As far back as in December 2013, the rhetorical question was asked “Has Prashant Jain lost his magic touch?” The reason for the question was the poor performance of the funds personally managed by Prashant Jain such as HDFC Top 200, HDFC Prudent Fund, etc.

At that time, Vivek Kaul of valueresearchonline, who tracks mutual funds with a microscope, suggested that the reason for the poor show is the massive size of the Fund (Rs. 1.73k crore as of December 2015) which makes it a huge elephant unable to find meaningful opportunities.

Sadly, the poor performance has continued to dog HDFC Mutual Fund to date. Worse, now even Prashant Jain’s stock picks are being called in question.

One of Prashant Jain’s contrarian stock picks was State Bank of India. Unfortunately, the timing was horribly wrong. The growing concern over the poor quality of PSU Banks coupled with an adverse macro-economic environment has sunk SBI’s prospects.

#Chart – Prashant Jain's concentrated & contrarian call on SBI (both in Top 200 & Equity fund) went nowhere in 9 yrs pic.twitter.com/kRMEf7JVBH

— Jagadees (@eeswardev) February 3, 2016

Sadly Prashant Jain's HDFC MF is worst performing FundHouse

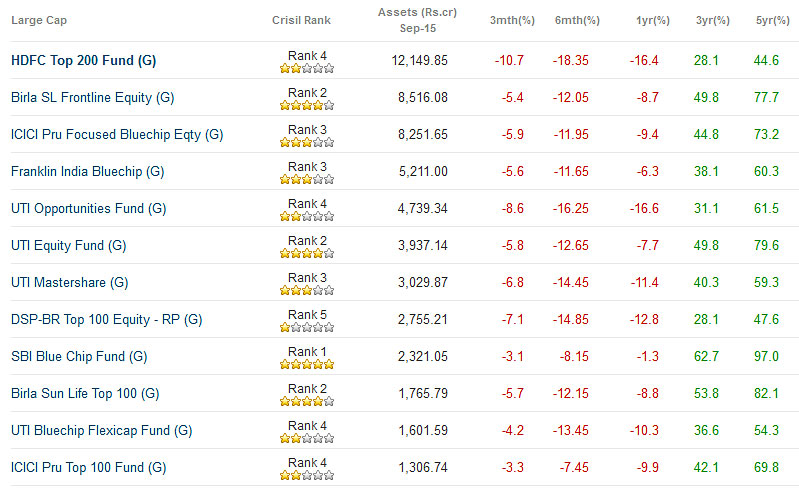

Its HDFC Equity & Top200 has given -20% negative returns https://t.co/vvGeNytpXB— Rishi Bagree (@rishibagree) February 3, 2016

HDFC Mutual Fund has suffered more embarrassment because Mint 50, which is highly influential amongst mutual fund investors, put the schemes of the Fund “under watch”.

Kayezad E Adajania, an editor at Mint, expounded the reasons for the downgrade in the following words:

“Fund managers such as Prashant Jain of HDFC Asset Management Co. Ltd, who have been banking on better conditions, have been caught between a rock and a hard place as the stocks and sectors that they have bought aren’t showing much signs of improvement. The banking sector – especially the government-owned banks, led by the country’s largest lender, State Bank of India – are still burdened by rising non-performing assets and markets are looking for signs of improvement before they throw their weight behind the sector. And now, having bought these stocks and suffered for more than a year or two, some of the fund managers don’t seem to want to sell such stocks only to be caught off guard; what if the stocks turnaround after they sell?”

Kayezad E Adajania also pointed out that some financial advisers have asked their investors to exit Prashant Jain’s schemes and that they are reluctant to let their investors suffer for “the cost of Jain’s conviction or pride”. “Year 2016 will be a litmus test for Jain since his equity schemes have been in the bottom quintiles in three of the past five calendar years” Kayezad E Adajania added in a grim tone.

It is also stated that Mint has put an “orange” flag on HDFC Funds and advised investors to stop lump sum investments and to continue only SIPs.

Mint50: Curated list of 50 Mutual Funds is back

Puts "orange" flags on HDFC Funds – Says Stop lumpsum, Continue SIPshttps://t.co/l4cjzbtq6w— Manoj Nagpal (@NagpalManoj) February 8, 2016

The other aspect that has irked investors is that the Mutual Fund has continued to receive huge fees despite the non-performance.

HDFC can't charge 100 crores in fees for delivering a 7% CAGR over a 5 yr period. Fees should be based on 1 & 5 year CAGR and alpha. Period

— Vijay Pahwa (@Vijay_Pahwa) December 16, 2015

However, Prashant Jain is not without his supporters. His loyal fan club of admirers includes the analysts at Morningstar. On the earlier occasion, Larissa Fernand had rushed to his defense on the basis that he is “incredibly diligent with his research” and “sticks to his conviction”. Even in the present crises, Morningstar’s Himanshu Srivastava has called Prashant Jain a “supremely skilled manager” and awarded his Top 200 Fund a “Gold rating”. It was added that “Despite a poor showing in 2015 so far, our conviction in the HDFC Top 200 fund’s long-term prospects remains unchanged”.

So, in the light of the conflict of opinion between the experts, it is difficult to opine on whether investors should stick to HDFC Mutual Fund or jettison it in search of greener pastures!

I in my career in stock market have learned that there would good periods and there would be bad ones. Its quite like a cricket batsman…bad patches do come…that doesnt mean one can write off a genius like Prashant Jain. Also, in multal funds specially the big ones, fund managers has to work with strict constraints. That limits possibilities.

I have great respect to Parshant Jain,but he has definitly gone wrong.It seems he believed too much in recovery of Indian Economy and on Modi also like rest of the nation.He forget old saying never put all your eggs in one basket (of recovery).But in my view he don’t have any choice now but to continue with most of his existing bets, as now due to deep correction in most of the stocks in his portfolio ,these stocks have become under priced.

The point is well made at the top, since the fund is very large it is not easy for it to change positions quickly. It would only end up losing more value. Also let us be realistic the fund has grown so big because of HDFC and HDFC Bank’s reputation and their marketing and distribution efforts not because investors were greatly impressed by returns of management quality. Investors rarely look at fund managers though they should.

Fund size may be issue in mid cap or small cap funds but not in large cap funds.In funds all are many mega cap or atleast very large cap stocks .Fund size inspite of being large ,is small in comparison to total market cap of all BSE 200 stocks.So if he had wanted to change positions,he could have.He was betting on corporate lenders like ICICI bank,state bank and BOB,but he could not anticipate slugginish in economy resulting in NPA.. But his competetrs were Beting on retail bankers like HDFC bank,Kotak and Indusind.He was first fund manager to take call on FMCG during 2008 crash by avoiding infra.He exited FMCG too soon citing over valuation, but valuations never come down resulting his under performance.It is purely his call going wrong on economy.But as now his Portfolio stocks are beaten down and offering attractive valuations,in my view he should hold on till next recovery in market.Investers should also wait and certainly invest more throgh SIP as fund may out perform now on basis of sector rotation and bets on stocks with reasonable valuations .This is certainly not a time to exit,but investers can look to cash out some portion after next out performance ,when market is up.More over this is not a good time to exit any of mutual funds, rather time to start fresh SIP as Market is down.

All your points resemble Prashant Jain points in interviews. Comparing market cap of BSE200 with mutual fund AUM is silly! Check the huge amount invested in each scrip and then imagine how many number of shares the fund manager need to sell. Consider the same for his other bad calls. You will understand how silly it may be to compare Prashant Jain’s own argument of saying the AUM is much lesser than BSE200. He is the fund manager and he needs excuses. The problem with him is his lack of courage of admit his own mistakes. Good Luck to its investors.

Banking was something most analysts got wrong.I was recommended by ICICI’s RM to go into banking MF 2 years back and which has been in red ever since. I think most of them underestimated the size of NPAs and the oil crisis.

I am sure Prashant Jain will bounce back, he is not God even the great Warren Buffet has made mistakes

Please report Dolly Khanna’s stylam purchase and porinju + Ashish Kacholia’s Royal orchid purchase

I am a investor in HDFC Equity and Top 200 fund since 2003.

Prashant style of fund management will always underperform in the short run, but it will exceed the market return in long run. His conviction to say away from dot com bubble stocks or the real estate and infra stocks in 2006 and 2008 made the fund look ordinary and underperformer and at times you will feels your fund is not matching the market returns. As the market turn towards the value stocks that he would have accumulated during the underperformance period, the performance of the fund will outclass the market return for the whole period.

I have experienced this in 2005, 2008 and now it is on going. But I pretty sure it will return back. Trust him and back him. We are always ready to be critics thats out problem at times.

I think it’s high time one should stop remembering Jain’s good performance more than 10 years back. I don’t understand why people forget the recent 5 year horribly poor performance just because he gave excellent returns a decade back in different economic setting and in less mature market. Maybe he is aging or maybe now the fund industry has much more intelligent fund managers that it had 10 years back which now makes Jain just an average manager.

Funds and market changes cannot be predicted on the timeframe when it will go up or down, the banking sector funds in his portfolio is expected to give more returns in the coming years when the banks have done their cleanups of their balance sheets and other contra stocks will give way for best returns in the coming days/years where all would again start praising him on his wonderful picks,

All his portfolios will again be in the limelight and people will start investing inspite of the high AUM, most of the funds in ICICI stable and Franklin have their AUM raising to near 10k crore and more will also see the same for a couple of years and then bounce back again