Style & Sector Rotation – A Key to Generating Alpha Moving Forward:

Risk-reward is gradually improving in mid- and small-cap stocks, though recovery is expected to be slow and gradual through 2026. Near-term consolidation is likely, with market breadth remaining narrow.

In this environment, our strategy focuses on Growth at a Reasonable Price (GARP), quality businesses, market leaders, and domestically-oriented sectors. We continue to:

1. Overweight: BFSI, Telecom, Consumption, Hospitals, and Interest-rate Sensitive Sectors

2. Maintain a positive view on discretionary and retail consumption plays

3. Prefer select capex-linked cyclical stocks, which now offer attractive valuations and reasonable growth visibility

4. Remain cautious on export-oriented sectors due to tariff uncertainty and global macro risks

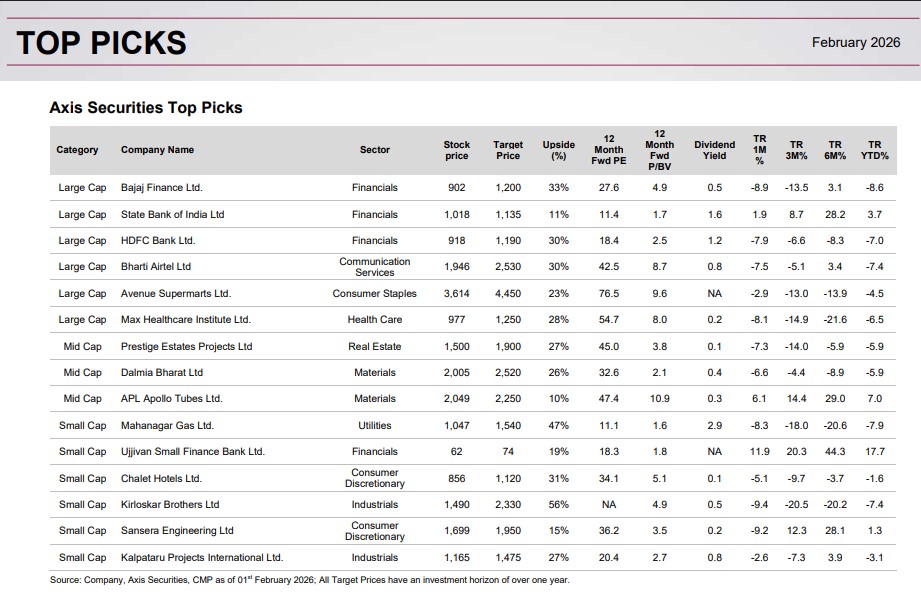

We have updated our Top Picks by replacing Inox Wind with Dalmia Bharat Ltd, as we remain focused on identifying superior-quality companies aligned with our thematic investment approach.

Based on the above themes, we recommend the following stocks: HDFC Bank, Bajaj Finance, Bharti Airtel, Avenue Supermarts, State Bank of India, Max Healthcare, Kirloskar Brothers, Kalpataru Projects, APL Apollo Tubes, Mahanagar Gas, Prestige Estates, Ujjivan Small Finance Bank, Chalet Hotels, Sansera Engineering, Dalmia Bharat Limited