Amitabh Bachchan, the doyen of Bollywood, appears to have developed a special liking for Venkata Srinivas Meenavalli, the technocrat – promoter of two companies called Stampede Capital and Ziddu.com (Meridian Tech Pte Ltd). While Stampede is an Indian company, Ziddu/ Meridian is a Singapore based company. Amitabh Bachchan has invested large sums of money in both companies.

Amitabh holds 779,609 shares in Stampede Capital as of 30.06.2015. This constitutes 3.42% of Stampede’s total capital.

Amitabh has also gone ahead and invested $2,50,000 (Rs. 1.57 crore) into Ziddu.com. While $150,000 was invested from his personal account, $100,000 was invested from Abhishek Bachchan’s account. In fact, the Big B is one of the first to take advantage of the RBI’s Liberalised Remittance Scheme (LRS) which permits Indian citizens to invest upto $125,000 in foreign assets.

Rajesh Yadav, MD & CFO of ABCL, revealed that the investment in Ziddu.com was made because it has “value and potential”.

If you are not a tech-savvy person, you will have difficulty in understanding the business model of Stampede and Ziddu.

Venkata Meenavalli gave a talk in May 2015 where he sought to explain the business model of Stampede Capital. The essence of the talk is that the company is engaged in “electronic market making” in foreign stock and commodity exchanges.

While Venkata Meenavalli was not very intelligible about what it is that Stampede does, he did make it clear on many occasions during the talk that his role models are other “designated market makers” like US-based Virtu Financial, Renaissance and Citadel. According to Virtu’s website “DMMs are obligated to facilitate price discovery and act as dedicated liquidity providers contributing to more narrowly quoted spreads, deeper markets and greater price stabilization”. Virtu is also engaged in “high-speed trading”.

Interestingly, Virtu Financial came out with its $314M IPO in April 2015. The shares were offered at $19 each. The IPO was a success and oversubscribed 15x. The stock surged 20% on listing to $22. It is presently at $20.70.

There is more clarity as to the business model of a market maker in the CNBC interview of Virtu Financial. Apparently, though the spreads are wafer-thin and they make only a few bucks on each trade, the several million trades done in a day across several markets across the Globe contributes to hefty earnings.

Venkata Meenavalli was clever in associating Stampede Capital with Virtu Financial. Some of the excitement related to Virtu’s NASDAQ IPO listing may have rubbed off on Stampede and contributed to Stampede’s success on the Indian stock markets.

Ziddu.com is an online cloud storage and sharing solutions firm. It pays its users for sharing the files uploaded on the site and gets revenues from advertisements. It claims to have given away rewards worth $1 million to its users by way of “bit coins”. Ziddu boasts of 1.2 billion page views with more than 300 million visitors a month. It claims to have 30 employees at its centers in Singapore, London and Hyderabad.

There are a number of youtube tutorials on how to “make money from Ziddu”.

To my untrained eye, Ziddu appears to be similar to hundreds of file sharing sites like google drive, dropbox.com. megaupload.com, rapidshare.com etc.

The sustainability of the business model is suspect. Rapidshare.com, one of the most popular file sharing sites, closed in March 2015 after a long decline because it was no longer a viable business.

One big problem with the file sharing business is that of piracy. The “incentives” to users is an invitation to them to host pirated movies, music etc and share links so as to increase traffic. However, this has severe legal repercussions especially in developed countries like the USA and the EU. In fact, the business model of Kim Dotcom’s Megaupload and Rapidshare went bust because of legal woes related to copyright infringement.

So, whether in the midst of such cut-throat competition from rival file-sharing sites and potential legal issues, there will be any takers for Ziddu’s proposed IPO for a NASDAQ listing remains to be seen.

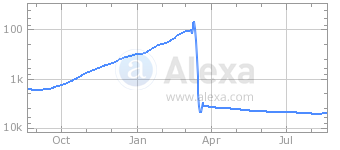

An intriguing aspect is that Ziddu’s traffic had soared to a high of 100,000 visitors in April 2015, when the Big B made the investment. Since then, the traffic has slumped to about 12,000 a day as per Alexa. Ziddu’s global rank is also shown by Alexa as having slumped to 5,134. It is not known what the rank was earlier when the Big B invested.

One interesting tit bit of information is that Amitabh Bachchan is not the first celebrity to be fascinated by file sharing. That credit goes to Frank Zappa, the legendary maverick musician. As far back as in 1989, Frank Zappa conceived of a website for “online sharing” of music files.

Meanwhile, the sheen is coming off Stampede Capital’s stock market performance. The stock surged like a rocket over the past one year probably buoyed by the IPO success of Virtu Financial and the resultant hype. However, as its quarterly results were disappointing, it is also plunging rapidly. The stock touched an all-time high of Rs. 800 on 06.08.2015. Since then it has been on a freefall and is breaching successive lower circuits. At the CMP of Rs. 366, there is a loss of more than 50% in just a couple of weeks.

Fortunately, Big B is still in the green because his purchase price ranges from Rs. 84 to Rs. 127. However, if he is spotted anywhere close to Dalal Street seeking to peddle off his holding in Stampede Capital, the sky will fall on the Company! So, we have to watch and see which way the investments in Stampede and Ziddu turn out for Amitabh Bachchan.

The same Venkata Meenavalli promoted another listed company North Gate Technology ( Now name changed to Green Fire Agri Commodities) touched a price of Rs.1587 in 2007 .This stock now trading around Rs.3 ! . This is the quality of Mennavalli promoted companies .Beware of such companies , BIG B may have enough money to loose but the story of poor retail investors may be different . Don’t buy any stock without proper due diligence only because Big B buying it.

Thanks for the info.

It is starting to become easy for retail investors when they don’t know where to invest. Find out if Big B is invested in the company. If he is, then stay very far away from that stock. There is no need to get into any fundamentals, management, or anything. If Big B bought it, then you make sure you stay away from it. It is shocking at the types of companies he is buying.

Good read.

Would you say Stampede Capital is about the same as Lyka Labs.

Price going up without the fundamentals not being in sync?

Big B may not be even aware of what his fund manager/broker or what his PMS (discretionary) is doing.

Dictionary meaning of “stampede” is self-explanatory.

He can afford to lose money.

Arjun , I would like to ask you , why is that you extolled the virtues of Mr AB as a stock picker just a few months ago on the very same stock and today you are talking in a different vein ? Did you analyse the stock in depth when you published the initial report, I am asking this because this website has loyal followers and they depend on you for correct analysis of stocks.

ULTRA HNI’s are always looking to book capital loss to reduce their taxes