Learn when to exit multibaggers

Most experts talk about buying multibagger stocks.

However, few talk about exiting them in time.

Sumeet Nagar of Malabar Fund has mastered both aspects, i.e. the art of buying multibaggers and exiting them in the nick of time.

Avanti Feeds is a textbook example of this.

He stormed into the counter when the pessimism was its peak and the stock was available at rock-bottom valuations.

“People were very concerned about the risk in this business and they never looked at the opportunity … Those are the places where you have the potential to generate significant returns. For many years they have been growing at 50% year-on-year with ROEs north of 50% and yet people continue to ignore them,” he explained the investment rationale.

Later, when the stock got caught up in extreme exuberance and surged to an all-time high in December 2017, Sumeet quietly exited the stock.

He pocketed nearly 1000% (10-bagger) gains from the stock (See Sumeet Nagar’s Malabar Investments Pockets 1000% Gain & Escapes Melt-Down In Stock).

Today, Avanti Feeds is a shadow of its former glorious self, with all multibagger gains having been drained out.

Worse, the Company has been raided by Income-tax sleuths for alleged tax evasion which means it could be Game Over.

Income Tax department conducts searches in 20 premises of Avanti feeds ltd and Trendset Builders Pvt ltd across Andhra Pradesh and Telangana

— TOI Hyderabad (@TOIHyderabad) November 7, 2019

Yet another example is that of Page Industries.

Sumeet cornered the stock, milked multibagger gains from it, and made his exit before anyone even knew what was happening.

“We were earliest investor in Page industries in more than 10 years ago. At that time, it was trading at 10-11 times trailing P/E. At that point of time, it was growing at 40-60 percent year-on-year. As they continue to deliver, people’s willingness to pay has kept on increasing. People say that it is long runway for growth and pay a little bit today. But that can go too far,” he said in a prophetic tone.

Needless to say, Page Industries is also a shadow of its former glorious self.

Be wary of stocks quoting at extreme valuations

The important lesson that we can learn from these experiences is that it is not only important to buy multibagger stocks but we should also know when to exit them.

“In case of many other consumer companies, where the valuations went so far ahead of themselves and the underlying growth could not sustain with them. Because there is assumption that high level of growth will continue forever, if you see any faltering of that growth then it brings that thesis into question. If you are investing in those names at very high valuations, the risk reward is not very favourable. You have to be so sure that this earnings growth will remain for a long period of time“, Sumeet advised.

He also counselled us to be wary of stocks quoting at exorbitant valuations.

“Exorbitant premiums are never a good recipe for generating good returns. If you are invested in a company which is trading at very high multiples, then it is tough to generate returns from there because those exorbitant premiums will go away in a period of time,” he explained.

He also drew a masterful distinction between a “great company” and a “good investment“.

“For many consumer companies, the growth rate is also not high enough. That risk reward is not attractive …. When a company starts trading at 80-90 trailing P/E, then it is not a good investment anymore. It is still a great company, but it is not a good investment,” he advised.

The one investing parameter Malabar Investments' Sumeet Nagar swears by…

Watch the Alpha Moguls conversation with Malabar Investments' Sumeet Nagar here: https://t.co/VEpRI7ootw pic.twitter.com/cqDX8FnvYc

— BloombergQuint (@BloombergQuint) June 8, 2019

Safari Industries gave 15,957% gain over 10 years

Safari Industries, the manufacturer of luggage, is yet another mind-boggling multibagger stock.

In the period from June 2009 onwards, the stock has given an eye-popping gain of 15000%+, according to a report in Business Today.

As of 30th September 2019, Sumeet’s Malabar India Fund holds 19,33,889 shares comprising 8.66% of the capital.

His Malabar Value Fund holds 4,03,781 shares comprising 1.81% of the capital.

He has explained the rationale behind the investment in cogent terms.

Safari Ind up 40% in one month… Sumeet Nagar spoke about the rationale for owning Safari, and his bullishness on the luggage space exactly 40 days ago on #AlphaMoguls … worth listening to this https://t.co/cy2EScnAZ8

— Niraj Shah (@_nirajshah) April 19, 2018

What drew Sumeet Nagar of Malabar Investments to #invest in Safari Industries https://t.co/eEtmZZuCO3 #markets #stocks #investing pic.twitter.com/A8h0Fx17nW

— Outlook Business (@OutlookBusiness) June 28, 2018

Affle India is a “Phenomenal Company Run By Great Management”

Sumeet Nagar recommnded Affle India to us on the eve of its IPO.

The logic was quite convincing:

“India is one of the fastest growing advertising markets in the world …. digital advertising in India is growing at 30 percent year-on-year …. in India more people are spending time on mobile and mobile becomes a primary source of internet connection …. Mobile phone is the most expensive real estate in the world, because more and more commerce and transaction will happen through that and so whoever is going to get on that is very valuable to the companies and people are willing to pay money for that and this is where Affle sets in“, he said.

He pointed out that Affle is already the largest player in India and is also growing internationally.

“Its Already a profitable company, 100 percent return on capital and keeps growing at a perfect rate. I think this past year they have grown earnings by 70-80 percent. So, it’s a phenomenal company and run by great management theme. They should likely come up with an IPO before end of the year. It is a fantastic company that we liked and we invested in it“.

As of 30th September, the Malabar India Fund holds 16,16,214 shares comprising 6.34% of the capital.

The Malabar Value Fund holds 2,85,851 shares comprising 1.12% of the capital.

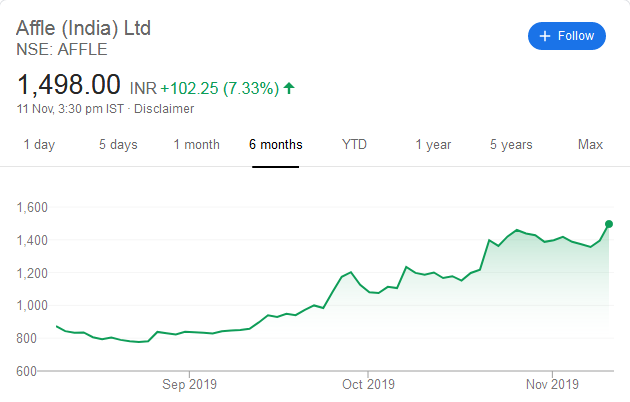

100% gains since IPO in August 2019

The Malabar Funds, as well as the subscribers to the IPO, have reaped rich rewards already.

The IPO price in August 2019 was Rs. 745. The CMP is Rs. 1498, which means that 100% gains are already on the table, waiting to be harvested.

Investors’ Presentation reveals game plan

To understand the reasons for the meteoric rise in the share price, we have to peruse the latest investors’ presentation of Affle India.

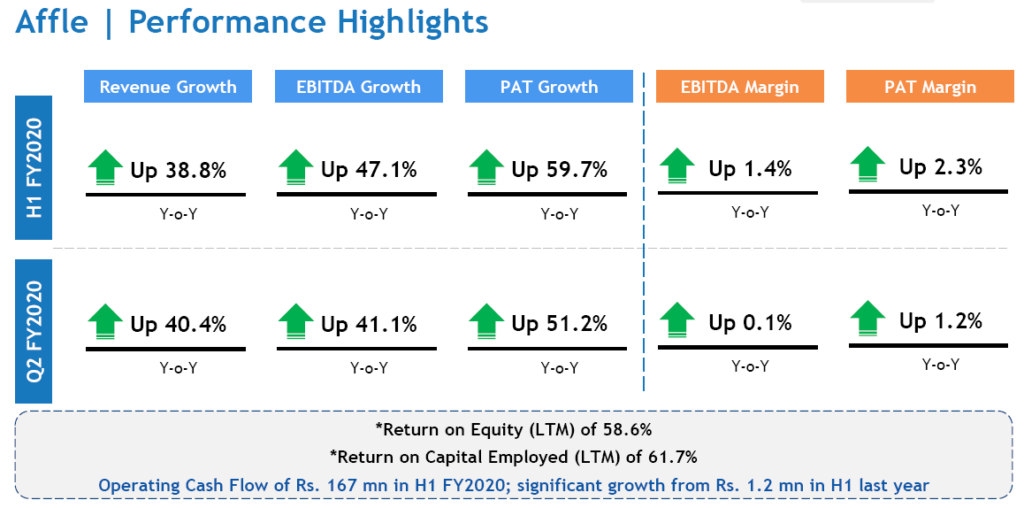

The Company is earning an eye-popping RoE of 58% and a RoCE of 61%, which implies that it is a unstoppable powerhouse juggernaut.

“Affle (India) Limited has continued to build upon the strong growth momentum of the previous years and delivered a stellar performance during the Q2 & H1FY2020,” Anuj Khanna Sohum, the boss man of the Company stated.

“Affle reported a robust performance for H1FY2020 with an increase in revenue by 38.8% y-o-y and an increase in EBITDA by 47.1% y-o-y; registering an EBITDA margin expansion of 1.4%,” he reported.

He also pointed out that the CPCU business continued on a strong growth momentum delivering a total of 35.1million converted users (up 39.4% y-o-y, India and International combined) as compared to 25.2 million converted users delivered in the H1 last year.

Affle is riding the internet wave and is a must-buy: Nomura

Nomura, the mighty foreign brokerage, has thrown its hat in the ring and recommended a buy of Affle India.

Nomura on Affle India

Initiate with BUY and Tgt of Rs1900 pic.twitter.com/d04zAgcfJK— Bharat Bagrecha (@bharat_bagrecha) November 11, 2019

“We think the underlying macro is attractive in Affle’s key markets (India & SEA-South East Asia), where a large internet user base, rising smartphone sales, improving data connectivity and young demographics augur well for the shift to digital,” Nomura stated.

It opined that advertising spends are expected to grow at 32 per cent and 18 per cent on a compounded basis in India and South East Asia versus 15 per cent globally over FY18-FY21.

“Despite this, penetration is expected to remain low at 25-30 per cent by FY20/ 21 versus 54 per cent globally, thereby offering a long runway for growth,” it said.

It added that as advertisers shift to direct sourcing, advertising technology vendors like Affle could retain a higher share of digital advertising spends, implying faster growth.

Market price has already doubled since the IPO. Whether juice still remains or not: no idea. These all are high tech companies where understanding, assessment and evaluation becomes difficult except that the numbers are showing improved results.