Special Situation Report

Tender Buyback – Infosys Ltd

The board of directors of Infosys Ltd had approved buyback proposal on 11th September, 2025 based on which retail investors can

take benefit of the opportunity. Below are the buyback details:

➢ No. of shares to be bought back: 10,00,00,000 equity shares

➢ Buyback price: Rs 1,800 per share

➢ Buyback size: Rs 18,000 cr (2.41% of the total equity shares outstanding)

➢ Eligible Shareholders: All equity shareholders of the company as on the Record Date

➢ Small shareholders category: 15% of the buyback offer (15% x 10 cr shares), i.e. 1,50,00,000 no. of shares; Rs 2,700 cr

➢ Outstanding shares as of 05

th September, 2025: 4,15,43,92,203

➢ CMP (closing price of 12th Sep): Rs 1,525

➢ Assumed Participation ratio: 100%

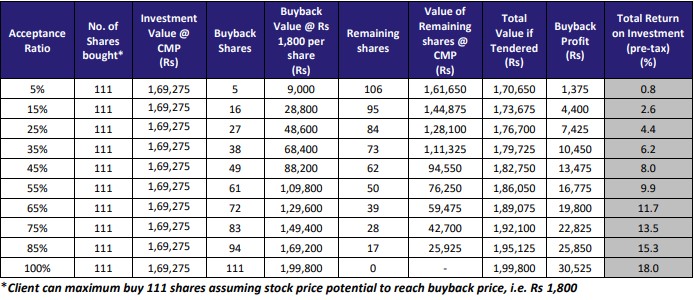

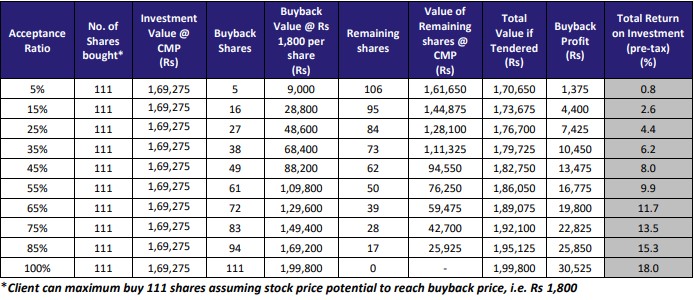

Pay-off scenario in case of different acceptance ratios:

Key Notes:

• The buyback is through tender offer route.

• Small shareholders mean shareholders with holding value of less than Rs 2,00,000 as on the specified date.

Tax Implication:

• Buyback amount received by shareholders will be deemed as dividend and will be taxed based on slab rates.

• The cost of the shares bought back by the company will be treated as a capital loss (either short term or long term). This loss may be offset against any other capital gains.

• If there are not enough capital gains to offset the loss in the current year, it can be carried forward and offset against capital gains in future years, up to a maximum of 8 years.

I have 25 Infosys shares since 2020

Kindly tell me whether I am eligible

For buyback scheme or not.what is last date &what procedure I have to follow.

You will be eligible if you hold the shares as of the record date (date is not announced yet). The buyback offer opening and closing dates will also be announced. The broker’s platform will have a “offer for sale” section where the Infosys buyback will show. You have to choose the number of shares you want to offer. It is a simple matter.

You are eligible