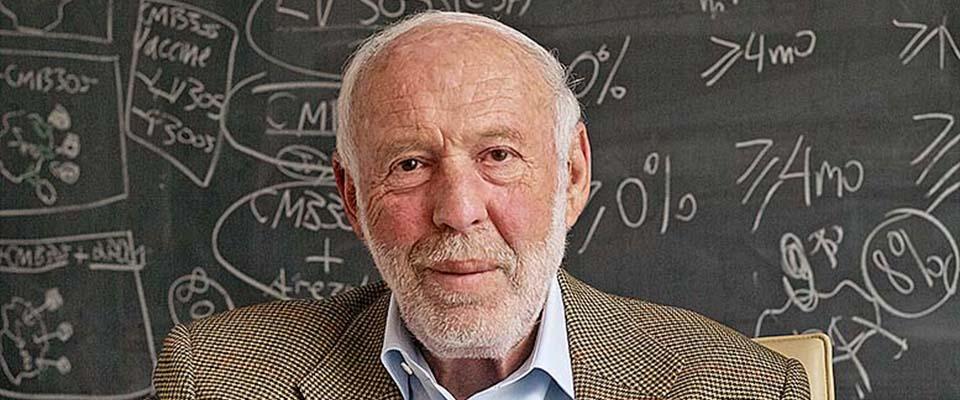

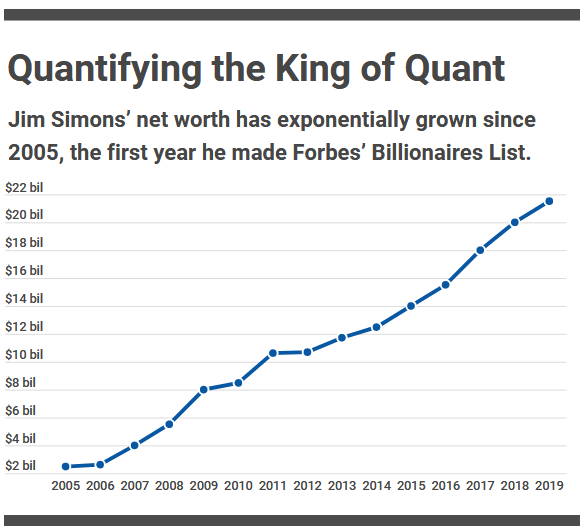

Jim Simons raked in a fortune of $23 Billion from the stock market

Billionaire Jim Simons is rightly described as “the most successful money maker” in the history of modern finance.

This is because since 1988, his flagship Medallion Hedge Fund has earned a mammoth average annual returns of 66%.

The return after charging fees to investors is 39%.

In sharp contrast to Jim Simons’ record, Warren Buffett‘s Berkshire Hathaway was able to eke out a return of only 22% or thereabouts.

The same is true for the record of George Soros and Peter Lynch.

While these living legends beat the S&P 500 Index and other benchmarks, their track record pales in comparison to Jim Simons.

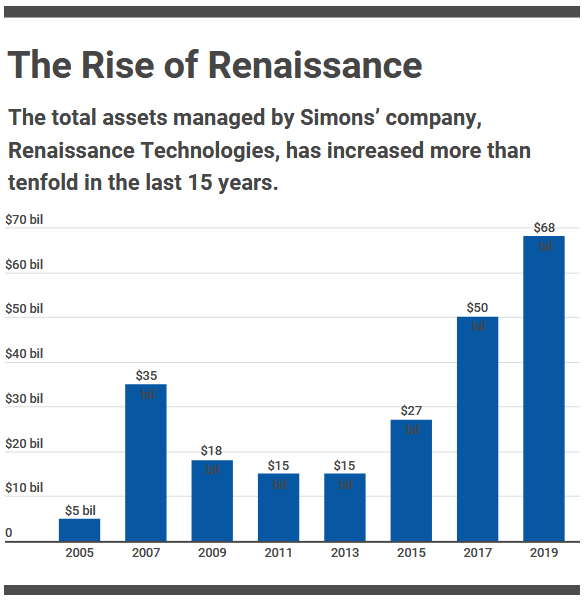

The total trading profits that Renaissance rakes in annually is about $7 Billion.

In addition, even average employees of the Fund are making about $50 million each.

Several employees are Billionaires in their own right.

(Image credit Forbes)

Journalist studies modus operandi and decodes secret formula

A journalist named Gregory Zuckerman, who writes for the Wall Street Journal, has painstakingly studied Jim Simon’s modus operandi and decoded the secret formula.

The entire formula is revealed in a book titled “The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution“.

“Jim Simons is the greatest moneymaker in modern financial history. His record bests those of legendary investors, including Warren Buffett, George Soros and Ray Dalio. Yet Simons and his strategies are shrouded in mystery. The financial industry has long craved a look inside Simons’s secretive hedge fund, Renaissance Technologies and veteran Wall Street Journal reporter Gregory Zuckerman delivers the goods,” it is stated in the introduction to the book.

If you have enough data, you can predict the market

We can gauge the extent of Jim Simons’s genius level that he figured out the importance of data much before the advent of the internet and email.

His Renaissance Fund began digesting all kinds of information.

The team collected every trade order, including those that hadn’t been completed, along with annual and quarterly earnings reports, records of stock trades by corporate executives, government reports, and economic predictions and papers.

Researchers in the Fund also tracked newspaper and newswire stories, Internet posts, and more obscure data – such as offshore insurance claims -racing to get their hands on pretty much any information that could be quantified and scrutinized for its predictive value.

The Medallion fund was a data sponge, soaking up a terabyte, or one trillion bytes, of information annually, buying expensive disk drives and processors to digest, store, and analyze it all, looking for reliable patterns.

“There’s no data like more data,” a researcher said, revealing the Fund’s secret mantra.

Renaissance’s goal was to predict the price of a stock or other investment at every point in the future.

“We want to know in three seconds, three days, three weeks, and three months,” a researcher explained.

If there was a newspaper article about a shortage of bread in Serbia, for example, Renaissance’s computers would sift through past examples of bread shortages and rising wheat prices to see how various investments reacted.

Some of the new information, such as quarterly corporate earnings reports, didn’t provide much of an advantage.

But data on the earnings predictions of stock analysts and their changing views on companies sometimes helped.

Watching for patterns in how stocks traded following earnings announcements, and tracking corporate cash flows, research-and-development spending, share issuance, and other factors, also proved to be useful activities.

The team improved its predictive algorithms by developing a rather simple measure of how many times a company was mentioned in a news feed – no matter if the mentions were positive, negative, or even pure rumors.

“Simons solved the market, amassing a $23 billion fortune along the way, with a radical and pioneering investing style. He built computer programs to digest torrents of market information and select ideal trades involving mostly stocks but also bonds and currencies. Simons and colleagues at his firm, Renaissance Technologies LLC, sorted data and built sophisticated predictive algorithms years before the founders of Facebook, Google and their peers in Silicon Valley began grade school,” Zuckerman has observed with deep admiration in his tone.

Scalping profits with High Frequency Trading (HFT)

Jim Simons was also the pioneer of High Frequency Trading (‘HFT’).

The game plan of HFT is to make multiple trades, lasting only a few seconds or minutes, and scalp tiny profits from each.

In the beginning itself, the Medallion Fund clocked between 1,50,000 and 3,00,000 trades per day.

Care was taken to ensure that the ticket size was small so as to fly under the radar and avoid alerting other nosy Hedge Funds.

Presently, when HFT trades are commonplace, the Medallion Fund places an incalculable number of buy and sell orders per day.

Index and Stock Options are a gold mine with limited risk and unlimited gains

Jim Simons was one of the first to recognize the potential of ‘Options‘ when they were first introduced.

The best part about buying Options is that they have a limited risk because the maximum that one can lose is the premium paid.

However, the gains are unlimited.

In contrast, in buying stocks, one has the risk of 100% loss of the capital invested.

“Basket options are financial instruments whose values are pegged to the performance of a specific basket of stocks. While most options are valued based on an individual stock or financial instrument, basket options are linked to a group of shares.

If these underlying stocks rise, the value of the option goes up-it’s like owning the shares without actually doing so,” Gregory Zuckerman has stated in the book.

“The basket options were a crafty way to supercharge Medallion’s returns,” he added, explaining how the wily Billionaire used them to his advantage.

Apparently, there are restrictions on how much a hedge fund can borrow through traditional loans.

However, the options gave Medallion the ability to borrow significantly more than it otherwise was allowed.

While competitors generally had about seven dollars of financial instruments for each dollar of cash, Medallion’s options strategy allowed it to have $12.50 worth of financial instruments for every dollar of cash, making it easier to trounce the rivals.

We have also seen recent examples of how rank-and-file investors like us have amassed a fortune through the judicious use of Options (see Trader Makes 14000% Gain In Two Simple Trades & Reveals Secret Technique).

Nifty Bank Call options up more than 10x today

30600 up 14x

30400 up 13.6x

30500 up 13.4x

30700 up 12.1x

30300 up 12x— Jayesh Khilnani (@jayeshkhilnani) September 26, 2019

Rs.50K in Banknifty Call options would have fetched you 1Crore plus today.

— E. (@EngineeRoholic) September 20, 2019

Simple strategies work best and are scalable

Yet another of Jim Simons secret formulas is the “keep it simple” credo.

Most quant and normal traders bungle up because they adopt numerous strategies, leaving them without an easy escape plan when things go haywire.

ln contrast, Jim Simons used a single strategy for the Medallion fund.

Zuckerman has explained this in cogent terms:

“The beauty of the approach was that, by combining all their trading signals and portfolio requirements into a single, monolithic model, Renaissance could easily test and add new signals, instantly knowing if the gains from a potential new strategy were likely to top its costs.”

Predict human behaviour and profit from it

The most brilliant “secret” of Jim Simon’s formula is realizing that human behaviour is most predictable.

Humans are wired for a “fight or flight” response.

When the chips are down and there are clouds on the horizon, investors instinctively dump their stocks and bolt from the market.

This allows other sensible investors to buy stocks at rock-bottom prices and profit immensely (see I Told You To Buy The Fear: Sanjiv Bhasin Predicts More Gains & Recommends New Multibagger Stocks and I Bought Stocks During Crash & Made Hefty Gains: Sandip Sabharwal Explains Technique & Reveals New Stock Picks).

“Humans are most predictable in times of high stress – they act instinctively and panic. Our entire premise was that human actors will react the way humans did in the past … we learned to take advantage,” a researcher at the Mediallion Fund revealed.

“What you’re really modeling is human behavior,” he added.

Forget the Why’s and the How’s: What works, works

A major reason normal investors fail is because we are obsessed with the rationale of the trade. We don’t take the trade if we are not convinced with the reasoning.

In contrast, Jim Simons has no such bias because he does not come from any investing background.

He does not care about how or why something worked, just that it did.

He exploits trends and oddities which happen so quickly that they are unnoticeable to average investors. They are faint but repetitive in nature.

“The whys in the markets don’t always make sense,” he famously observed.

Any Indian company specializing in such programs and market operations?

Why we Indians can’t have such funds/companies?

Remember Bernie Madoff, anyone ?

Almost got the same vibes from the story..To good to believe

everyone is a fraud?

No, but not able to understand the link between the content of this post and Bernie Madoff. We all know that he ran ponzi schemes and has the distinction of running the largest financial fraud in the US history, is currently in jail with a sentence of 150 years (longest as per law in US), all his family members are either dead/divorced/separated. So the story of Bernie Madoff is of course chilling.

But do you think that having quant based trading or an investment scheme having quant based trading/investment is akin to a ponzi scheme running into fraud.

Btw, most of the trades (as per one estimate, in India, currently, about 60 to 70% trades) which take place on bourses today are basically quant-based computer generated trades only. Are all such trades frauds?