ET points out that UBS has identified Financials as its most preferred ‘overweight’ sector over the next 18 months as lower inflation and declining rates should support earnings growth. UBS is also overweight on banks (private/PSU), oil and gas, power, telecom and media stocks. It is pointed out that valuations remain attractive versus the historical trading range.

UBS’ sectoral picks are as follows:

Private Sector Banks: Overweight

Public Sector Banks: Overweight

Oil & Gas sector: Overweight

Auto (2 wheelers): Underweight

Consumer staples: Underweight

Autos (four wheelers): Neutral

Cement: Neutral

Consumer Discretionary: Neutral

IT Services: Neutral

Pharmaceuticals: Neutral

Small and Mid-caps: Neutral

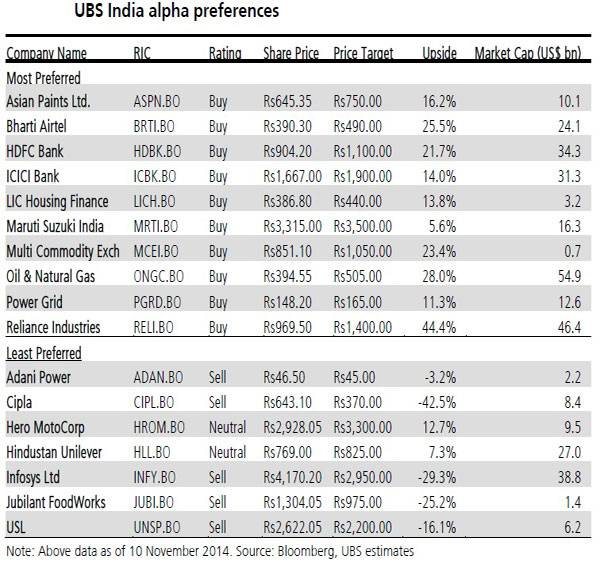

UBS’ Most-preferred & least-preferred stocks: