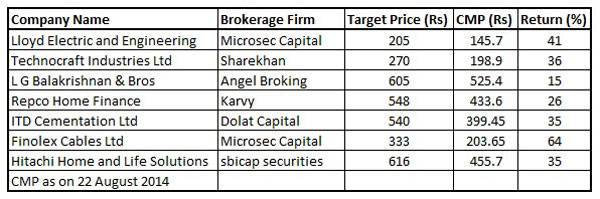

Kshitij Anand has collated a list of seven stocks where brokerages have initiated their coverage in the month of August 2014. These stocks have the potential to rally up to 64% in the next 12 months:

Lloyd Electric & Engineering Ltd: Target price set at Rs 205 (Microsec Capital)

Lloyd was incorporated in 1988 and is India’s largest manufacturer of evaporator and condenser (E&C) coils for air conditioners (ACs). The company is an OEM supplier to various multi-national companies in India.

Microsec Capital believes that its higher presence in railway HVAC business, market leadership in coil and heat exchanger business, growing consumer business, fully integrated business model, strong acquisitions in past, wide-spread global presence and strong fundamentals are expected to bolster up the company’s future performance.

The scrip has been trading in a historical P/E range of 2.2x to 24x in last ten years. Currently the stock is trading at an attractive P/E of 4.7x and EV/EBITDA of 2.1x, respectively.

Microsec believes that Lloyd Electric deserves a higher premium as compared to its peers on back of its better margins, higher earnings visibility and improving ROE. Hence, by assigning a target P/E multiple of 5x for FY16e, it has arrived at a target of INR205 per share.

Technocraft Industries Ltd: Target price set at Rs 270 (Sharekhan)

Technocraft Industries India Ltd is a diversified player with interests in drum closures, scaffoldings, yarn and garments and is also the second largest player globally in the drum closure manufacturing space with an estimated market share of 35 per cent.

Drum closures contributed almost 50 per cent of its operating profit in the last fiscal. The revenues from the business are set to grow at 8-10 per cent annually with an OPM of close to 35 per cent.

While the drum closure business is the cash cow, the scaffolding & formwork (S&F) business has emerged as the key growth driver for the company. At the current market price, the stock is attractively trading at 5x FY2016E earnings and 2x FY2016E EBITDA which is quite attractive for a debt-free company with healthy cash flow and potential to improve return ratios through the hive-off of the non-core businesses.

Finolex Cables: Target price set at Rs 333 (Microsec Capital)

Finolex Cables Ltd (FCL) is one of India’s largest manufacturers of electrical and telecommunication cables with 9 per cent market share across India. FCL holds a strong brand image. It has 3,500 dealers and distributors in its traditional strongholds of South and West India and recently added over 500 channel partners in North.

Microsec expects Finolex Cables to post a healthy 18.3 per cent revenue CAGR over FY14-FY17E.

They prefer Finolex Cables over the longer term due to (a) a scalable and de-risked business model, (b) a strong balance sheet, (c) cash flow CAGR of 41% over FY14-17E, (d) sizeable hidden value in its 32% stake in Finolex industries.

For 19 per cent overall ROE and 41 per cent cash flow CAGR over FY14-17E, the stock trades at 2x FY16E P/B. Microsec believes it should trade at a premium to its peers. They have assigned a P/E multiple of 14.1x to its core cable business, for switchgear business and have taken an EV/EBITDA multiple of 11x. Microsec values Finolex Cables’ stake in Finloex industries at a 50 per cent discount to market price.

L G Balakrishnan & Bros: Target Price set at Rs 605 (Angel Broking)

L G Balakrishnan has a strong brand – ‘ROLON’ – in the automotive chains segment which contributes nearly 65 per cent to the company’s revenue.

In automotive chains, the company has a 70 per cent market share in the OEM segment and around ~50% market share in the replacement segment. Thus, the brokerage firm believes that L G Balakrishnan is best placed to take advantage of an expected recovery in the two-wheeler industry.

L G Balakrishnan has tied up with leading two wheeler players like Bajaj Auto, Hero MotoCorp (HMCL), Honda Motorcycle and Scooter India (HMSI), TVS Motor, Yamaha Motor etc., all of which have good growth prospects.

These OEMs are increasing their capacity and also entering newer geographies for export which would drive growth of the industry. Hence, going forward, the brokerage firm believes that expansion plans at various OEM clients would trigger volume growth for L G Balakrishnan.

The brokerage firm sees L G Balakrishnan report net sales CAGR of 16 per cent over FY2014-16E to Rs 1,484cr and Net Profit CAGR of 12 per cent during the same period to Rs 79cr.

Repco Home Finance: Target price set at Rs 548 (Karvy)

Structurally, Repco Home Finance Ltd. (RHFL) is well positioned to sustain high growth momentum with best in class return ratios. Over the next few years, the brokerage firm expects Repco Home Finance’s sanctions, disbursements and loan book to grow at a robust pace, which is likely to be driven by expansion in branch network, increasing urbanization and shift towards nuclear family.

Karvy expects loan book to sustain the 25-30 per cent growth trajectory for the next two years. Further, profits of RHFL are expected to grow 30-35 per cent primarily owing to lower NPA’s, superior margin profile and low cost operating model.

ITD Cementation Ltd: Target price set at Rs 540 (Dolat Capital)

ITD Cementation (ITD), a mid-size EPC player, is setting itself up for a significant rebound as it improves working capital management and unclogs its balance sheet. The company turned loss making on delayed project execution and rising finance costs. The company has taken significant steps in the last few months to address these issues and the same will get fillip as the environment turns for the better and order visibility improves.

The order flows have picked up for the company and the brokerage firm expects settlement of dues to curb interest costs going ahead. ITD order book stands at Rs 38.2 bn (Q2CY14 end). However subsequent to June 2014, the company is favourably placed (LoI + L1 position) in orders worth Rs 16 bn.

The company is in the process of raising funds via QIP entailing 26% dilution. Based on diluted EPS estimate of Rs 48.8 per share for CY15E, the stock trades attractively at a P/E multiple of 7.1x.

Hitachi Home and Life Solutions: Target price set at Rs 616 (sbicap securities)

Hitachi Home and Life Solutions India Ltd (HHLS) is at an inflexion point. The stock is attractive due to (a) operational improvements from a refurbished plant at Kadi wherein the brokerage firm expects 20 per cent rise in assembly efficiency, (b) reduction of lead time in procurement of some key raw material leading to controlled working capital cycle, and (c) improved focus on operation and marketing to reap the benefits from an upcoming growth of the industry. It’s an industry that we believe will see a 20% CAGR in air conditioners (AC) and a 15% CAGR in refrigerators over F14-F17e.

With an operating leverage unshackled by volume gains and plant efficacy, the brokerage firm expects the company to double its EBITDA margin to 8 per cent, in-line with EBITDA margin of peers.

The brokerage firm expects 118% EPS growth over F14-17e (32% during F11-14). Yet the stock is trading at 17.5x/13.9x F16e/F17e EPS, that is a 20% discount, on an average, to peers on F17e earnings.

Source: ET

Thanks for posting this Parul. Much appreciated.

Right now my problem is too many stocks to buy, and too little money 🙁 Anyone else in the same boat ?