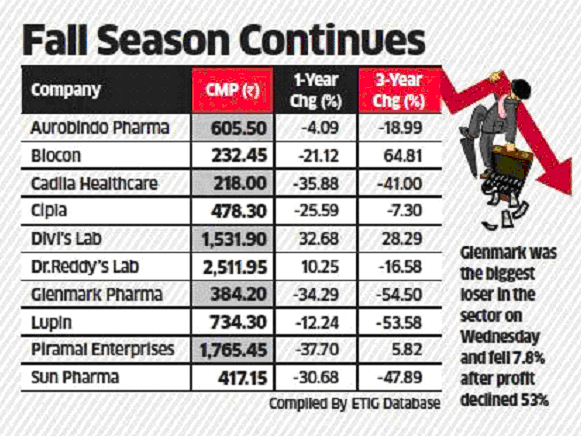

The ET has pointed out that the Nifty Pharma index fell 5.9 per cent in the last one month, under-performing the benchmark Nifty which plunged 4.8 per cent during the same period.

Blue-chip Pharma stocks like Lupin, Cadila, Sun and Glenmark have fallen about 40-60 per cent in the last three years because of regulatory issues in the US.

Their generic drug business has come under pressure with a consequent hit to the earnings.

Analysts said the price erosion in the US, which has been the chief reason for the downturn in pharma sector stocks in the last few years, seems to be settling down and most companies are reporting 8-12 per cent growth in India business.

Valuations Are Attractive In Pharma Sector: Saurabh Mukherjea

Such dire situations are like music to the ears of accomplished investors because they get an opportunity to scoop up top-quality stocks at rock bottom valuations.

We saw a live example of this a few days ago when Sandip Sabharwal revealed that he had grabbed stocks at a discount and raked in hefty gains.

Similarly, Sanjiv Bhasin has given a detailed explanation of how we should not miss such opportunities to “Buy the fear”.

Saurabh Mukherjea is of the same school of thought.

He has opined that the time is ripe for us to venture into Pharma stocks.

“Pharma is a beaten down sector that has been thrashed badly in the last three years but the fundamentals in terms of ROCs are very strong; cash generation is strong and the last three-four months of channel check that we are doing suggest that an export-driven pharma recovery should be round the corner and this is a sector where at the top of my head, I can think of four of five names where the ROCs are north of 25%,” he said.

He also pointed that the businesses have “strong moats” around them together with strong balance sheets, proven record of generating cash flow and shareholder value.

“Pharma recovery stage has been set as there is further currency depreciation ahead of us; decent Q3 numbers from the pharma companies and worst of the FDA issues are behind us,” he added.

He also revealed that he is scouting for top-quality Pharma stocks to tuck into.

“Pharma has been an unfashionable sector for a long time. Divi’s is the main stock that we have held in several of our clients’ portfolios but we are getting to that juncture where there might be other stocks that we would like to look at in the pharma sector”, he said.

“We are going to get into a stage where the tastiness of the bargains on offer might prove too tempting for investors like me to resist beyond a certain point,” he candidly admitted.

Saurabh’s hypothesis is supported by Gautam Shah, an expert on technical analysis.

Gautam Shah opined that the sector has bottomed out and that a foundation has been laid for a large recovery in the foreseeable future.

Friends, as I study more sectors I realise that the pharma index which has been in a bear mkt for 3 years could have bottomed out. The index lost 50% (insane) in this period. Foundation laid for a large recovery over the next many weeks/months.

— Gautam Shah, CMT, CFTe, MSTA (Distinction) (@gshah26) November 7, 2019

Abbott India is a “cash machine” which should be in every “classy Indian portfolio”

Abbott India is one of Saurabh’s all-time favourite stocks owing to its MNC pedigree and credentials.

He fondly described it as a “cash machine” and opined that it should form part of every “classy Indian portfolio”.

“Abbott is a cash machine. It makes it to my consistent compounder portfolio. It has got almost a quasi monopoly in some elements of therapeutic care, but it is a domestic play and I like it for that. It is in the consistent compounder portfolio …. as a steady compounder over the next three, four, five years, Abbott should be in there in a classy Indian portfolio,” he said.

Saurabh also revealed that he was looking for an opportune time to buy the stock.

“Abbott Labs is a company we have been looking at quite carefully for a while. It seems to have all the classic characteristics of a great compounder, strong proprietary technology, proprietary IP, superb cash flows. It is a company we are looking at quite carefully, perhaps we will add it to our portfolio at some stage this year,” he stated.

That stage has now come and Abbott has been added to the portfolio.

This was formally announced a few days ago.

The investment rationale is as follows:

(i) Excellent track record:

Abbott India has delivered an excellent historical financial performance track record with industry-beating revenues, EBITDA and net earnings CAGR of 18%, 23% and 22% respectively over the last 10 years.

(ii) Consistent high ROCE:

Abbott India has consistently generated high ROCEs, averaging 39% (pre-tax) and ROICs (averaging 94% pre-tax) over the last 10 years.

(iii) Strong focus by MNC parent:

The firm benefits from a strong focus on India by its MNC parent firm Abbott Laboratories, which is reflected in terms of new product introductions, rigorous oversight on product/ manufacturing quality and support in the implementation of global best practices across all key functions.

(iv) Top brands:

All top ten revenue contributing brands of Abbott India rank either as #1 or #2 in their respective application areas – for instance Thyronorm (treating Thyroid), Duphaston (infertility/miscarriages), Vertin (Vertigo), etc.

(v) Will grow faster than other Pharma companies:

Abbott India has an opportunity to grow faster than Indian pharma industry on the back of:

(a) presence in under-penetrated therapy areas like thyroid, gynaecology, vaccines, etc;

(b) market share gains in core products as well as introduction of new products for treating adjacencies within the broader therapy areas.

(vi) Strong resilience to price control measures:

Abbott India is exceptionally strong in product efficacy, sales and marketing.

The company’s earnings have historically demonstrated strong resilience to price control measures – for instance, reduction in Thyronorm prices in FY14 led to an increase its market shares/volumes and the ensuing operating leverage helped mitigate the adverse impact on margins.

(vii) Margin expansion:

There exists an opportunity for margin expansion on the back of rising share of own brand contribution (currently Abbott India generates ~30-35% revenues from distribution of Novo-Nordisk Insulins where the distribution margin is low).

(viii) Strong track record of capital allocation:

Miles White, the Chairman and CEO of Abbott Laboratories has had a strong track record of capital allocation which is particularly important for a high cash generative firm like Abbott India which currently holds Rs 17 billion of surplus cash on its balance sheet.

CLSA recommends Abbott India for a price target of Rs. 14,500

CLSA, the influential foreign brokerage, has recommended a buy of Abbott India on the logic that it has a strong balance sheet, superior return ratios and stable earnings profile.

It is also stated that the Company has a portfolio well aligned with its parent and a strong track record of building brands.

CLSA: Initiate coverage on Abbott India with a BUY rating and target price of Rs14,500 pic.twitter.com/emKXhVKwCi

— Bharat Bagrecha (@bharat_bagrecha) November 13, 2019

We had written on Abbott a while backhttps://t.co/aLzymOnUMn https://t.co/19MvOOFQ4g

— Darshan Mehta (@darshanvmehta1) November 13, 2019

Key risk: MNC may launch blockbuster products from 100% sub and starve listed company

According to some experts, the parent Abbott has a wholly owned subsidiary in India named ‘Abbott Healthcare Pvt Ltd’.

There is a grave risk that the parent company may be tempted to route money-spinner and blockbuster products through its own 100% subsidiary rather than through the listed company.

In fact, it appears that two bestseller products named Pediasure and Ensure in the Abbott portfolio are already routed through the private company and the listed company has no share in the spoils.

Example: Pediasure, Ensure etc belong to Abbott Healthcare Pvt Ltd. Nothing to do with the listed entity which is Abbott India Limited. (2/2)

— Balaji Vaidyanath ⚡️ (@nbalajiv) November 12, 2019

A similar shenanigan has already been done by Siemens India Ltd, the blue-chip MNC engineering behemoth.

Siemens sold off its high-growth business of railways modernisation, signalling and electrification to its parent company, leaving the poor Indian shareholders high and dry.

Totally agree before any MNC needed a Indian partner now not needed 100% FDI norms https://t.co/PsCByfsfJc Siemens India has sold divisions to the parent. There have been 33 such transactions in the last 18 years.

— A.K.Prabhakar (@AKprabhakar) November 12, 2019

Obviously, the stock price crashed!

Also, Multibase India Ltd, the 75% subsidiary of Dow Chemicals, a multi-billion dollar conglomerate, appears to have been subjected to some such shenanigan, given the steep plunge in its market capitalization.

Generally investment in MNC is a good idea but here are some exceptions too. Avoid these 11 – MNC stocks for investment perspective:

1. Novartis

2. Ingersoll

3. Disa Ind

4. Cummins

5. Camlin Fine

6. Castrol

7. Linde India

8. Hexaware

9. Blue Dart

10. Thomas Cook

11. Multibase— Pankaj Parekh (@DhanValue) November 10, 2019

Hopefully, parent Abbott will not subject Abbott India to such step-motherly treatment and will continue to give it its rightful share!

He is betting on a stock which is 12X of book value and PE is double of Industry average, although EPS is remarkable. He is betting on likes of HDFC Bank and Asian Paints. I think real wealth creation lies in the names which has come down significantly due to USDFA issues which are getting closed now. Those names are at 1 or 2 of Book value, PE is half of Industry average. There is no way but upwards for them to move now after being eaten down so heavily. Most of those names saw their ATH in 2015 and since then giving negative returns for 4 years now. Although Business growth is intact. Sun, Lupin, Aurobindo, Ajanta, Granules are the few names. Look at SMS Pharma too which is at >10 PE.

Cheers,

Correction: SMS Pharma too which is at <10 PE

I agree. Most of these MNCs have their private ltd. which is 100% subsidiary of their foreign parent company and also a publicly listed company and more profitable businesses are being increasingly routed through their unlisted subsidiary route which is very dangerous.

Secondly, it is very risky to have a company having a PE of more than 50 and P/BV of more than 5. So, theoretically, you would require 50 years with the constant earnings to recover your money.

One should be careful.