Universal techniques for finding multibagger stocks

The name of Luiz Alves Paes de Barros is not familiar to us. This is because this Billionaire investor does not invest in the Indian stock market. He invests in the Brazilian stock market.

However, the techniques that Luiz Alves Paes de Barros has adopted to find multibagger stocks in the Brazilian stock market are equally applicable to the Indian stock market and so we have to pay close attention to his words of wisdom.

The “Anonynmous Billionaire”

Luiz Alves Paes de Barros prides in calling himself an “anonymous Billionaire” because of his reclusive nature. However, he has shot into fame because one of his latest stock picks has yielded an enormous gain of 1000% in just 12 months.

10-Bagger gains in just 12 months

Barros bought truckload of stock in a company called Magazine Luiza SA in late 2015. Magazine Luiza SA is a retailer and has suffered heavy losses owing to the deep recession that Brazil is presently in.

Barros scooped up his quota at a throwaway price because nobody wanted to touch the stock with a barge pole.

Today, barely 12 months later, Magazine Luiza SA has become the cynosure of everyone’s eye. Investors are making desperate no-holds barred bids for the stock.

The result: The stock is up an eye-popping 1000% and is a magnificent 10-bagger.

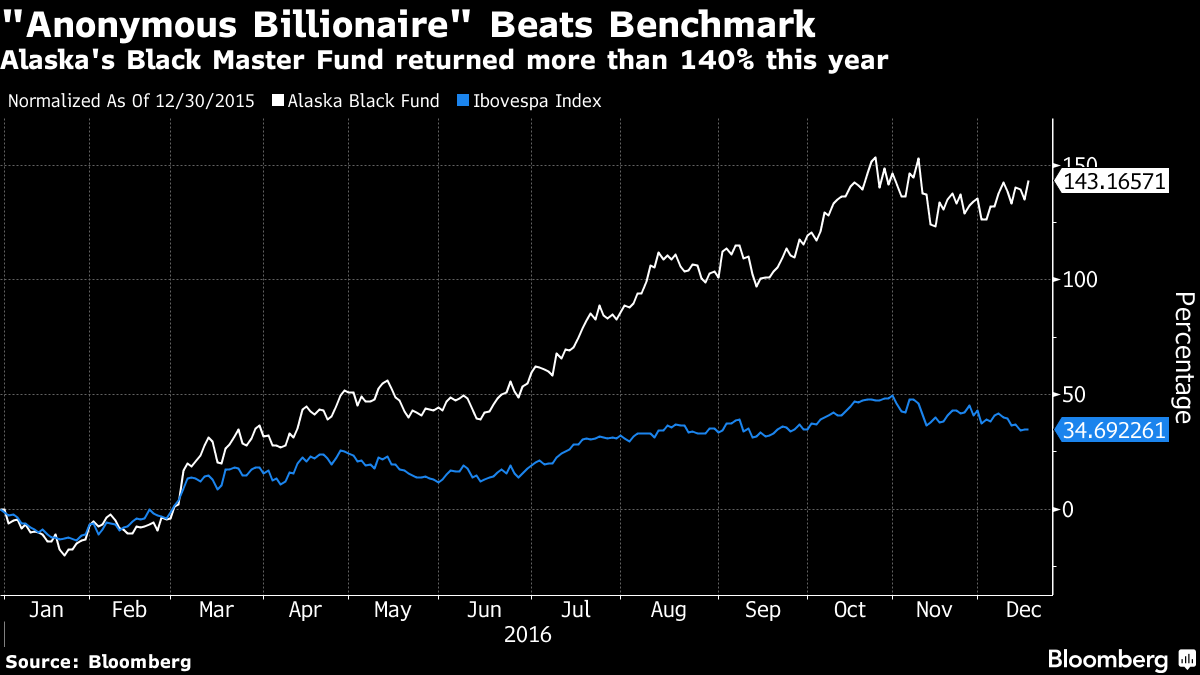

(Image Credit: Bloomberg)

Top-secret technique – Buy when things are bad and be patient

Naturally, the sleuths of Bloomberg were hot on the trail of the anonymous Billionaire, determined to prise out all of his top secrets.

The Billionaire has not disappointed.

“Perfecting patience is all I’ve done over the past 50 years,” Barros said. “I love when things get bad. When it’s bad, I buy.”

Barros’ explanation sounded too simple to be true and did not convince the Bloomberg sleuths. So, they demanded to know how the Billionaire knew Magazine Luiza would do as well as it did.

Barros candidly admitted that didn’t know how Magazine would fare and that all that he knew was that it was “cheap.”

When prodded further, Barros explained that the company had a market value of only 180 million reais even though a bank had offered to pay 300 million reais for the right to offer extended guarantees on Magazine Luiza products.

This clearly revealed that something was amiss about the valuations and that the stock was dirt cheap.

“Either the bank was crazy or there was value there,” Barros said with a chuckle.

Future multibagger stocks that the market has forgotten

Barros has identified four stocks which has claims the “market has forgotten” and which are potential multibaggers. These are companies called Fibria Celulose SA, Braskem SA, Marcopolo SA and Vale SA.

He has also provided a cogent explanation about the prospects of each stock and emphasized that they are all “fundamentally sound” and quoting at “low valuations”.

It is notable that two of the stocks are commodity stocks. While Braskem SA is a manufacturer of petrochemicals, Vale is an iron-ore mining company.

Fibria is a manufacturer of pulp and paper products while Marcopolo is a maker of trucks and buses.

The common theme of all four stocks is that they will benefit immensely as Brazil rebounds from recession.

“There’s no economic expansion in Brazil without infrastructure investments,” Barros said, echoing the investment climate in India as well.

Fail-safe investments

The best part is that Barros has paid such a pittance for the stocks that he is in a fail-safe state.

“If the stocks return just a fraction of what Magazine Luiza did, they’d count as stellar investments,” the Bloomberg editors commented in a tone of admiration.

Best time to buy stocks is when times are bad

It is explicit from Billionaire Barros’ inspiring life story that the simplest investment technique is to buy truckloads of stocks which are fundamentally strong when they available at throwaway valuations.

Barros confirmed that the time to buy is now. “I am positive that the market is going to rise,” he said without an iota of hesitation, sending the clarion call to us to aggressively scoop up top-quality stocks.

Arjun, thanks lot for this inspiring article.

Well revealed story about the true secret behind successful investments i.e. patience. Buying stock when things go bad for fundamentally strong companies and sit tight with patience is a simple secret but hard to follow. This simple trait of patience is rare to find these days as everyone wants to make quick buck. 6 months horizon has become long term while short term is days or a week at the most.

The mantra is when it is blood bath.

It could turn into like Satyam

or,

like – Subex, Tree House

Due to demonetisation most MFI ‘s like : Equitas, Ujjivan, Bharat etc have been turned from good business to small stuff with doom reports of all kinds of currency shortage / loan recovery etc etc

The people who were never accepted by banks / financial world as their customers they had only the mfi ‘s to support them for their dreams.

Mfi ‘s will rise again as its a good business undergoing transitional pain.

As MOSL says : buy right sit tight .