Daljeet Kohli appears to have mastered the fine art of homing in on stocks that are on the verge of a ‘turnaround’ or which are undergoing some corporate action which will result in “unlocking of value”.

There are three recent examples to prove the point.

The first example is Mastek. This stock was in such a miserable state that even Ashish Dhawan of ChrysCapital, who held the stock patiently for several years, got fed up and dumped his entire holding one fine day. However, in the midst of all that despair, Daljeet was able to see “value unlocking” in the form of demerger of an insurance subsidiary (Majesco) and its listing on NYSE. Daljeet’s prediction came true and Mastek surged from Rs. 190 (the market price at the time of recommendation in July 2014) to a high of Rs. 513 on 10th March 2015, leading to incredible gains of 170% in just about 9 months. It narrowly missed Daljeet’s target price of Rs. 550. The stock is now demerged and is quoting at Rs. 187. Majesco is expected to be listed on NYSE in August 2015.

OnMobile Global is the second example. No sensible investor would have touched OnMobile with a barge pole. Yet, in November 2014, when the stock was languishing at Rs. 39, Daljeet recommended a buy on the basis that there would be a “turnaround” of the fortunes of the company. Later, when the stock price slumped, Daljeet implored investors to “be greedy”. Today, there has in fact been some positive corporate action and OnMobile stands tall at Rs. 102, resulting in fabulous gains of 161% in about 8 months.

Meghmani Organics is the third example. I have already discussed this in my piece (Dolly Khanna Backs Daljeet Kohli In Quest For Mega Bucks From Micro-Cap Turnaround Stock) and will not repeat it.

Now, Daljeet’s attention is fixated on Pennar Industries, the classic NAMO stock. He first recommended the stock in September 2014 when the stock was at Rs. 47. Daljeet’s logic was that Pennar has such huge capacity that when the economy revives and demand picks up, the company would enjoy “operational leverage”.

So far, Daljeet’s theory has proven to be correct because Pennar Industries did report blockbuster results for the financial year ended 31st March 2015.

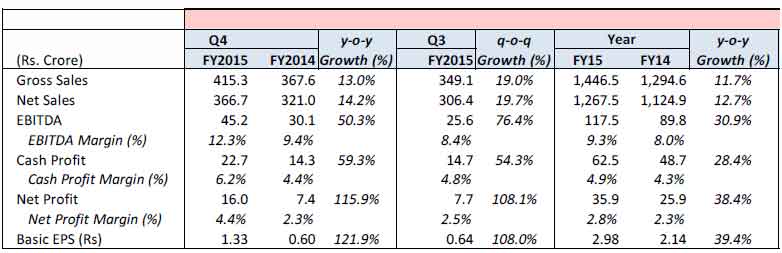

Pennar reported the highest-ever consolidated Gross Sales of Rs 1,446.5 crore which is up 11.7% YoY. The EBITDA surged 30.9% YoY to Rs 117.5 crore while the PAT surged 38.4% YoY to Rs 35.9 crore. The cash PAT surged 28.4% YoY to Rs 62.5 crore.

Presently, the news that Pennar Industries intends to separate its subsidiary called “PEBS” and list it separately has gripped Daljeet’s attention. He claims that the listing of the subsidiary will result in huge “value unlocking”.

In an interview to ET, Daljeet explained his logic in succinct words:

“The company has a subsidiary called PEBS, whose IPO has just got SEBI’s approval.

There is going to be a value unlocking for that. Of course, the company has to come out with the timeline in next two-three months, when they will do it. But according to our understanding, the value unlocking will be almost equal to what is the current market cap of the company. Therefore, there is a big potential in Pennar Industries as well.

In any case, we have a target for Pennar Industries at Rs 81 as of now, without taking the value unlocking part. So both these stocks are very strong, fundamentally, and have trigger points for their upmove.”

Daljeet’s theory has found support in the initiating coverage report issued by Ventura Capital. Ventura has recommended a buy on the logic that Pennar “is well poised to capture the growth potential envisaged in the solar, railways and pre-engineered building systems industries” and “is expected to be a direct beneficiary of the government’s thrust on solar energy, railways, infrastructure, ‘Make in India’ and ‘Smart Cities’ campaign”.

Ventura has projected a target price of Rs. 92 for Pennar over 21 months, which is a whopping 88% upside.

The projections by Daljeet and Ventura cannot be taken lightly because Ashish Kacholia, the stock wizard with the reputation for being at the right place at the right time, has parked himself firmly in Pennar Industries with a massive holding of 25,00,000 shares.

We need to keep a close watch on how things pan out at the Pennar counter.

thanking for giving your valueble sugessions