Ambush Of Bears Yields Mega Gains For Bulls

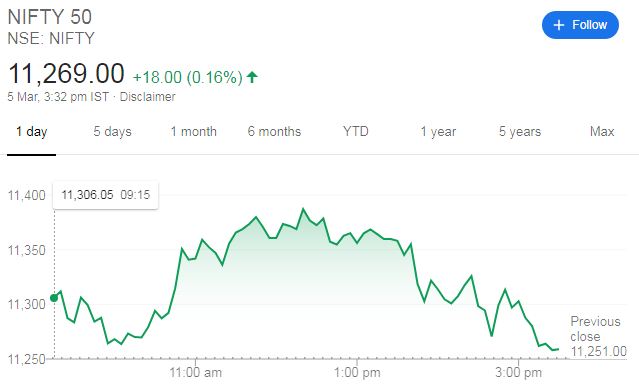

Today, the Bulls Army Of Dalal Street (‘BADS’) staged a brilliant maneuver which took the wind out the sails of the Bears.

The Bears walked in as usual, with an evil glint in their eyes, determined to wreck mayhem once again.

However, unknown to anyone, the Bulls spread the news/ rumor that SBI would take over the beleaguered Yes Bank.

Yes Bank, which is otherwise a junkyard and pariah stock, suddenly surged like a supersonic rocket, notching up a massive gain of 27+%.

This caused the other Banks like Kotak Bank, HDFC Bank, SBI to also surge.

Naturally, the Bears had no option but to cover their shorts in a desperate manner, which in turn led to a flaring of the prices.

This created a rare phenomenon known by experts as a “shorts squeeze”.

However, by the EOD, the ruthless Bears did manage to claw back lost ground and salvaged the situation to some extent by causing SBI to issue a dampening statement.

Indian government is said to approve plan for SBI-led consortium to buy Yes Bank stake, reports Bloomberg.

Read: https://t.co/mwVwBn2WlC pic.twitter.com/GGiWqII0Ib

— BloombergQuint (@BloombergQuint) March 5, 2020

But they are saying ulta pic.twitter.com/4wpU1lZqKz

— Harshit (@2weet_harshit) March 5, 2020

In the midst of all the hungama, Yes Bank was degenerated into the status of a penny stock with a target price of a princely Rs. 1.

BREAKING NEWS

JP MORGAN Cuts YES BANK Price target to Rs 1 per share

— Yatin Mota (@YatinMota) March 5, 2020

Even a person like me who is permanently bullish also gets shaken

Raamdeo Agrawal candidly admitted that the Global equity rout caused by the deadly Corona virus had shaken him also despite his experience over the past 40 years.

“What I have seen in my 40 years is when these crises come, right at the bottom of it, a person like me who is permanently bullish also gets shaken,” he disclosed.

Raamdeo likened the present disaster to the horrible 9/11 event when the US markets had plunged a mammoth 16% over the space of a few days.

However, he opined that the point of maximum fear has already been reached.

“I would think that the 1,000-point fall is kind of peaking of fear. It is more about understanding where it will all go. So fear of the downturn has peaked out, I would say. Now let us see how it goes from here.”

This implies that the stock markets have already discounted the worst case scenario and a further plunge is not warranted.

Corona Virus has a positive impact

One of the reasons Raamdeo became a Billionaire in Dalal Street while the rest of us are still struggling to make a living is because he is an incorrigible optimist.

He is able to spot something positive even in the biggest disasters.

“All commodity prices have collapsed because China is the largest consumer of commodities and now their consumption is down by 30-40 percent,” he said with a sparkle in his eyes.

It is obvious that India will reap the benefit of this because we are importers of commodities like crude and other minerals.

A lowering the raw material prices will increase the EPS which will in turn increase stock prices.

“The global system is wired up in such a way that the production continues or there is excess production and hence prices will correct or have corrected in many cases,” he added.

Boss, I do not care and I will stay put

Raamdeo advised that we should stop obsessing about the stock market and stock prices and instead focus on the fundamentals of the company.

“Do not focus on the market, focus on the portfolio if you are a true investor,” he said.

He also advised that we should stop trying to time the market but should instead buy on dips and in a staggered manner.

“I have seen in the past is that timing does not work. Like you did not know what was the top 10 days back, and this decline came the same day, we do not know at what pace and in what shape the recovery is going to come,” he said.

He also advised that we should adopt a defiant attitude and say: ‘boss, I do not care and I will stay put. I will find entry opportunities in few companies where prices have gone haywire”.

Buy insurance and auto stocks, Buy Gold

Raamdeo pointed out that the news that life insurance companies can now also offer health insurance augers well for the sector because the opportunity size is very large.

The space could be a good bet because these developments could expand the opportunity for existing life insurance companies, he opined.

Raamdeo also advised that we should grab auto stocks because they are now quoting at bargain basement prices.

“Auto demand should come back very strongly particularly from April onwards, once BS-IV and BS-VI adjustment is done,” he said.

He also opined that the fall in fuel prices augers well for the auto industry.

Raamdeo also expressed a liking for Gold.

“Gold has become very attractive and remains a safe haven right now. In the last ten years gold has done as well or even to some extent beaten the Nifty index,” he stated.