Sanjiv Bhasin had predicted that the Nifty would surge to 14,600 after the Budget

First, we have to compliment Sanjiv Bhasin, the veteran investor-cum-trader, for the accuracy of his predictions.

In mid-January, he had made the chilling prediction that the markets would correct and had advised that we stay light.

I am very sure the markets have topped out or will top out in the next few days. The second half of January may see a sharp correction. Avoid Bank & NBFC stocks because the yields are rising & margins will get crunched. The Pharma sector is safe. Cadila Pharma is a good buy now https://t.co/t959ymZa3R

— RJ Stocks (@RakJhun) January 11, 2021

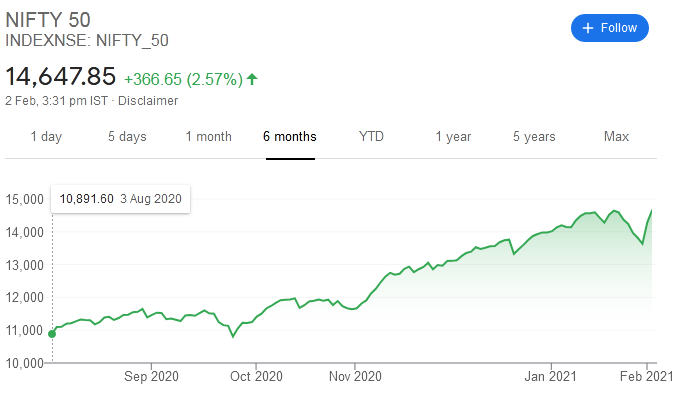

This prediction came true because the Nifty did plunge like a stone from 14,650 on 20th January to 13,650 on 29th January.

Thereafter, he predicted that the Budget would be a “game changer” and that the Nifty would surge to 14500+.

“When we meet next week,the Nifty (CMP 13,600) will be at 14,500,” he had proclaimed with immense confidence.

I am very Bullish. The correction was routine & has gone. The Budget will be a game-changer. Nifty (CMP 13,850) will surge to 14,200 in the next few days. Even Global markets will surge after 4th Feb. Quality stocks like Bajaj Finserv & HCL Tech are good for a buy now https://t.co/uQ39hKpkM7

— RJ Stocks (@RakJhun) January 29, 2021

The resumption of the Mumbai locals is the biggest Bullish sign that Covid is behind us & normalcy is returning. The markets are extremely oversold. All signs are positive. This is the time to invest in quality stocks. When we meet next week,the Nifty (CMP 13600) will be at 14500 https://t.co/MPJYcl73GB

— RJ Stocks (@RakJhun) January 29, 2021

Needless to say, this prediction has also come true with the Nifty looking strong at 14650.

Top Trader rakes in Rs. 10.50 Crore in just 2 days

Asit Baran Pati‘s profile is well-known to us.

He regularly posts screenshots of his massive gains (and losses).

A few months ago, he had shocked everyone in Dalal Street by announcing that he had suffered a loss of Rs. 1.7 crore in a single trading session [see Top Trader Suffers Loss Of Rs. 1.7 Crore (In One Day)].

Thankfully, those days are now in the past.

According to the latest update, Asit Baran Pati raked in a massive gain of Rs. 2.14 crore yesterday, when Nirmala Sitharaman announced the Budget.

He was initially bearish and was carrying long Puts and short Futures of various high-momentum Indices and stocks.

However, when these started bleeding and notched up a massive loss of 1.67 crore, Pati did a somersault and loaded on to truckloads of long Calls and Futures.

This change of strategy paid off big time because the Indices took off like a supersonic rocket during the delivery of the Budget.

They yielded fabulous gains.

One of the best trading days of my life with 2nd highest profit day with 2.14cr. Would hv been much better n bigger had Upstox not screwed up. What made it special is the recovery from -1.67cr loss in the morning as I was bearish since Friday. Its not the number but the fight pic.twitter.com/I66KHDicbU

— Asit Baran Pati (@asitbaran) February 1, 2021

Today was an even better day for Pati because he notched up a mind-boggling gain of Rs. 8.4 crore, representing a colossal return of 50% of the Capital.

A dream Trading day..Personal best with around 8.4cr profit (50%, ROI) crossing my previous best of 2.4cr. Have lived through enough bad struggling days to see this day. DREAMS DO COME TRUE. Just believe in your passion and chase your dream..It’s possible and doable 🙂 pic.twitter.com/bXX6Qu0uGG

— Asit Baran Pati (@asitbaran) February 2, 2021

This appears to be a record-breaking achievement in Dalal Street.

What about Stop-Loss?

One of the banes of carrying positions overnight is that a stop-loss cannot be placed. This makes the trader vulnerable to gap-ups and gap-downs.

Pati has solved this problem to some extent by ensuring that only the earned profit of the previous trading sessions is put at risk.

He squares-off the transaction and books loss as soon as the threshold of profits is breached.

This strategy ensures that the capital is kept safe from the vagaries of the market.

I book losses when it goes beyond the threshold of previous profit, so I should have been out by 55-60 but couldn’t get out in time and hence loss went to 95l..which is technically 40l more than my comfort..which is upsetting but part of the game..We must all know our skin in

— Asit Baran Pati (@asitbaran) November 19, 2020

Is Options buying better than Options selling?

The massive MTM gain screenshots posted by traders on both sides always kindles the debate as to which of the two strategies is superior.

According to Pati, options buying is better if the trader has the skills to catch the trend with momentum.

He has advised that we should buy ATM CEs or PEs as soon as we understand the trend of the market.

He pointed out that most traders lose money because they buy OTM options which are ‘Hero ya Zero‘ trades.

ATM CE/PE can be bought and carried on once you catch the right trend

The trick is to look for weaknesses in the bulls before going short, or pinpoint areas of weakness in the bears before going long and vice versa

2 ways to combine them to uncover trading opportunities

— Asit Baran Pati (@asitbaran) January 26, 2020

An Option buyer must know how to catch the trend with momentum and when to trade and when not to, option buying is probably a better strategy than people been led to believe (and I strongly believe that).You lose money as a buyer cause of you are wrong in direction, trend, 5/

— Asit Baran Pati (@asitbaran) May 23, 2020

Similar advice has been offered by Nitin Murarka, an expert with SMC Global.

Murarka has opined that options selling is fraught with great risk and also requires huge capital.

On the other hand, buying options in the form of ‘Bull Call spreads’ and ‘Bear Put spreads’ is a sensible way for retail investors to participate in the riches of the market with limited risk and reward.