Bulls call the shots in Dalal Street

There is now no doubt that Bulls have occupied Dalal Street and are calling the shots.

The Bears are nowhere to be seen.

Sonia Shenoy confirmed this situation. She pointed out that the Nifty is at a 6 month high and is up 6.8% in March alone.

The Bank Nifty appears to be on steroids. It is up a mammoth 2000 points in just 7 days.

This is because FIIs are making a no-holds-barred move towards Dalal Street and are scooping up high-quality stocks.

They have invested an eye-popping sum of 23,086 crore in Indian stocks in March 2019 itself.

happy holi ! bulls are def in the front seat ! listen in to the most imp cues today https://t.co/dPbUxECYEg

— Sonia Shenoy (@_soniashenoy) March 20, 2019

Nifty ends in green for 7th straight day

Nifty at 6 month high, up 6.8% in march

Bank nifty at record highs, up 2000 points in 7 days

FIIs buy 2132cr in cash market yest

FIIs bought 23086cr in MarchMarch 2019

MSCI India up 9%

MSCI Asia ex japan up 1.7%

MSCI EM up 1.8%— Sonia Shenoy (@_soniashenoy) March 20, 2019

Goldman Sachs upgrades India, predicts target of 12,500

The optimism of the FIIs is driven by the fact that Goldman Sachs, the eminent research agency, has upgraded Indian stocks to “overweight” and recommended an aggressive buy.

Goldman has predicted that the earnings of Indian stocks will grow at a hefty 16% CAGR which is more than what one can expect from the other developed and emerging markets.

Goldman sachs upgrades India to overweight

Nifty target of 12500 in 12 months

this is a catch up pre-election rally driven by FII flows

sharp underperformance, better Q3 earnings,pick up in FII flows leads to upgrade

expect earnings to grow 16% this yr, highest in the region— Sonia Shenoy (@_soniashenoy) March 19, 2019

It is notable that HSBC, also a reputed foreign investment agency, has also recommended an aggressive buy of Indian stocks with the prediction that the Sensex will surge to 40,300 by December 2019.

HSBC has also very kindly given us a list of 16 high-quality stocks which have multibagger potential (see Get Ready For Sensex At 40,300 By Dec 2019, 16 Blue-Chip Stocks To Buy Now).

Akash Prakash storms Dalal Street and grabs Laurus Labs

Nobody can dispute that Akash Prakash is a visionary and has mastered the art of finding multibaggers amongst Indian stocks.

In fact, the AUM of his India-focused Amansa Capital Fund is now in excess of $1 Billion (Rs. 6,500 crore) owing to the stellar success in finding winners.

Laurus Labs, an unknown small-cap company with a market capitalisation of Rs. 4,100 crore, is the latest stock pick of Akash Prakash.

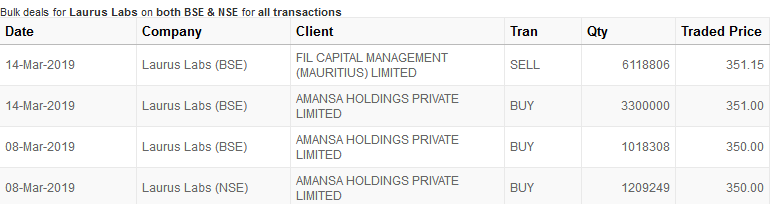

On 8th March 2019, his Amansa Capital bought 12,09,249 shares from the NSE and 10,18,308 from the BSE.

This was followed by a buy of 33,00,000 shares on 14th March 2019 from the BSE.

The acquisition totals 55,27,557 shares and is worth Rs. 213 crore at the CMP of Rs. 385.

Margin Accretive Synthesis is a major trigger for Laurus Labs

The mystery as to what Akash Prakash saw in Laurus Labs has been explained by the sleuths of ET Now.

Apparently, “Margin Accretive Synthesis” will be a major trigger for the stock.

Amansa Capital has bought over 45 lk shares in Laurus Labs in a three-block deal. Margin Accretive Synthesis is a major trigger for Laurus Labs.@LaurusLabs #AmansaCapital pic.twitter.com/JfJVPKswEV

— ET NOW (@ETNOWlive) March 19, 2019

| LAURUS LABS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 4,092 | |

| EPS – TTM | (Rs) | [*S] | 9.15 |

| P/E RATIO | (X) | [*S] | 42.01 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 15.00 | |

| LATEST DIVIDEND DATE | 28 JUN 2018 | ||

| DIVIDEND YIELD | (%) | 0.39 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 143.27 |

| P/B RATIO | (Rs) | [*S] | 2.68 |

[*C] Consolidated [*S] Standalone

| LAURUS LABS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2018 | DEC 2017 | % CHG |

| NET SALES | 529.46 | 478.93 | 10.55 |

| OTHER INCOME | 1.42 | 9.94 | -85.71 |

| TOTAL INCOME | 530.87 | 488.88 | 8.59 |

| TOTAL EXPENSES | 441.74 | 391.58 | 12.81 |

| OPERATING PROFIT | 89.13 | 97.29 | -8.39 |

| NET PROFIT | 17.82 | 34.87 | -48.9 |

| EQUITY CAPITAL | 106.44 | 106.03 | – |

(Source: Business Standard)

On track for strong growth; retain BUY on positive risk-reward

BOBCaps has conducted an in-depth study of the affairs of Laurus Labs and recommended a buy for the target price of Rs. 495.

The rationale is as follows:

“Management upbeat on growth:

Management expects positive news flow on launches over the next 12-18 months and also visible operating leverage in its

formulations segment. Further, any decline in Efavirenz (EFA) sales would be sufficiently mitigated by ramp-up in Lamivudine and Dolutegravir (DTG), as and when the market shifts.

The company believes the worst of pricing pressure on the ARV portfolio and China-related cost inflation is behind us.

ARV guided to grow in mid-single digits, synthesis at 30% CAGR:

ARV funding remains adequate and franchise revenues are guided to grow in mid-single digits annually.

Laurus has participated in the ARV tenders in South Africa (2019-22) via a partner and remains hopeful of allocation in the near term. Management expects the synthesis business to log a >30% CAGR in FY19-FY21.

Lamivudine commercial launch planned for Feb’19:

Exhibit batches to customers are in progress and most customer contracts are in place.

Laurus continues to expect 30% market share by FY21 (we assume 20-22% share).

Well prepared for market shift to DTG:

Laurus has already converted capacity for a few EFA intermediates into DTG which can be further augmented at

minimal cost.

The company is targeting annual capacity of 40-50tonnes depending on the market shift. Plant economics will be largely similar given that DTG is 1/12th in volumes and is priced 12x higher to EFA.

Import cost risk has materially reduced:

Vertical integration of Tenofovir and Entricitabine to N-3 intermediates stage has lowered the risk from rising import costs, which had eroded H1FY19 gross margins.

No greenfield investment in next five years:

From FY20, capex will reduce to Rs 1.5bn annually (vs. a Rs 3bn run-rate seen in each of the last three years).

This should bolster free cash flows.

Retain BUY with 32% upside potential:

In our view, the market is disregarding investments and potential upsides in formulations, even as resurgent FCF and ROCE would support valuations. Retain BUY with a Mar’20 target of Rs 495”

High visibility on recovery, earnings to triple

HDFC Securities has recommended a “strong buy“.

The logic is quite succinct:

“Some of this will be seen in the next quarter as well; which, along with orders worth Rs 400-500mn postponed from 3Q, will result in a bumper 4QFY19. We have kept our estimates unchanged.

With utilization of the Formulations plant and growth in the profitable synthesis/oncology segments, we expect earnings to triple over FY19-21E (on a low base).

Reiterate strong BUY with a TP of Rs 480 (18x Dec-20E EPS).“.

Clean chit by other experts as well

Other eminent experts have also given Laurus Labs a clean chit and recommended a buy.

#BrokerageRadar | @MotilalOswalLtd on Laurus Labs pic.twitter.com/qr8B1npz5n

— ET NOW (@ETNOWlive) January 17, 2018

Jefferies positive on Laurus Labs, raises target for the stock pic.twitter.com/dQmqFMuQoX

— CNBC-TV18 (@CNBCTV18Live) May 14, 2018

#2QWithCNBCTV18 | Laurus Labs says have 80 registrations in formulations & filed for 16 ANDAs pic.twitter.com/fPHkPBQ1j7

— CNBC-TV18 (@CNBCTV18Live) November 2, 2018

#JustIn | Laurus Labs receives approval from @US_FDA for Hydroxychloroquine tablets & also gets tentative approval for Abacavir, Dolutegravir & Lamivudine tablets pic.twitter.com/CmOoRLV4De

— CNBC-TV18 (@CNBCTV18Live) March 11, 2019

Laurus Labs gets USFDA nod for #Malaria treatment tablets https://t.co/9lNubmHQOe pic.twitter.com/ki2MWotyLQ

— Business Line (@businessline) March 11, 2019

Laurus Labs is ready to flood the US with cheap HIV drugs https://t.co/Dk4oApPSVF

— Livemint (@livemint) December 4, 2017

ETHealthworld | Laurus Labs gets USFDA nod for malaria, auto-immune diseases drug https://t.co/o3N40lpjo3

— ETHealthWorld (@ETHealthWorld) March 11, 2019

Conclusion

There appears to be unanimity amongst the experts that Laurus Labs is indeed a good buy. So, we can also consider tucking into the stock in a slow and steady manner, whenever there are dips!

Well, If Laurus Lab is a buy with 106 Cr eq, I would buy IOL Chem with 56 Cr eq with 1029 Mcap compare to 4000 Cr Mcap of Laurus Lab.IOL Chem will end up with 1700-1800 Cr sales this year, so not much difference between sales too. With new drugs and API’s in pipe line from IOL Chem , it seems a good buy too.

IOL Chem has big debt but I think it will be taken care of sooner or later as Ibuprofen prices are on up.Maybe IOL Chem speciality division may start making profit as well.

Probably, it looks that looking at the historical performance and developments, IOL Chemicals is better than Laurus Lab. But the problem with stock market is that it always talks about the future value discounted to the present. And if the product and patented portfolio of Laurus Lab is superior than IOL Chem, then, Laurus will always command a better price.