|

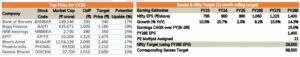

Stock |

Price on 12.01.2010 |

Price on 25.01.2013 |

Absolute Return (%) |

|

Indraprastha Gas Limited |

200 |

260.95 |

31.73 |

|

Mahindra & Mahindra |

594.63@ |

899.60 |

51.29 |

|

Aurobindo Pharma |

176.84 @ |

187.30 |

5.91 |

|

Sterlite Industries Ltd |

218.91# |

112.25 |

-48.72 |

|

Deepak Fertilizers |

117 |

116.70 |

2.19 |

|

HDIL |

366 |

82.50 |

-77.38 |

|

IndusInd Bank |

146 |

431.30 |

207.3 |

|

Kalpataru Power |

236.44@ |

100 |

-57.71 |

|

Crompton Greaves Ltd |

246.34$ |

110.45 |

-55.16 |

|

GAIL |

415 |

353 |

-17.38 |

|

Absolute Returns |

42.07 |

||

|

Annualized Returns |

14.02 |

||

@adjusted for split

#adjusted for split & bonus

$adjusted for bonus

As can be seen, out of 10 stocks, only 5 stocks were in the green, with two being absolutely flat. IndusInd Bank spared Ventura the blushes with a stellar performance of 200+% gains.

The worst performer was Housing Development and Infrastructure (HDIL). The steep fall in the stock over the past few days over rumors that it was going bankrupt/ had debt repayment issues/ the promoters are dumping the stock and the general indifference over realty and infrastructure stocks have meant that poor investors have lost a whopping 75% of their wealth over 2 years.

Deepak Fertilizers and Petrochemicals is a good example on why you must never dabble in stocks that are dependent on Government policies for their survival because given a choice between profit mongering corporates and the common man, the Government will (rightly) prefer to support the common man. That is why fertilizer and sugar stocks never do as well as stocks of other companies.

Anyway, what the Ventura Portfolio performance shows is the importance of diversification. Ventura spread out their stocks over various sectors – Banks, Oil & Gas, Autos, Capital Goods, Fertilizers, Realty etc. It is thanks to this sensible allocation, that the Portfolio has kept its head above water.

Ventura’s 10 Stocks Picks Of 2010

[download id=”341″]