In Q4FY24E, we expect continued subdued performance from the specialty chemical industry. The revenue is expected to fall by 24.0% YoY and grew 15.9% sequentially for the chemical companies under coverage.

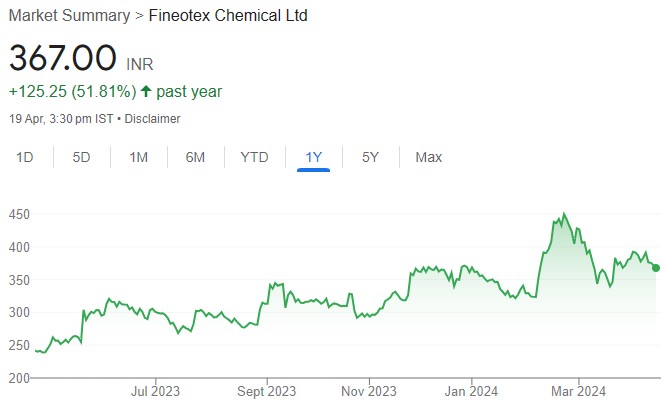

We expect positive growth for Fineotex Chemical (textile finishing chemicals), Rossari Biotech (focuses on specialty surfactants, the phenoxy series, institutional cleaning, and performance chemicals), Supreme Petrochem (due to demand pick up with Original Equipment Manufactures)

We expect decline in growth for UPL (due to challenges in pricing in key herbicides and insecticides, and channel destocking), Gujarat Fluorochemicals (due to the volume and pricing pressure across business), Anupam Rasayan (decline in volume and lack of demand from end customers segments).

Globally the destocking narrative is diminishing, the demand environment is anticipated to pose challenges till Q1FY25E, and then it is expected to pick up from Q2FY25E.

Most companies are anticipated to experience a continued decline in price realization throughout Q4FY24E.

The global crop protection industry is currently facing challenges due to prolonged destocking and ongoing pricing pressures. The sector is navigating through a difficult phase as it works to address these issues. Agrochemical demand is delayed and expected to rebound by H2FY25E

The ongoing Red Sea crisis, which has persisted for six months, is forecasted to affect revenue in the upcoming quarters due to increased shipping costs, as well as delays caused by rerouting.

These factors are expected to continue disrupting global value chains and narrowing margins.

Although the moderation of raw material prices has offered some relief, the majority of chemical companies will need to transfer the benefits of this decrease in input costs to their customers.

The chemical demand recovery in China post-lockdown has been weaker than anticipated, contributing to global price decline in chemical prices and margins, especially with the ongoing construction of significant new capacity in the region.

Overall, the Q4FY24E is expected to remain subdued due to ongoing global macroeconomic challenges, slower consumption growth, and competition from Chinese players engaging in dumping practices.

The key monitorables are demand outlook in end-user segments, push in the volumes at reduced prices and sequentially recovery in the performance.

Our top picks are Rossari Biotech (double digit YoY revenue growth), Ami Organics (volume growth across segments), Supreme Petrochem (demand pick up in the OEM segment). Overall, we remain cautious on the sector

Click here to download research report on specialty chemicals stocks by K. R. Choksey