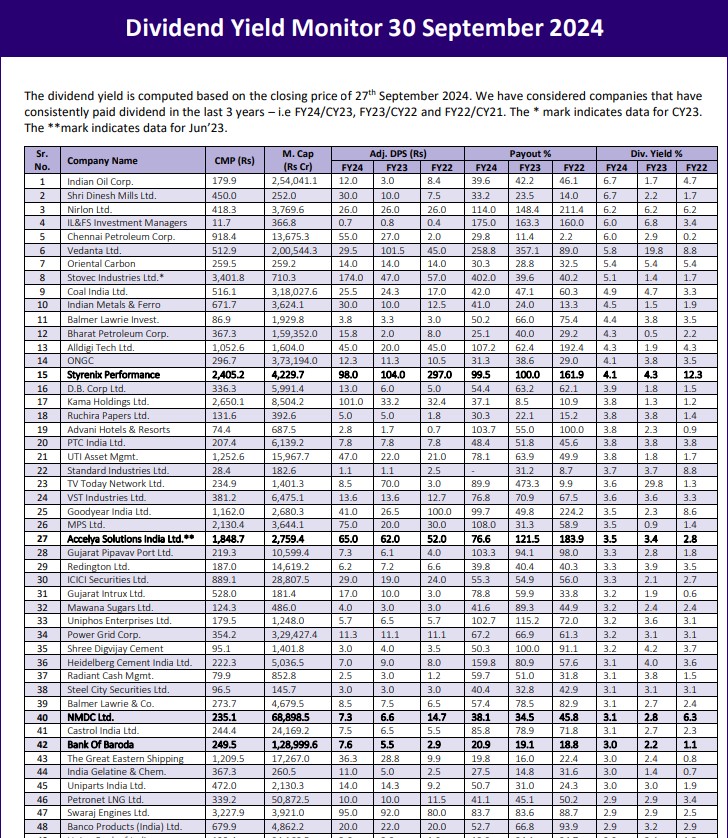

The dividend yield is computed based on the closing price of 27th September 2024. We have considered companies that have consistently paid dividend in the last 3 years – i.e FY24/CY23, FY23/CY22 and FY22/CY21. The * mark indicates data for CY23. The **mark indicates data for Jun’23.

The dividend yield is computed based on the closing price of 27th September 2024. We have considered companies that have consistently paid dividend in the last 3 years – i.e FY24/CY23, FY23/CY22 and FY22/CY21. The * mark indicates data for CY23. The **mark indicates data for Jun’23.