Porinju Veliyath loses, and regains, faith in Tata Global

“You sold off your holdings in Tata Global Beverages?” the trio of Lata Venkatesh, Anuj Singhal and Sonia Shenoy asked Porinju Veliyath in unison, with an incredulous look on their faces.

The reason for their surprise was because Porinju is known to be a die-hard supporter of Tata Global. He recommended the stock as far back as in 2010 and has stayed loyal despite the non-performance of the stock (see After “Chor” Co, Porinju Veliyath Puts A Buy On Top-Quality Blue-Chip Stock).

Porinju nodded in affirmation, his shoulders slumped. He was dismayed at the unseemly brawl between the two illustrious Billionaires of the Tata Group, Ratan Tata and Cyrus Mistry, and the ouster of the latter from the position of Chairman of the group.

“It is shocking … It is too early for long-term investors to take a call … the inflection point is in danger …” Porinju mumbled, making an attempt to keep his emotions under control.

Fortunately, Porinju’s disappointment with the Tata Group was short-lived.

When the announcement was made that N. Chandrasekaran, the visionary chief of TCS, would be anointed Chairman of the group, Porinju knew that the fortunes of the Tata group would be revived and hefty gains would gush out of the stocks.

The talk of restructuring of the group so as to eliminate cross holdings and unlock value was also like music to his ears.

“These are very old bluechip companies but are still trading at 1x sales largely because of Tata’s. If these companies were handled by dynamic and good management they would be trading at 3x sales,” Porinju said, his famous smile back on his lips.

“I am very bullish on the branded consumer business of Tata Group and hold Tata Global Beverages and Tata Coffee for a long time in my personal portfolio,” he added cheerfully.

Forget the past, look at the future: Rajen Shah

Some novice investors are still wary of buying Tata Global Beverages because of its past history of non-performance.

To allay their fears, Rajen Shah explained that not only is Tata Global quoting at valuations that are “dirt cheap” in relation to the valuations that other FMCG companies are quoting in India and abroad, but the restructuring planned by N Chandrasekaran is likely to result in “value unlocking” and also breathe new life into the Company.

“Now with N Chandra at the helm of affairs in Tata Sons, Tata Global could be interesting play. Globally also, beverage companies like Pepsi, Coke or Starbucks are trading at anywhere between 3 and 5 times. Starbucks is currently quoting at about 4.5 times the sales internationally. In India, you are getting Tata Global for just about one time. Revenue is about Rs 9000 crore, market cap is around Rs 9000 crore.

You are getting it for one time the sales which is absolutely dirt cheap. Globally companies trade at this kind of valuation and even in India FMCG companies are at about four-five times the sales. Here is a company which derives almost 70% of its turnover from branded sales and it is trading at just one time. There is a huge amount of rerating possible in Tata Global Beverage. This is a stock which can actually multiply,” Rajen said, his eyes sparkling.

People laugh at me when I recommend Tata Global but investors will make a fortune

“Yes, people laugh at me when I recommend the stocks because they are not moving,” Rajen said with a wistful look.

“However, these levels of Tata Power at Rs 78 and Tata Global at Rs 162 are very compelling levels. You are going to end up making fortune in both the stocks,” he added in a defiant tone.

“I am pretty confident that over the next few years, we will see significant money being made in both the stocks. These are quality companies and we have a strong person at the helm of Tatas now to restructure debt, consolidate holdings, unlock value.

…. Both these companies are in for big time. Big money is going to be made in both the stocks. We are not looking at 25%, 50% or 100% returns. Returns would be in excess of 100% but you would need to have patience,” he added.

Stock surges like a rocket

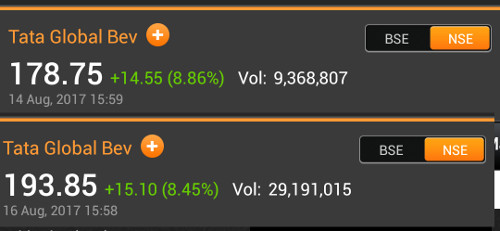

Rajen Shah’s bullishness appears to be bearing fruit because the stock surged 16% in just two sessions.

#InNews Tata Global Bev

Signs Agreement with Talking Rain Beverage Co to sell Himalayan water in US

(Stock Was Up 9% On Monday)@CNBC_Awaaz— Ashish Verma (@AshVerma111) August 16, 2017

#Tataglobal has started restructuring finally. Sold loss making Chinese & Russian subsidiary. Management now serious on RoE.

— Ritesh (@WithRitesh) August 5, 2017

The surge baffled Porinju to the extent that he turned philosophical:

Just woke up at Skt. Petri in Copenhagen. Confused, what to make in room – Tea or Coffee?

— Porinju Veliyath (@porinju) August 16, 2017

TGBL was created by God to test the patience of investor-humans! Tatas were just agents playing the role of villain, need not blame them?

— Porinju Veliyath (@porinju) August 16, 2017

It is a “no brainer”, Just buy and forget: It is the “next Britannia”

Rajen again waxed eloquent about the prospects of Tata Global.

“I am looking at a price of Rs 450 for Tata Global Beverage. It may raise many eyebrows and I think that this is a highly under researched stock. Globally if you see any beverage company, it traders at about 3-5 times the sales. In India you see any FMCG company, it trades at 4-6 times the sales.

This is a company which derives 70 percent of its revenues from branded products, and it is trading at just – if you take out the investment it has in Tata Chemicals, about Rs 700 crore, it is trading at just 1.3 times the sales. So I think it is a no brainer, Rs 450 stock.

The other most important thing which I would like to mention here is, in China, there are 2,800 outlets of Starbucks and in China Starbucks, the parent company has said that in the next three to four years, they will scale it up to 5,000 outlets. In India it is only 94 outlets. So, imagine what happens if it touches 1,000-1,500.”

#Starbucks 1st store in China was in Jan 1999. Today it has 2500 stores in 118 cities & plans to expand to 5000 in next 5 years. #TataGlobal

— Ritesh (@WithRitesh) July 31, 2017

At the end, Rajen implored that investors should think of the stock as a 10-year story.

“You just need to buy this stock and forget it. It is going to be another Britannia in the making,” he added.

The reference to Britannia is very significant because the stock weathered a lot of under-performance before it finally delivered multi mega bagger gains to its loyal shareholders.

Fail safe and risk free stock

Prima facie, there is no reason for us not to follow the advice offered by Porinju Veliyath and Rajen Shah.

Even if the two stalwarts are horribly wrong in their theory that the stock will rebound, we will not suffer any loss of capital because of the blue chip credentials of the stock. At the most, there will be an opportunity loss.

On the other hand, if the two stalwarts are proved right and the stock does become a mega multibagger, we will cut a sorry face for not having trusted them and keeping the stock in our portfolio.

So, it is better for us to err on the side of caution and tuck into the stock ASAP!

In what rate I want enter tatagloble sir

http://fb.me/3nkwKF2ir TGBL’s global chief marketing officer – Adil Ahmad talk about Tata’s foray into retail coffee & trace the road map

Tata Global from 193 to 450 in ten years? C’m on, you guys must be joking. What a poor rate of return!! Even the index return will outperform Tata Global. Secondly, we wary of Starbucks expansion to 1500 outlets. Many fewer people go to Starbucks compared to Coffeeday or Costas. Be very careful before investing in TGBL. There are dime a dozen stocks which can give much higher returns.

Venky ,I do agree there may be dozens better ideas with you but members are intrested to know top 3 from you ,ie only just fraction of more than dozen ideas.Members expect alternate pick if some boday says idea is not apealing.

I am of the view that an important requirement of investment process is know what not buy and why.

In my experience buying sustainable high growth companies with decent ROE,ROIC rewards you in the long term. Valuation multiples like P/E and P/B are not that important as market in general efficient. If you end up buying overvalued high growth stocks you may loose profits of 1 or 2 years. But in long term it will still reward you handsomely.

Financials and Consumer space provides most sustainable growth ideas and midcaps are always preferred for long term growth.

DCB, RBL, Federal in pvt banks

Pnb housing, Canfin, Repco and DHFL in housing

Capital first, L&T finance in NBFC

Ujjivan, Satin, Equitas in Microfinance

dmart, Thyrocare, Future consumer are good option in consumer space. Valuation are probably too high in consumer space right now, but these should be great buy on market correction.

I agree with Logic but no comment on individual stocks.

kharb, do some hard work, I will not give you even one. However, you may go through my older posts for my success with multibaggers.

Just looking at this comment…TGBL has shown a dramatic rally in last 2 years

My personal experience at Tata global Starbucks in Mumbai I am sorry to say but fact is it is far inferior quality of coffee preparation by the Starbucks crew employees. They are not trained properly if you don’t believe me I give you offer I am ready to show you any day.it is shameful starbursts name is getting spoiled just because they are trained badly. Such a shameful. I am forced to go to other coffee places because of this. People open your eyes and just checkout

Starbucks started with a big bang, but somewhere lost their way. Even its high profile female CEO resigned. Just because of Starbucks is a venture by Tata Global dosent make the latter a buy grade stock. By the way, Starbucks is a 50:50 JV between Starbucks and TGBL.

I was happy when they launched now Starbucks in india are indianised dumbest employees are just interested in jobs not services. Caste creed doesn’t matter but cleaniness their body language makes lot of difference they always means always looks tired Somebody from USA STARBUCKS MUST VISIT TO NOTICE WHAT I AM POINTING TO.

Please learn to speak English correctly before critiquing hard working driven Indians.

We dont speak Queen’s English. Those days are gone. You are unlikely to meet any Indian these days who speaks or writes in grammatically correct English. In UK too many whites dont speak good English. We are better off than most of them.

Why are you not active in stocks talk? it appears you have lot of investment wisdom to impart. kindly consider.

Looks like TGBL is not going to win on the financial results after several quarters of dismal numbers and hence stock price gone no where. To boost the price, articles such as these taken indirect route of PE ratio, International Brand and Peers comparison and Expansion. I am not really sure about the same stores sales going up in near future and also profitability. Let result talk and these articles are big trap for innocent investors.