Mumbai, October 31, 2025 — The Securities and Exchange Board of India (SEBI) has penalized 20 individuals and entities a total of ₹2.64 crore for orchestrating a scheme to manipulate the price and trading volumes of Quasar India Limited, a small-cap listed company. The regulator found that the group engaged in coordinated trading activities between May 2022 and December 2023, creating a false market in the company’s shares and misleading investors.

The order, issued by Adjudicating Officer A. K. Das under Section 15-I of the SEBI Act, details how the entities violated key provisions of the SEBI Act, 1992, and the Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) Regulations, 2003.

Coordinated Trading to Inflate Price and Volume

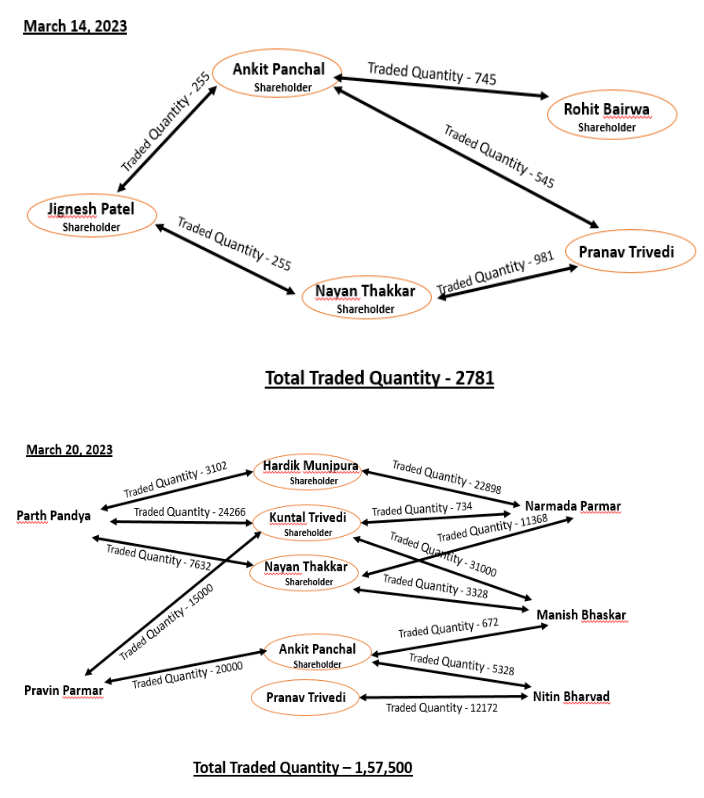

SEBI’s investigation revealed that 18 interconnected entities, aided by two key operators, engaged in circular and synchronized trades in the shares of Quasar India. These trades were structured to give the impression of heightened liquidity and demand, artificially inflating the share price from ₹8.65 to ₹42.36 within a two-month period in early 2023.

The manipulative trading was executed in three phases (“patches”):

-

Patch 1 (May 2022 – March 2023): Nine entities accounted for nearly 75% of total market volume, primarily engaging in buying activity.

-

Patch 2 (March – May 2023): The full network of 18 traders became active, contributing over 33% of market volume through cross trades and circular transactions.

-

Patch 3 (May – December 2023): The group gradually offloaded their holdings as prices declined, booking profits estimated at ₹1.96 crore.

The order noted that these activities were designed to mislead retail investors into believing that the stock was actively traded and gaining in value.

Key Figures and Evidence

Among those penalized were M/s Chandrima Mercantiles Limited and its Managing Director and CFO, Mr. Pranav Kamleshkumar Trivedi, identified as central figures in orchestrating and financing the manipulative trades. Two other individuals, Mr. Mrugesh Natwarlal Ruparel and Mr. Arpit Piyushbhai Shah, were found to have assisted in operating the trading and banking accounts of several connected entities.

SEBI’s analysis uncovered common mobile numbers, shared addresses, and overlapping bank branches, establishing strong connections among the participants. Technical evidence such as common IP and MAC addresses and similar mobile tower locations further reinforced that the trades were executed from coordinated setups rather than independent accounts.

Failure to Cooperate with Investigation

In addition to manipulation charges, SEBI noted that Mr. Ruparel and Mr. Shah failed to comply with investigation summons, violating Section 11C(3) of the SEBI Act. Their non-cooperation hampered SEBI’s ability to fully trace fund flows and trading intent, aggravating the severity of their violations.

Noticees’ Defence

M/s Chandrima Mercantiles Ltd. and Mr. Trivedi argued that their trading was based purely on market trends and liquidity, with no intent to manipulate prices. They maintained that they were independent investors acting on technical analysis, not colluding with others.

However, SEBI dismissed these arguments, stating that the pattern of trades, fund transfers, and common digital identifiers clearly pointed to coordination. The regulator observed that the “normal market behaviour” claimed by the noticees could not explain synchronized trading accounting for such a large proportion of daily market volume.

Findings and Penalties

The Adjudicating Officer held that all 20 noticees had violated Section 12A(a), (b), and (c) of the SEBI Act and Regulations 3(a)-(d), 4(1), and 4(2) of the PFUTP Regulations by creating a false and misleading appearance of trading and manipulating the price of Quasar India shares.

Penalties were imposed under Sections 15HA (for fraudulent and unfair trade practices) and 15A(a) (for failure to furnish information during investigation) of the SEBI Act.

The cumulative penalty of ₹2.64 crore was determined after considering factors under Section 15J of the Act, including the disproportionate gains made and the impact on market integrity.

A Strong Message to Market Manipulators

In concluding the 56-page order, SEBI emphasized that manipulative trading in low-liquidity stocks damages investor confidence and undermines market fairness. The regulator stated that such practices “strike at the very root of market integrity” and must be met with firm punitive action.

The order is part of SEBI’s continuing crackdown on “pump-and-dump” schemes involving small-cap companies, where networks of connected traders create false liquidity and lure unsuspecting retail investors.

Broader Implications

The Quasar India case highlights SEBI’s growing reliance on data analytics, IP tracing, and banking forensics to uncover collusive trading patterns. It also underscores the regulator’s increasing focus on accountability, even for those who fail to cooperate with investigations.

For investors, the case serves as a reminder to exercise caution with sudden price spikes in lesser-known stocks, as such movements may not reflect genuine market sentiment.

Source: SEBI Adjudication Order No. Order/AK/DS/2025-26/31761-31780, dated October 31, 2025

Link: https://www.sebi.gov.in/enforcement/orders/oct-2025/adjudication-order-in-the-matter-of-price-and-volume-manipulation-in-the-scrip-of-quasar-india-limited_97578.html