The ET has reported that Credit Suisse economists have projected India to see the fastest USD nominal GDP growth in 2015, with the growth gap between India and the rest of the world expanding.

Credit Suisse believes that the Indian market is not expensive yet and it will likely to pay more for growth going forward. It is also pointed out that in a world struggling for growth, India stands out. It is emphasized that promising medium-term prospects come from an extremely low base, and a stark improvement in state-level governance.

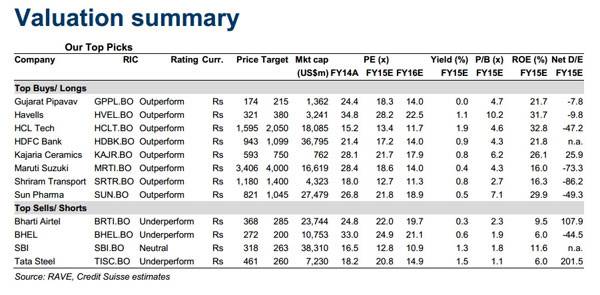

The best part is that apart from providing comfort that the Indian market is not expensive on both absolute and relative terms, Credit Suisse has also identified the stocks that it considers will outperform.

The stocks that have been given the distinction of being “top picks” and “out performers” include Gujarat Pipavav, Havells India, HCL Technologies, HDFC Bank, Kajaria, Maruti Suzuki, STFC and Sun Pharma. The stocks that have been branded “under-performers” are Bharti Airtel, BHEL, SBI and Tata Steel.

It should be noted that even Akash Prakash of Amansa Capital came on record a few days ago to assure us that Indian markets are still not too expensive and that it is not too late to buy stocks