FIIs pump in Rs. 20,000 crore in 4 days, send stocks flying

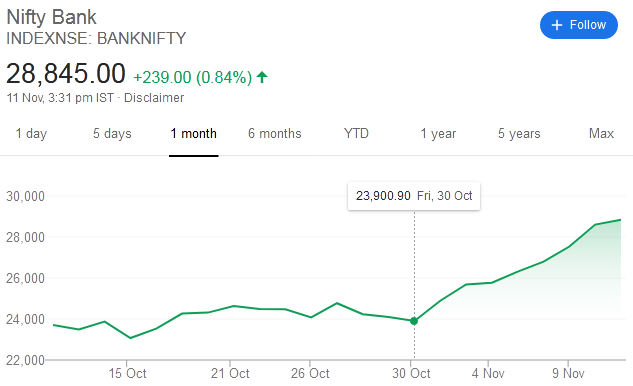

It is unbelievable but true that in just the last 10 days, the BankNifty has surged a mammoth 5000 points, from 23900 on 30th October to the present 28845 on 11th November.

The Nifty has also surged 1100 points from 11642 to 12749 in the same time period.

This ferocious rally has happened because the FIIs have been aggressively buying the front-line stocks.

In fact, a record sum of Rs. 20,000 crore has been invested by them in the cash market in just the last four days.

In last 4 days, FIIs have pumped in Rs 20,000 crores in Cash market.

When was the last time, they have done like this?

— P R Sundar (@PRSundar64) November 10, 2020

One reason for the enthusiasm of the FIIs is because the Government has promised to grant a stimulus to the economy, with an emphasis on employment and growth.

Sources say Govt may announce next stimulus package before Diwali, #employment to be its focus.@rituparnabhuyan reports. pic.twitter.com/YFWvfQhBJR

— CNBC-TV18 (@CNBCTV18Live) November 11, 2020

Obviously, in a market like this, it is impossible for even the dumbest of investor or trader to not make money.

Even raw novices are strutting around like Millionaires in Dalal Street, their pockets bulging with massive gains.

Trader named Manu Bhatia reports earnings of Rs. 1.25 crore in 10 trading sessions

Many traders in Dalal Street follow the salutary practice of posting screenshots of their MTM profits.

A well-known trader named Manu Bhatia had surprised everyone a few weeks ago by reporting a huge earning of Rs. 73 lakh in a day.

This was on a trending day when the BankNifty had given a breakout.

73L+ for the day

A New record for me

A Trend day which traders were waiting for since long, Was all prepared for the Breakout to happen this/next week [Check Yesterdays Tweet]. Upside BO was a surprise but executed the plan to perfection ??

Markets have been very kind ?? pic.twitter.com/BaM3qiTU2E

— Manu Bhatia (@bhatiamanu) May 27, 2020

A few days ago, on 19th October, he had sent the clear indication that there is a high probability of another Breakout in the BankNifty and that we should prepare for that.

BO = Breakout

By default it's always the Indices I am referring to

Watching BankNifty as of now

— Manu Bhatia (@bhatiamanu) October 19, 2020

He also disclosed that he is long the BankNifty (presumably through Futures and/or Calls) with the first target being at 25800.

Long on BANKNIFTY at 24210 with a SL of 23700, First Target at 25800, Trail post that

Prices are on Spot

— Manu Bhatia (@bhatiamanu) October 20, 2020

The target of 25800 was highly conservative, though the stop loss of 23700 may have been hit on 30th October. The BankNifty thereafter effortlessly surged in an almost vertical trajectory and now stands tall at 28845.

The rewards are very sweet indeed.

Manu Bhatia has now reported a mammoth earning of Rs. 1.23 crore in the period from 29th October 2020 to 10th November 2020, comprising of just 10 trading sessions.

It is notable that the screenshot shows only the result of the Futures. If there were any short calls also held, those may have reflected a loss, depending on the strike price and the selling price.

1Cr+ in BANKNIFTY20NOVFUT

An important milestone in my trading journey – A 0to1 event

Tried something new, A Discretionary Trade with multiple Sub-Trades ranging from Scalps to Positional and having an aligned objective, Worked out well ??

Markets have been kind ?? pic.twitter.com/ljfwnnThRP

— Manu Bhatia (@bhatiamanu) November 11, 2020

What is the Modus Operandi for earning such large amounts consistently?

A careful study of Manu Bhatia’s interview to moneycontrol.com reveals secrets about his trading strategy.

He follows a different strategy for intraday trades and positional trades.

For positional trades, Bhatia looks to enter a sustained trend or a resumption of a trend with the requirement that there should be a confluence of multiple things.

These things can be a trendline and a moving average bounce or a support level and moving average.

He then looks for triggers in the form of either an increase in open interest or a big candle which will confirm that market is respecting this confluence.

Money management and risk management

Bhatia explained that “position sizing” i.e. deciding how much to risk given the expected reward, has played an important role in his success.

“Position size has to be defined by the money that I am risking in that trade divided by the difference between entry and stop loss point,” he said.

“Having the right position size will improve the performance of the strategy,” he added.

“I have a rule that I would not be risking more than 1 percent on a trade and not more than 5 percent at any point in the market,” he emphasized.

He also pointed out that from the money management perspective, the power of compounding is a helpful tool in trading.

“I add back the profits from the trades to the capital and then calculate the risk to be taken on each trade. So the 1 percent that I am risking on each trade is automatically increased. This move has helped improve my return considerably,” he said.

He has also explained the entire concept in great detail in a youtube video.

Master one strategy and implement it

Bhatia also offered valuable advice that traders should master one strategy and stick to it at all times, instead of frivolously experimenting with multiple strategies.

As beginners we wander from one method to another without developing a deep understanding of any of the methods

Ideally one should delve deep into one method, Either deploy it or discard it before moving onto the next

Be a master in atleast one method, As a trader it help ??

— Manu Bhatia (@bhatiamanu) November 1, 2020

Preserve capital, trade with less risk

He also advised that we should not be compulsive traders and should know when not to trade.

“As a trader it is very important to know when not to trade or trade with less risk. Capital preservation should be the primary focus, Rest of the things tend to fall in place with time,” he said.

As a trader it is very important to know when not to trade or trade with less risk

Capital preservation should be the primary focus, Rest of the things tend to fall in place with time

I generally reduce my risk appetite whenever I see a tight range and/or Low Vol

— Manu Bhatia (@bhatiamanu) October 3, 2020

will be interesting to hear the views of eminent traders like porinju ji and basant ji on this strategy.