JPMorgan has made some fine points on why the time is ripe to buy home appliance stocks:

(i) The two key variables affecting demand are inflation and sentiment. The outlook on both is positive, considering the fact that inflation is likely to trend down and consumer sentiment expected to improve;

(ii) Lower commodity prices and a reduced power deficit are additional demand kickers. Lower value consumer appliances are likely better longer-term plays given better affordability, a higher share of the unorganized segment in the market and lower competition currently from global MNC players (although intensity is rising at the margin) and a lower level of technology churn;

(iii) Shares of appliance companies have been starting to re-rate of late, after a two- to three-year slowdown. The market is treating these as ‘clean plays on a consumer discretionary improvement’, as most of these companies have limited debt, reasonably good ROEs and, importantly, high operating leverage around volume growth’;

(iv) A 5-10% change in revenues could mean disproportionate growth in EBITDA and PAT.

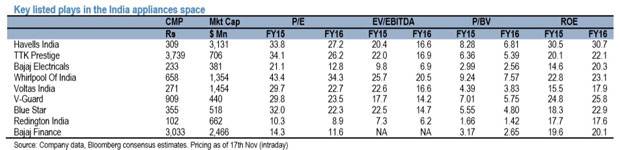

JP Morgan’s top picks are Havells India, Bajaj Electrical, Symphony, TTK Prestige, V Guard, Whirlpool of India, Redington, Blue Star and Bajaj Finance.

Surprisingly, Hawkins Cookers has not made the cut.