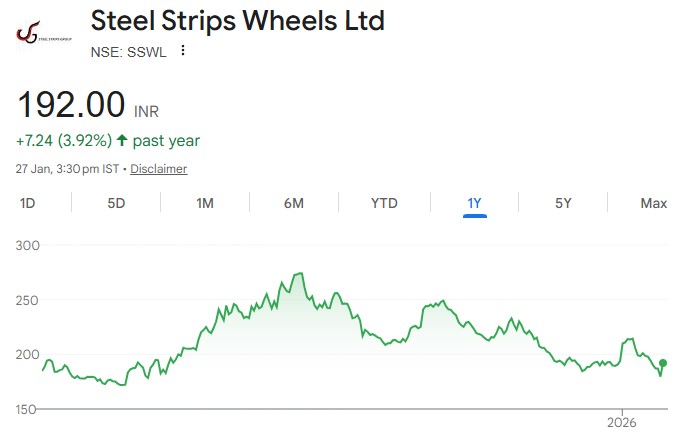

Improved Q3, Growth outlook improving, Uncertainties transitory in nature, Maintain BUY!

Despite US tariff issues, Steel Stripsreported better-than-estimated performance largely led by realizations & lower cost. Strong performance was because of robust domestic performance despite weaker export market and lower RM cost coupled with operational efficiencies supported EBITDA. The company’s revenue grew by ~23% YoY supported by both volumes & realization growing by ~8% & ~14% respectively despite US tariff related loss lowering export performance. EBITDA per wheel remained flat YoY but grew by ~8% QoQ owing to better product mix & operating leverage benefits. As per management, EBITDA per wheel will improve going ahead & they will largely offset the impact of US tariff by focussing on other markets like EU. We slightly lower EBITDA per wheel growth estimate to ~3.5% (earlier ~4.4%) CAGR from FY25-28E as exports related headwinds persist. Despite short term upheaval led by US tariff & moderation in demand, management is quite confident on the exports market & growth for the next 2-3 years. The company will transition to newer markets like EU and South America to maintain its volume momentum & slightly negate the negative impact of US tariffs. On Aluminium Knuckles business, management maintained its revenue guidance of Rs1.05-1.15bn by FY27E with double-digit margin. Overall, we expect total volume to grow at CAGR of 6% (similar to last quarter estimate of ~6%) from FY25-28E led by growth in alloy wheels exports, long-term agreements signed with several tractor OEMs, identification of new growth markets for OTR, ramp up of knuckle casting project for a few OEMs, and consistent growth in export steel wheels. Led by improved product mix on the back of rising alloys wheel contribution, we anticipate the EBITDA margin to increase from ~9.8% in 9MFY26 to 10.4% by FY28E. We roll forward our valuations to March 28E & maintain our target multiple of ~14x & arrive at a target price of Rs 266 per share, upside of ~47.5% from current valuations.

Q3FY26 –Beat on performance led by realizations

• Revenue/EBITDA/PAT stood above est. by ~8/~10/~17% respectively. Revenue beat of ~8% was on account of better realization. EBITDA margin at 9.7% was higher than our estimates by 21bps, due to lower than anticipated other expenses. Reported PAT was higher by ~17% vs estimates, largely due to higher topline and better operational performance.

• During the quarter, exports declined by ~30.5% YoY owing to uncertainties relating to US tariff. The company is offsetting US tariff impact by building its EU market presence; EU exports contributed 58% in 9M (up from 32% in FY25).

• Despite uncertainties surrounding US tariff, management has stated that they remain confident of derisking a chunk of US business into other exports market. Management remains confident of uptick in other international markets excluding US. Although, muted demand in US markets coupled with tariff uncertainty will keep its momentum slow, company has proactively shifted focus towards the EU and South America. Despite dip in exports, EBITDA/wheel improved supported by diversification, expect improvement in coming years

• EBITDA per wheel remained flat on YoY but grew by ~8% QoQ because of better product mix & lower operational cost.

• We expect EBITDA per wheel to rise to Rs 264 in FY27E and Rs 283 in FY28E (excluding Knuckle Casting business, which itself is good mid-teens margin business).

• Alloys, Exports and Off-road segment should support in improving EBITDA per unit in the foreseeable future. Exports to grow by ~9% (earlier ~10%) CAGR from FY25-28E considering US tariff impact getting partially offset by other markets like EU.

• Additionally, mid-teens margin businesses such as Tractors, OTR, and the ramp up of Knuckle casting revenue will further enhance value.

Steel Strips Wheels Ltd – Q3Y26 Result Update – SMIFS Institutional Research