Key highlights of 1QFY25 result

Robust performance driven by high Akshay Tritiya sales, healthy footfall and attractive offers & launches despite heatwave and general elections: Senco Gold reported decent sales growth of 7.5% YoY at Rs 1,404 cr supported by higher footfall growth, rise in gold prices and attractive offers & launches during the quarter. Retail sales growth was 9.6% YoY and Same-Store-Sales growth (SSSG) was at 3.7%. The Akshay Tritiya sales during the first 41 days of 1QFY25 registered growth of 21% YoY despite challenges in the form of heatwave, elections and lower wedding days. Avg. Transaction Value (ATV) grew 12% YoY to Rs 73,900 and Avg. Selling Price (ASP) grew 13% YoY to Rs 49,000. Wedding jewellery share was 40-45% during the quarter. Stud ratio decreased to 9.7% during the quarter from 11.5% in 1QFY24. However, as per management, entire industry witnessed lower diamond jewellery sales and expects to achieve stud ratio of 12.5-13.0% by FY25 end.

EBITDA/PAT grew 61.8%/85.3% YoY to Rs 109 cr/Rs 51 cr respectively. EBITDA margin rose 260 bps YoY to 7.7%.

Added 6 new stores in 1QFY25: The company net added 6 new stores during the quarter out of which 2 were franchise stores and 4 were company operated stores. The total store count of Senco Gold stands at 165 as of Jun’24. The company retained its FY25 store expansion plan of 18-20 stores.

Growth outlook for FY25: Management aims to clock 18-20% topline growth and 15-18% bottomline growth in FY25. The reduction in customs duty on gold and silver from 15% to 6% will lead to a financial impact of ~Rs 50 cr due to inventory valuation and the same is expected to spread over 2-3 quarters. However, the company is planning to take necessary actions to rationalize this impact via. discounts/offers to customers, increasing contribution of higher margin products, etc. The company is targeting to reach Gold Metal Loan (GML) share to 75% to reduce its blended interest cost.

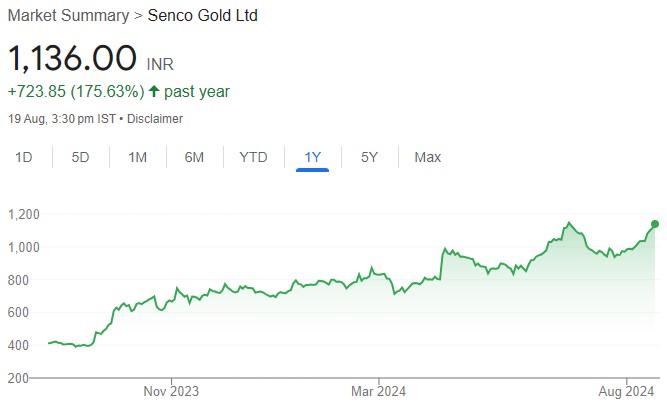

Maintain BUY – Target Rs 1,319: We believe Senco has huge headroom to grow given its strong legacy in the jewellery business, expanding footprint through a strong and diverse distribution channel, focus on light affordable jewellery with better price point and healthy growth visibility from both its company operated and franchise stores. We maintain BUY on the stock and upgrade our target price to Rs 1,319 which implies an upside potential of 20.0% for 12-18 months.