HSBC points out that the rate cut cycle is one of the main reasons for its ‘overweight’ stance on India and its preference for cyclical rather than defensive sectors. It states that its analysis suggests that each 1% ofsavings on interest rates would result in a 1.5% improvement in corporate earnings.

HSBC adds that it is important to note that there would be a lag between the event and the impact given the intervals between the resets on rates, the pace of transmission from market levels to bank lending rates, the individual corporate treasury’s mix of fixed and floating rate funds in its liability book and the treasury’s mix of FX and INR borrowings.

It explains that the falling cost of borrowing is also likely to benefit mid-cap companies with higher gearing ratios than large caps, said the report. HSBC has projected a BSE Mid-Cap target of 12,950 for end-2015.

(Image Credit: ET, click on image for better view)

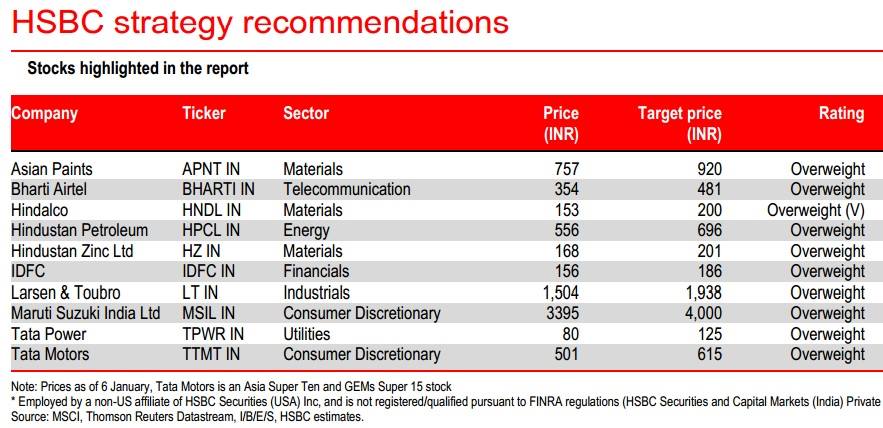

HSBC prefers domestic cyclicals (such as industrials, materials) over defensives to play the ongoing cyclical and structural upturn. It is overweight on consumer discretionary, private banks, industrials, metals and utilities; and underweight on healthcare, real-estate and PSU banks.

HSBC’s top stock picks include IDFC, Tata Motors, Maruti Suzuki and NTPC.