October 30, 2025 — Shares of Shaily Engineering Plastics Ltd. tumbled over 12% today after news broke that Dr. Reddy’s Laboratories has faced a delay in securing Canadian market approval for its Semaglutide injection, a key diabetes and weight management drug.

The setback has rattled investor sentiment, as Dr. Reddy’s is Shaily’s largest client, accounting for a significant portion of its revenue through specialized polymer components and packaging supplies for pharmaceutical products.

The Trigger: Health Canada Delay

Dr. Reddy’s confirmed that Health Canada has delayed the approval of its proposed Semaglutide injection, a generic version of Novo Nordisk’s blockbuster Ozempic. The company, however, sought to reassure stakeholders, stating:

“We remain confident in the quality, safety, and comparability of our proposed product and remain committed to making this important therapy available to patients in Canada and other markets at the earliest,”

— Dr. Reddy’s Laboratories spokesperson.

The delay appears regulatory rather than technical, suggesting eventual approval remains likely — but with a timeline that’s now uncertain.

Impact on Shaily Engineering

Shaily’s stock reacted sharply, falling 12% intraday, as the market priced in potential near-term revenue softness. With Dr. Reddy’s being its top client, any delay in key product launches can materially affect Shaily’s order flow and profitability.

Despite today’s drop, the broader context remains impressive:

-

400% return over 5 years

-

128% return over the past year

These figures underscore Shaily’s long-term growth trajectory, driven by deep partnerships in the pharmaceutical and healthcare sectors.

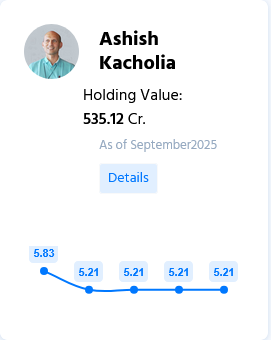

Ashish Kacholia’s Stake Adds Interest

Ace investor Ashish Kacholia, often dubbed “the small-cap czar,” holds a 5.21% stake in Shaily — valued at approximately ₹535 crore before today’s correction. His continued holding suggests long-term conviction in the company’s fundamentals.

Kacholia’s investments typically focus on high-quality niche manufacturers with strong export linkages and technical moats — criteria that Shaily fits well.

Dr. Reddy’s Stock Also Hit

Shares of Dr. Reddy’s Laboratories were not spared, slipping around 5% as investors digested the news. The market’s initial reaction reflects disappointment, though analysts expect the impact to be temporary if the approval delay is resolved within a few quarters.

Is This a Buying Opportunity?

For long-term investors, today’s sell-off could represent an opportunity rather than a red flag. The fundamentals of Shaily remain intact:

-

Strong partnerships with global pharma majors

-

Proven track record in specialized plastics and drug delivery systems

-

Expanding global footprint

However, near-term volatility is likely as markets await clarity from Health Canada. Conservative investors may prefer to wait for official updates, while high-conviction investors could view this as an accumulation zone for a multibagger-quality stock temporarily under pressure.

Bottom Line

The 12% plunge in Shaily Engineering reflects short-term uncertainty rather than a structural issue. As long as Dr. Reddy’s maintains its commitment to bringing Semaglutide to market — in Canada and beyond — Shaily’s long-term growth story appears intact.

In the words of Warren Buffett: “Be fearful when others are greedy, and greedy when others are fearful.” For those who believe in Shaily’s fundamentals, this correction might just fit that mantra.