Chris Wood of CLSA, in an interview with ET Now, made it clear that he is viewing India as a five-year story under NAMO. He said that he has allocated 41 per cent of the portfolio to Indian stocks.

Chris Wood added that his confidence in India came from Narendra Modi. He pointed out that Modi is the most pro-business, pro-investment political leader in the world today. So in all likelihood he would get the investment cycle going again, Chris added.

Chris warned that as we are coming close to the end of the QE tapering in the US, there is a risk of a stock market correction.

Chris Wood suggested that such stock market corrections need not be a cause of concern because he is viewing India as a five-year story given the fact that Modi has been elected for five years.

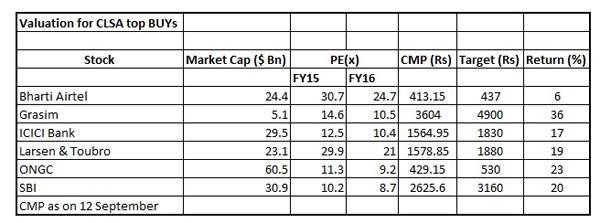

Chris identified CLSA favourite sectors as being banks, autos and public sector undertaking companies. Among stocks, CLSA is bullish on Larsen & Toubro, ICICI Bank, SBI, Grasim, Bharti Airtel, ONGC etc.

What is so big deal in identifying these stocks… anyone who will spend 3 months actively in stock market can identify these…

Wht?? These are the ones he finds interesting??? Good luck to his clients

CHIEF STRATEGIST?? Picking up all sector leaders isn’t a strategy..

LOL at the strategy. Novices to the stock market used to buy these stocks when NDA under Vajpayee was in power.

Chris is correct in saying that in the regime of Mr. Modi In Indian market will do well provided Mr. U.N Singapore remain sebi chairman and get the investors awareness mission succeed where not the investors but mostly distributors are called for by Mutual funds Houses contrary to this mission

Doctor could you please elucidate what you mean in this comment what with Singapore and mutual funds and distributors being involved ?