Forget whether markets are going up or down; just buy stocks

“From one-two year point, it is a no-brainer. A guy sitting out there allocating money to the market, should not be worrying too much about the timing aspect …. So it is a no-brainer …. over the next two-three years, we are going to go up, up and only up. So there is no doubt about that”, Basant roared with his usual flamboyance.

Forget trying to time the market

Basant made it clear that he does not have a high opinion of experts who try to time the market.

“We are doing a big discredit to ourselves and to the viewers by saying that the market will go down, it will go up,” he said.

“Basically we do not know these things but I think it is just not wise at all to try and time it. It will be very wrong,” he added.

Basant also came down heavily on the tendency of novice investors who try to time the market.

“A guy sitting out there allocating money to the market … should not be timing it and if he tries to time it, he should just go and look at his own track record of seeing how many times he has got the timing right,” Basant said.

Mid-cap and small-cap stocks offer huge upside potential

Basant rubbished fears that there is “froth” in the valuation of mid-cap and small-cap stocks.

“If there is forth, it will get corrected,” he said dismissively.

“Midcaps and smallcaps are the areas to make money,” Basant added.

Average Raju investors should be careful not to buy based on tips on twitter

Basant cautioned that one has to be selective while buying mid-cap and small-cap stocks. He warned average Raju investors not to buy midcaps and smallcaps by looking at the TV screen or twitter handles or looking at the social media. Instead, they are better off buying large and well established names.

“Midcaps and small caps can correct 20-30% without notice and by the time you know why they are down, they are already be down 40%,” Basant said in a ominous tone.

“But in spite of all that, the money will be made in the midcaps and the small caps,” he added quickly so as to assuage novice investors.

Top 10 Mid-Cap Stocks To Buy Now By Karvy

Housing finance NBFC stocks should be bought as new SEBI MF rules augers well for them

Basant reiterated his bullishness for stocks in the housing finance NBFC sector. In the past, he has declared HFCs to be “blind buys”.

He explained that the new SEBI regulations which permit Debt mutual funds to invest up to 15 percent of their total net assets in housing finance companies augers well for the stocks because the cost of capital will come down and the profitability will increase.

Basant also pointed out that the rental yield of a house is coming very close to the EMI for Rs 20-25 lakh house. This means that instead of taking the property on rent, the customer would rather pay the same amount as EMI and obtain ownership of the house. This will obviously translate into more business for HFCs.

Specific stock recommendations

Unfortunately, the moderators made no attempt to coax Basant to reveal stock specific names. Instead, they were content with asking abstract questions.

However, there is no need for us to despair because Basant has already announced that his latest stock pick is PNB Housing Finance.

Basant has given three solid reasons why PNB Housing is likely to be a powerhouse multibagger:

(i) Stock is growing at 40% CAGR;

(ii) Stock will beat analysts’ projections and

(iii) Large institutional investors will want a slice of PNB Housing sooner or later.

Basant has also earlier revealed that he holds Can Fin Homes in the portfolio of his PMS.

PNB Housing will surge if there is a stake sale?

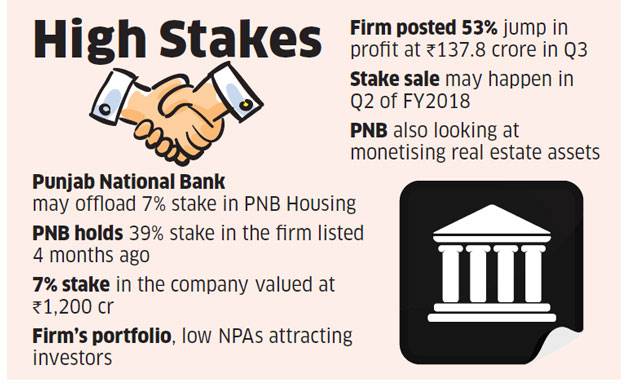

At this stage, we have to stay alert to the announcement by PNB that it is looking to sell a 7% stake in PNB Housing by Q2FY18.

REPORTS

PNB looks to sell 7% stake in PNB Housing

PE investors evince interest in PNB Housing stake

7% stake valued at `1200 cr— avanne dubash (@avannedubash) March 7, 2017

“We have had some early discussions. There is a lot of interest as PNB Housing has a great portfolio, low non-performing assets and has done considerably well after it got listed,” a top brass of PNB was quoted as saying.

(Image credit: ET)

It is obvious that if a big-ticket investor/ competitor steps into PNB Housing, it could send the stock soaring into an upward trajectory.

STOCKS TO WATCH : PNB Housing: Quality Invst Hldgs to buy 37.6% stake in co from Destimoney

— ET NOW (@ETNOWlive) March 17, 2017

2 min Silence for Morgan Stanley and other brokerages who gave Sell Report on PNB Housing Finance ?..

— Amitayu Ghosh (@amitayu_ghosh) March 14, 2017

Conclusion

Basant’s advice that we should not time the market and should instead buy for the long-term is very salutary. In the past, we have tried to time our purchases and have cut a sorry face with multiple missed opportunities. This time, we need to gird our loins, buy the right stocks and sit tight on them for the next five years!

In Housing Finance business competetion is increasing as large no of Enterpenures ,business houses and NBFCs are entering in it.So stay away from High PE stocks,as with slight slowing of growth,PE will fall in line with sector .I am invested in DHFL and GIC housing due to lower valuations and margin of safety.

I am also bulish and invested in Rel Capital as valuations are reasonable here and management is now focusing on core business ,coming out of non core areas.More over they are putting right people for right positions.for growth under Mr.Anmol Ambani .I expect this to be stock of 2017 in financial sector.

Kharb ji.. Can u pl. throw some light on the possible value unlocking o/a of hiving off and listing housing finance and insurance businesses of rel capital?

“We are doing a big discredit to ourselves and to the viewers by saying that the market will go down, it will go up,” he said.

“Basically we do not know these things but I think it is just not wise at all to try and time it. It will be very wrong,” he added.

Wise words.

stay away from the market… there is a correction in the corner. Many of the stocks are ready to drop 20%-30%

i am bullish on rcap as well, within the nbfc space i prefer it over PNB given the high P/B i am unable to understand why its still a value buy

Please give view over Basant’s favourtie Granules.

Old known recommendations again.

already price hence reco