It is unfortunate that the equitydesk forum, which showcased Basant’s stock picking skills and was instrumental in propelling him to great heights, met such an ignominious end.

At one time, in the not-so-distant past, the equitydesk forum used to be a bustling bee-hive of activity. It was *the* place to hang out if you wanted your daily dose of stock market discussion. Its members were passionate about stocks and also very knowledgeable. There was a warm and friendly atmosphere throughout and juniors could learn the tricks of the trade under the benign supervision of the seniors. The forum was a treasure house of wisdom and knowledge.

The forum boasted of a massive membership base of 60,000+ and was probably second only to Moneycontrol’s MMB.

Sadly, Basant’s ambition to start his own stock advisory service called ‘Basant Top 10’ conflicted with the growth of the forum. He set up another forum within the closed walls of Basant Top 10 which was available only to the subscribers of his service.

As most of the well-known and active members joined Basant Top 10, the equitydesk forum began to get neglected.

Basant also did not take kindly to members in equitydesk discussing the stocks recommended by him in the service. He made his displeasure clear and dealt with transgressions with an iron hand.

As the months turned to years, the forum went into a steady decline. With none of the popular members around, the traffic dwindled to a trickle.

There was some hope of revival of the forum when Basant abruptly closed Basant Top 10 after a raging controversy over whether he had dumped stocks like Hawkins and Page even while he was recommending them to his clients.

However, Basant made no effort to revive the forum and it stood there forlorn and neglected. It became a haven for spam bots and they took over the forum with impunity.

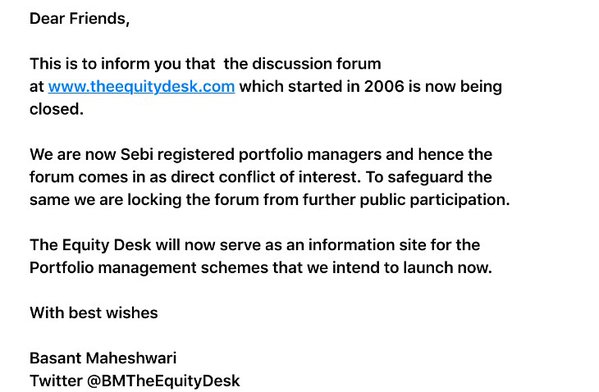

Yesterday, Basant finally pulled the plug on theequitydesk forum and ended its misery. He made this grim announcement:

Prima facie, Basant appears to have been hasty and short-sighted in his decision. The forum itself would not have been in conflict with Basant’s PMS though his participation in it would have been. So, what Basant ought to have done is to hand over the reins (including ownership?) of the forum to a trusted friend or a group of friends. The new manager(s)/ owner(s) could have fostered the forum and revived its past days of glory. This step would have advanced the growth of the equity cult in India because novice investors would have had a place to turn to for trusted advice.

Anyway, Basant has now got himself a brand new website which gives details of his PMS. One interesting fact is that while Basant has so far been a one-man show, one Ms. Shalu Mehra is now referred to as “co-founder/ partner” of the PMS. Shalu Mehra is described as a “passionate investor with significant personal investments in Indian Equities” and as a “value investor”. There is not much information available in public domain about Shalu Mehra or her stock picks. We will have to keep a lookout for her investments and stock picks.

Anyway, Basant has now got himself a brand new website which gives details of his PMS. One interesting fact is that while Basant has so far been a one-man show, one Ms. Shalu Mehra is now referred to as “co-founder/ partner” of the PMS. Shalu Mehra is described as a “passionate investor with significant personal investments in Indian Equities” and as a “value investor”. There is not much information available in public domain about Shalu Mehra or her stock picks. We will have to keep a lookout for her investments and stock picks.

In an earlier piece, I pointed out how a PMS can be a huge money-spinner for the PMS Manager. Even a modest AUM of Rs. 500 crore and a CAGR of 33% means that the manager gets to take home a whopping Rs. 31 crore per year. In fact, PMS Managers in the USA (called Hedge Fund managers) like Carl Icahn, Bill Ackman etc are billionaires in their own right.

Some other well-known PMS providers in India include Porinju Veliyath’s Equity Intelligence, Prof Sanjay Bakshi’s ValueQuest India Moat Fund, Nilesh Shah’s Envision Capital, Manish Bhandari’s Vallum Capital, Ravi Dharamshi’s ValueQuest etc.

It will be interesting to see which PMS garners the highest AUM over the next five years. Any guesses?

Fee charged are very high by these PMS. It should not be more than 2% ,they should compete with mutual funds in terms of cost structure. Other wise bear markets will result in shuting their shops like 2008 crash which resulted in wash out of many PMS .More over some of smart mutual fund managers who are presently managing successful small or micro cap funds will throw them out of business with low cost,higher transperency with matching performance.I would rather bet on these mutual fund managers .

I want to invest in small/micro cap mutual fund.Please guide me to invest in the best one.

dsp micro cap

Thank you.

did u guys notice this?. only 12 RTs and 58 likes for that announcement. thats shocking. earlier there was a huge response when he launched book and basant corner. even his tweets were getting good responses. nowadays he himself retweets after someone elese retweets his own tweet.

maybe did not renew the contract of the social media marketing company

See all actions of Mr Basant Maheshwari are for his own benefit and he does not care for those who stood by him – example he was supporting buying page and hawkins and gruh by his basant corner customers but in fact later on confirmed that he was selling ( perhaps he sold out the next day he closed basant corner but this is cheating in my view ) – another example he closed theequitydesk because he thinks he can make more money thro this pms – he will use pms money to buy same stocks which he is now long on and this way he will get double benefit – but basically the man is a fraud and most dangerous a hypocrite

I agree with you. He seems selfish. But this inspired me to work hard to set up my own pms.

Kindly do not provide space for him here to advertise. He is a greedy guy.

I have made good money through Basant’s Top 10 by buying his recommendations.

To be fair, I haven’t lost at all. But somehow, I dont trust him anymore and won’t be joining his PMS schemes.

Its a bull market in the past. You are bound to succeed.

Its astonishing that these cheap midcap and small cap peddlers in our country are compared to hedge fund moguls. These peddlers are not exceptional, people like us with our little knowledge and huge appetites to suck up are always on the lookout free ideas. We wont like it if one amongst our friends or family does it, but come someone with baseless ideas in unknown,illiquid small n micro caps, we elevate them to greatness. Its good that this bugger stopped his forum. It was corrupting the thoughts of people who had started to imagine that making money is really easy. Also all the funds,MFs n other money managers too became oblivious of the fact that 2014 was a great year for any tom,dick or Harry. So shut up n do your own research people n stop being cheap!

I lost money through Basant’s old service. I dont trust him any more with my money & will never join his services again….

omg, sir the sky has fallen on our heads….how will we feed our children now? shri maheshwari was providing all the income for us!!!! please ask him to reconsider…

it is true that basant was and is ruthless but thats not the point – the point is he has only one goal and that is self preservation and self advancement ….he sold page in the sly but now we know that selling page without creating any uproar was why he closed basant corner in such a speed.He sold gruh too and this too was communicated to all in such a round about manner thro an ndtv profit interview-The day he becomes selfless and starts thinking less of himself ( note the way he always says I his ego is a big issue ) then he may be worth calling a human being till then he is a money maker but a sly one a cunning one just like the many others in dalal street

Now a days, you are posting sensible posts. More balanced posts.

Previously, you used to glorify these people (sorry stock wizards) – almost as a broker for these people.

Now, you are presenting both sides of a coin and also publishing comments which are criticising you.

By doing hard work, one can gain good stock picking skills over long term and need not depend on anyone.

If you follow these people (sorry stock wizards), you will become a slave through out your life time and get many shocks.

i knew him from last many years, he had excellent stock picks,but as he made more money he became greedy and more egoistic in nature. This person cannot be trusted anymore. will stay away from him.

Basant’s exit is very timely because if you notice none of his top 10 stocks have performed this year with the exception of Granules. All the stocks that were in his recommendation list have ended up with negative returns admist great stock pickers like porinju, dolly khanna and daljeet kohli. Gruh was flat all year, repco is down, hawkins in the dumps, PI ind is struggling, page has a big hole now, his so called safe picks indusind, hdfc etc have gone nowhere. imagine how his fans would have felt to see a whole list of stocks fail. Had he kept his expensive service open he would have had to answer their questions daily. His track record over the years has been very very poor. he just got lucky with page and gruh during his early years

He is AK (politician) of Indian investing world.

I absolutely do not trust him any more. I once used to swear by him. Firstly, he needs to be humble. Let go of his ego. People can go wrong, misjudge. Do not be so self centric. Learn to take criticisms in his stride. Agree that there are other people who are as great as him in stock picking if not more. He will meticulously time his media appearances closer to major events which benefits him directly.

If I can guess, his media appearances/social media will be more active closer to the launch of his PMS service officially or actively and will seek ruthless publicity for his website and act humble. If you observe this, you will come to know.

All said and done, he is a master stock picker. Salute to this. I’m a fan of this capability. Also, couple of years back he used to be more down to earth.

ha ha ha loved reading the comments of people who cant subscribe to his PMS service..Sour grapes…Oh he handles client worth 2 Cr now…I’m surely gonna subscribe to his PMS

He handles clients he knows will not sue him when things go wrong. Please read the disclaimer carefully before you invest.

Completely agree with several people who have posted above, especially with the views of Rajeev Sharma. I have been a subscriber of BC and made money from some his picks. But in the last one year have seen him becoming very egoistic on tv channels. Also he made a statement on BC in response to a query on Page, when

it was around 15000 that “17000 was not a top for Page”. Two months later we come to know that he has sold Page around that time.

Feel cheated.

There is no way the returns of PMS can be verified…I wonder what is the fuss about BM investment ideas..markets have performed poorly this year but I think good/great returns are in store next year

When he started off small he needed v small investors so theequitydesk forum.Once he no longer needed it he just let the forum sink (you could see lot of advertisement threads every day but basant did not even spend time to delete such spams !that was his level of commitment to a past supporter ) and started basant corner a new breed of small HNIs-Once he no longer needed them because this was hampering his free flow of actions on his private money and when his stock picks had to be liquidated without alerting this crowd as it was in low liquidity counters like hawkins and page and gruh he again killed it ( and did not even spend time or thought to alert this past supporter group to his actions even post his sell out of page / hawkins/gruh/repco – they had to get it out much later thro ndtv interview ) . Now his target group is big funds and those HNIs who can afford 1 crore to lend to him and who are willing to take a 30% tax cut – Please see how smart he is because he has invested only 10% or so of his net worth in this new company (see the disclosure doc which says his net worth is some 2 crs ) so his main money will still stay where it was – so even he is not betting 100% on his own fund !

Basant’s net worth is 2 crocres. I thought he would be worth more than that. His followers used to boast that he is worth a lot and that the money he used to make from subscription fee of basant corner is peanuts for him. Did I miss something? Someone help me explain this.

His net worth is 20 crs but he has invested only 10% ie 2 crs in his fund so he has shown his nw as 2 crs