It is by now an undisputed proposition that all of Vijay Kedia’s stock picks are required to be scrutinized very carefully because they have the tendency to suddenly turn into multibagger stocks.

In the past, we have treated Vijay Kedia’s stock picks, Sudarshan Chemicals and Apcotex Industries, in a very casual manner and without according to them the utmost respect that they are entitled to.

We have paid a very steep price for this attitude by losing out on the chance to effortlessly pocket mega bucks.

Astec Lifesciences

Luckily, Astec Lifesciences, one of Vijay Kedia’s favourite stocks, is still a micro-cap with a market capitalisation of only Rs. 800 crore.

I have earlier diligently drawn attention to the fact that Gaurav Parikh, a leading stock market expert, has opined that it is only a question of time before Godrej Agrovet, the unlisted behemoth parent of Astec Lifesciences, uses Astec as a vehicle to go public.

80% Gains in just three months

Something appears to be cooking under the hood if you go by the stock price.

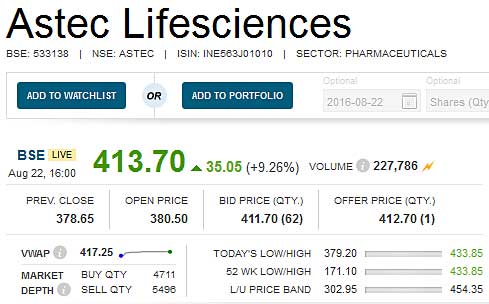

Today, the stock shot up nearly 10% without any apparent provocation. It appears that some deep pocketed investors are stealthily tucking into the stock.

In fact, in just the past three months since I drew attention to Vijay Kedia’s investment in Astec, the stock is up a magnificent 80%.

Savvy investors are barging in

It is a fact that Astec is attracting savvy investors to its rolls the way honey attracts bees. In addition to Vijay Kedia, Astec has attracted the attention of Narendra Kumar Agarwal. Narendra Kumar Agarwal is a savvy and heavy-weight investor in his own right. His portfolio boasts of multibagger stocks like GHCL, Nilkamal, APL Apollo, Himatsingka Seide, etc. He holds 8,57,762 shares in Astec Lifesceinces which are worth Rs. 35.51 crore at the CMP of Rs. 414.

Some other esteemed investors on Astec’s rolls include EM Resurgent Fund, Ajay Upadhyaya, Namita Bhandare etc.

Astec is also experiencing the benefits of being under the TLC of the Godrej group.

Excellent Q1FY17 Results

Ashok Hiremath, Astec’s MD, disclosed that the Q1FY17 results are “excellent” even though they don’t appear so from the figures. He explained that if the change due to the accounting standards is ignored, the sales are up by 34 percent and the profit before tax (PBT) is also up significantly.

He also stated that the underlying EBITDA is in excess of 20 percent and the revenue growth is 34 percent like-for-like under the old accounting standards. He assured that the EBITDA margins would be maintained at 20 percent CAGR going forward. The overall sales for the year should be up by about 25 percent, he added.

Hiremath also stated that Astec is seeing strong growth in demand in India as well as in the US and Australia. The export order book is also very strong and the ratio of 50 percent exports and 50 percent domestic will be maintained, he said.

Hiremath emphaisized that the debt, which stands at Rs 100 crore presently, has come down. He disclosed that ICRA has upgraded the Company by two notches in the credit ratings and that this would result in a significant improvement in the borrowing cost.

Accelerated growth is ahead

The dominant role that Godrej plays in the affairs of Astec Lifesciences is also apparent from the annual report where it is stated “Your Company is poised for accelerated growth given the Godrej brand, increased resources and synergies between Astec and the Godrej group of companies. GAVL has ambitious plans for Astec and this will drive growth. Astec’s strategy to continue its leadership in triazole fungicides and to expand its contract manufacturing business will remain unchanged”.

So, prima facie, it does appear that Gaurav Parikh’s prognosis for Astec will come true and that Vijay Kedia, Narendra Kumar Agarwal and the other savvy investors will have a lot to cheer about!

Suven life sciences boasts a greater financial sheet, and the prospects are far greater for them than Astec.

Looks like upside is not over for Astec yet.

I m actually a great fan of this site