When you spot that huge blotch of red in your portfolio, your heart sinks and you ask in despair “How could I have ever bought this trash stock?”

At such times, it helps to note that even great investment legends like Warren Buffett and Rakesh Jhunjhunwala have made, and continue to make, enormous mistakes. However, what distinguishes these legends from us is their attitude to losses. They don’t mope over the losses or let it overpower their thought process.

Warren Buffett candidly admitted that he had made a “huge mistake” in buying Tesco, the supermarket chain. The Company disclosed that it had “overstated” its profits and the stock price tanked. Warren Buffett sold a major chunk of the holding when the stock price hit rock bottom and suffered a loss of nearly $678M in just 3 months.

Buffett’s decision to sell Tesco at the bottom has come in for some criticism because there appears to be nothing wrong with the fundamentals of the company. Also, there is a new management in place which will set right the wrongs. Fool.com argued that in selling Tesco at the bottom, Warren Buffett had “betrayed his own philosophy” and committed a “second mistake”.

Several others of Warren Buffett’s core holdings like Coca-Cola and Exxon Mobil have been sluggish throughout the year.

Even IBM, Warren Buffett’s first big technology sector bet, is in the doldrums over disappointing earnings.

Interestingly, Parag Parikh’s PPFAS Mutual Fund holds a chunk of IBM stock worth Rs. 14.46 crore.

BYD, the Chinese electric car maker, shocked everyone by plunging a record 47% in one trading session a few days ago. The newspapers screamed that Warren Buffet had lost a billion or two in the crash. The stock has, however, partially recovered after that crash.

Rakesh Jhunjhunwala, our own Oracle of Mumbai, is very inspiring as well. In his latest interview to HT, he declared:

“Let me tell you, I am not afraid of making mistakes.”

He added:

“I have no stress. If I lose money — even if my wealth halves — what difference will it make? Will it take away my house, my car, or will my children stop going to school?”

When you have an attitude like that, can you ever lose?

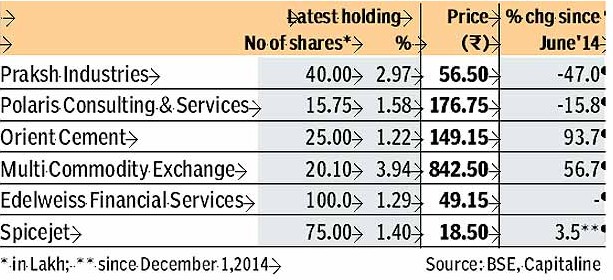

2014 has been a mediocre year for Rakesh Jhunjhunwala. While his latest stock picks like Orient Cement and Multi Commodity Exchange (MCX) surged and gave handsome returns, his other stock picks like Spicejet and Praksh Industries, Edelweiss Financial Services and Polaris Consulting are in the doldrums (see article in FE).

Dears

Being active in the market for 30 years i regard Rk dhamani, then Ramkesh Dhamani, Raamdeo agarval and lately Vijay Kedia

Their selection has been meticulous.

also though knowing well two stocks and their behavioral pattern for over decades and one i applied Ipo too( Himatsingha) bought it just becoz they bought it thinking they know better than me one is century textils and other one bought by a big mf himatsingha.. against my conviction

to see them bleeding…

so none is pefect

In “STOCK MARKET SPECULATION AND INVESTMENT” if you are 60% right in your “CALLS: then you are a millionaire.Thats the key to being a successful investor or in other words a successful gambler/investor.YOU WIN SOME AND LOSE SOME BUT YOUR WINS SHOULD OUTNUMBER YOUR LOSSES.

I think judging my SpiceJet is not right as Rk recently added that. Also NCC Ltd is not mentioned in the list which has appreciated much. and still going strong. Other than these two if all are mentioned above then surely RK has not had a good year as this much earning in bull market is not enough. Anyway, I also saw that biggies do not perform better on big bull run as they try to protect their money as well so that in bull or bear they earn decent amount so that avg is good one for long term. So, if possible, post about avg return over 3years or 5years period. Thanks.