Sensex & Nifty make history by surging to All-Time Highs (ATH)

“Aaj Ya Toh Is Paar Ya Us Paar,” Mukeshbhai, Jigneshbahi and me chanted in unison, as we marched in a determined manner towards the Sanctum Santorum in Jeejeebhoy Towers, accompanied by a horde of Bulls.

We were inspired by Sonia Shenoy.

She was leading us every inch of the way, inspiring us to reach the final frontier.

“Nifty 76 points away from all time high of 12103 … okkkkk….. Buckle up and enjoy the ride !! nifty now less than 50 points away from all time highs of 12103 … Nifty Bank 230 Points Away From Record High …,” she breathlessly kept up a running commentary, ensuring that our spirits are kept high and we do not falter.

Finally, we did reach the pinnacle and conquered Mount 12103 at 9.20 hrs IST.

Sonia Shenoy did the honours and announced the accomplishment in her trademark succinct style.

Nifty hits record highs , crossing earlier highs of 12103

sensex opens at record highs

nifty bank now 60 points from all time highs @CNBCTV18News— Sonia Shenoy (@_soniashenoy) November 26, 2019

Anisha Jain, who is learning the ropes of journalism from Sonia, explained the entire nitty-gritty of the episode with utmost clarity.

#MarketAtRecordHigh | #Sensex & #NIFTY scale #record highs. What are the #stocks that have contributed to this rally? @_anishaj has the details pic.twitter.com/V1TuyKnUD5

— CNBC-TV18 News (@CNBCTV18News) November 26, 2019

Experts baffled at surge

The surprising part is that leading experts are baffled as to why the Nifty and Sensex are surging like rockets.

Fund Manager Ravi Dharamshi eloquently expressed the bewilderment of the experts.

This is that stage of the market where economist can’t figure, political analyst can’t figure, journalists can’t figure, people focusing on high frequency data can’t figure…why the hell is market going up. Most of them will figure post facto. #markets

— Ravi Dharamshi (@ravidharamshi77) November 26, 2019

However, I was neither baffled nor bewildered.

This is because Atul Suri, who is Rakesh Jhunjhunwala’s protégé and a master in technical analysis, had already alerted us that a super-surge is on the way and that we have to prepare for it by tucking into top-quality stocks.

“Forget doom-sayers, a broad-based equity bull market is playing out globally,” he has declared with full confidence in his voice.

Atul Suri has also assured that Mount 13500 is in sight and that we will reach it within a few weeks.

He has also provided clear-cut advice on the stocks that we should buy to derive maximum advantage (see TINA Stocks Will Now Give Mega Bagger Returns: Atul Suri)

No doubt, he knows what he is talking about and we have to listen to him with rapt attention and obediently follow instructions.

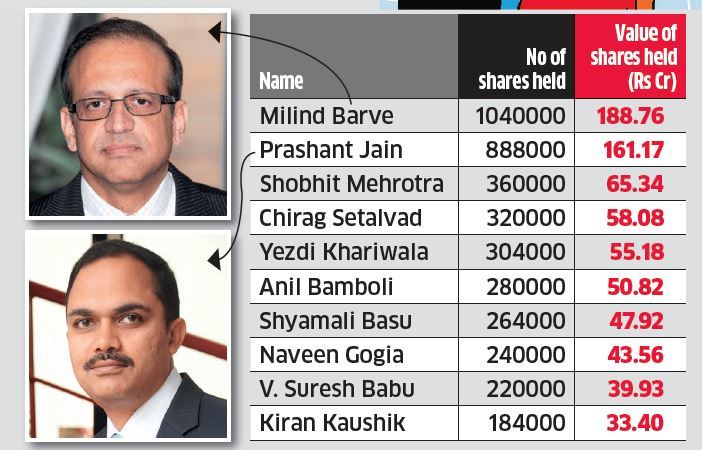

Prashant Jain’s net worth surges to Rs. 450 crore

While the experts are bewildered about the surge in the stock markets, Prashant Jain and his colleagues at HDFC Mutual Fund are grinning from ear to ear.

This is because there has been a quantum jump in their net worth.

Himadri Buch of moneycontol.com has done brilliant sleuthing and fished out details of Prashant Jain’s portfolio holdings.

She has pointed out that as of date, Prashant Jain holds 928,000 shares of HDFC AMC.

These were allotted to him under the ESOP, at the time of the IPO in August 2018.

The stock has more than doubled from the listing price of Rs 1,738 to the CMP of Rs 3,703.

This has caused the value of Prashant Jain’s holding to surge to a mammoth Rs 344 crore as of date.

Milind Barve, the distinguished MD of HDFC AMC, has even more reason to be pleased.

He holds 11.7 lakh shares of the AMC, which are now valued at nearly Rs 433 crore.

Other fund managers of HDFC AMC are also enjoying the spoils.

Shobhit Mehrotra and Chirag Setalvad, who own 371,200 shares and 336,000 shares respectively, are worth Rs 137 crore and Rs 124 crore, respectively, Himadri Buch reported.

Shyamali Basu, the distinguished lady stock-picker in the elite list, holds 264,000 shares and has pocketed Rs. 98 crore.

(Image from ET at the time of the listing)

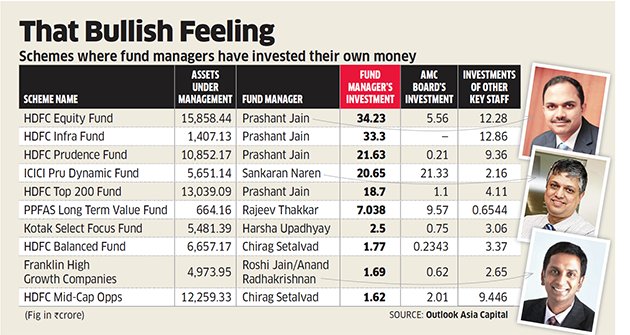

In addition to the holding in HDFC AMC, Prashant Jain also has about Rs. 100 crore+ in various schemes of HDFC Mutual Fund as is revealed by the ET in a report of August 2015.

This obviously means that his present net worth is not less than Rs. 450 crore.

It is notable that mutual fund managers also receive fabulous salaries, running into several crores of rupees.

Why is HDFC AMC a ‘TINA’ stock?

Atul Suri rightly described HDFC AMC as a ‘TINA’ (There is no alternative) stock.

This is because there are only two listed AMC companies in India, i.e. HDFC AMC and Reliance Nippon Life Asset Management.

This means that institutional investors who are desirous of having a finger in the lucrative pie have no option but to buy these two stocks, irrespective of valuations.

Himadri Buch has done a head-to-head comparison of the two stocks in her report.

She has pointed out that HDFC AMC is the market leader with an AUM of Rs 3.76 lakh crore as of September 2019.

Also, its AUM surged 23% last year while that of RNAM plunged 17% to Rs 2.02 lakh crore.

This implies that HDFC AMC is the hot favourite amongst investors.

Are more gains expected from the AMC stocks?

Atul Suri has answered this question as well.

“A very big trend is playing out in the insurance and AMC space. It has all the makings of a very large trend,” he opined, implying that these stocks have a long way to go.

Himadri Buch has also interviewed distinguished experts in search for a reply to the same question.

Experts opined that AMC stocks would be ‘consistent compounders’.

“We are confident that the mutual fund pie of investments will increase at a higher rate than FDs in the savings portfolio of an investor. AUM for HDFC AMC has doubled in the last three years. The company’s market share is around 15 percent,” Vineeta Sharma of Narnolia Financial Advisors was quoted as saying.

This was corroborated by another expert who said:

“The AMC as a business has more upfront cost-such as set up costs and investor acquisition cost whereas, later on the running basis, the cost is less, only needed for fund operations. Thus, profits in later years are higher for AMCs, giving good valuation visibility.”

He also explained that established AMCs with long track record have a regular investor base which provides regular income by way of SIP.

This recurring revenue model provides visibility and improves valuations.

It was also explained that HDFC AMC’s premium valuations to peers are justified as it has higher profit CAGR, strong pedigree, HDFC’s brand, distribution, long-term performance, relatively stable management profile, high dividend payout and high capital return ratios.

In fact, all HDFC Group companies trade at premium valuations and HDFC AMC is no exception to the rule.

On #HDFCAMC listing, @CNBCTV18Live's consulting editor, Udayan Mukherjee tells @moneycontrolcom's @sant0nair, asset management theme is an excellent theme in the long term. It's a cyclical business; will have its ups and downs

Watch FULL interview: https://t.co/BwioNshcij pic.twitter.com/dhOeVVCCtb

— moneycontrol (@moneycontrolcom) August 7, 2018

Leave a Reply