Bulls turn tables on Bears in brilliant maneuver

Today was a dramatic day on Dalal Street.

Sonia Shenoy, our lucky mascot, had already alerted us that the day would be a glorious one for making profits.

“Strong market opening … bank nifty leading from the front,” she said with a cheerful smile that lit up even the nooks and crannies of Dalal Street.

strong market opening

sensex up 315 points

nifty up 90 points

bank nifty leading from the front

bank nifty up 305 points

fresh 52 week highs on paint companies like asian paints and berger paints https://t.co/JubCsbkg93— Sonia Shenoy (@_soniashenoy) October 21, 2020

As usual, she was right.

Both Indices surged like supersonic rockets, leading to hefty gains for the punters.

However, at precisely 1328 hours IST, the unscrupulous Bears spread the news that the Cabinet is having second thoughts on the issue of interest waiver.

Breaking EXCLUSIVE FROM SOURCES

Cabinet dicsussed Ex-gratia payment of difference between Compound interest and Simple Interest today. Bcoz matter is in SC court so decision will be communicated to the court. It may be applicable for selective "specified loans"only.@CNBC_Awaaz— Lakshman Roy (@RoyLakshman) October 21, 2020

The plunge was so sudden and savage that even news persons were baffled.

“Sudden crack in markets, whats happening?,” they asked each other, with a bewildered look on their faces.

Nifty declines over 200 points from day’s high

Nifty Bank declines over 600 points from day’s high https://t.co/bylH4pS2Q3— Jayesh Khilnani (@jayeshkhilnani) October 21, 2020

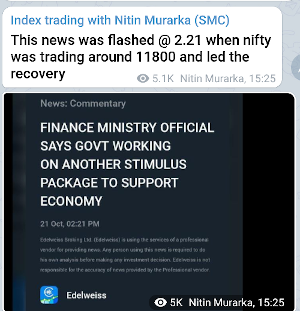

At this stage, we have to compliment the Bulls for their presence of mind because, realizing that they were badly trapped by the Bears, they spread the counter-rumor that the Government is working on a new stimulus package to support the economy.

This sent the Bears scampering like rats and the Indices resumed their glorious march upwards, exactly as predicted by Sonia Shenoy.

(Dramatic “V” shaped movement in the Bank Nifty which spooked the Bulls and Bears)

Buy stocks that will thrive irrespective of who forms the Government

Donald Trump is very gung-ho about his role in propping up the stock market.

“Stock Markets will hit new highs if President Trump wins. Tremendous growth like never before. If Biden wins, it’s strangulation. Not good,” he said in his latest tweet.

“Stock Markets will hit new highs if President Trump wins. Tremendous growth like never before. If Biden wins, it’s strangulation. Not good.” @SteveKalayjian @Varneyco

— Donald J. Trump (@realDonaldTrump) October 20, 2020

So, it is obvious that the best case scenario for us is that Trump is re-elected and everything carries on as before.

However, we have to prepare for the eventuality that Joe Biden may oust Trump from the Oval Office.

That is why I have already cherry-picked the stocks that should be bought to benefit from a Biden Presidency.

Jim Cramer, the Guru on Wall Street, has counselled us to pick stocks that are indifferent to political regimes.

“You should buy stocks that have good earnings and you should try to measure whether the earnings will continue to be good irrespective of who the President is,” he rightly advised.

He cited the classic example of Proctor & Gamble, the blue-chip FMCG behemoth, which has continued to thrive over the decades despite the innumerable calamities that have come and gone.

“Look for great investing Themes,” he added.

He advised that we can tuck into stocks like Caterpiller from the manufacturing sector and also stocks from the Aerospace sector.

He also advised that the seven stocks which have surged like supersonic rockets during the Pandemic, namely, Netflix, PayPal, Square, Roku, Tesla, Peloton and Zoom Video Communications, are a good buy irrespective of any issues.

“Buyers don’t care how well the underlying companies are doing, they want to own those stocks regardless. In each case, the thesis is so powerful that it overwhelms any mundane attempt to figure out what the business might be worth,” he said

“No one’s going to the movies anywhere around the world, which means the Netflix bull thesis must be true regardless of what the company says when it reports. If the stock goes down after it reports tomorrow, history says buy it anyway regardless of the results,” he added.

Cramer was also dismissive of the fears that Biden would impose heavy taxes which could cripple the economy.

“I don’t care about the tax situation because you have to invest no matter what. You can’t avoid investing because of taxes,” he said.

Applying Cramer’s sensible logic to Dalal Street, the stocks that are “Biden-Proof” include all-weather stocks like HDFC, HDFC Bank, Nestle, HUL, Colgate Palmolive, Asian Paints, Pidilite, Bata India, Tata Consumer Products etc.

These stocks have survived various adversities and will continue to thrive no matter what the circumstances!