Dolly Khanna & Anil Kumar Goel are sending us the clear message that automobile component stocks are the new sector to bet on.

The reason why these eminent stock wizards are so gung-ho about the sector becomes clear if one does basic research.

Chiranjivi Chakraborty of ET has interviewed several leading experts on the outlook for the automobile components sector. The experts are unanimous that the sector is an excellent proxy for the revival of the auto sector.

A similar opinion has also been expressed by Rashmi Wankhede of DSIJ. Rashmi Wankhede has explained that the automakers, who are main revenue drivers of auto ancillary, will witness a renewal in consumption demand in urban as well as rural area owing to the implementation of the 7th pay commission recommendations and good monsoon.

Parvatha Vardhini C of Business Line has also conducted a meticulous study as to why automobile ancillary stocks are doing well. Her opinion is that the fall in prices of key raw materials, such as steel, lead, rubber, and aluminium, among others, has worked in favour of the component manufacturers. She has confidently asserted that the “party is not over yet” despite the steep run up in the prices of some stocks.

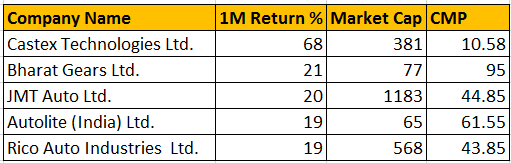

It is worth noting that automotive component stocks have already taken off like rockets. Select stocks like Pricol, Porwal Auto Comp, Sibar Auto Parts, IP Rings, Castex, Bharat Gears, JMT Auto etc have notched up hefty gains in a short time.

Dolly Khanna and Anil Kumar Goel, both of whom are value investors at heart, have been scouting for stocks of well managed companies which have tremendous potential but which have not moved up much in the recent past.

We saw a few days ago that the duo has scooped up a truck load of Sterling Tools (Vallabh Bhanshali has also bought a chunk).

Now, Dolly Khanna and Anil Kumar Goel have set their sights on PPAP Automotive Limited, a micro-cap (Rs. 208 crore) manufacturer of “Automotive Sealing Systems” and other components.

| PPAP AUTOMOTIVE LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 200 | |

| EPS – TTM | (Rs) | [*C] | 9.59 |

| P/E RATIO | (X) | [*C] | 14.92 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 10.00 | |

| LATEST DIVIDEND DATE | 30 AUG 2016 | ||

| DIVIDEND YIELD | (%) | 1.37 | |

| BOOK VALUE / SHARE | (Rs) | [*C] | 146.81 |

| P/B RATIO | (Rs) | [*C] | 0.97 |

[*C] Consolidated [*S] Standalone

| PPAP AUTOMOTIVE LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2016 | JUN 2015 | % CHG |

| NET SALES | 80.99 | 73.23 | 10.6 |

| OTHER INCOME | 0.36 | 0.22 | 63.64 |

| TOTAL INCOME | 81.35 | 73.46 | 10.74 |

| TOTAL EXPENSES | 68.37 | 60.95 | 12.17 |

| OPERATING PROFIT | 12.99 | 12.5 | 3.92 |

| NET PROFIT | 3.57 | 2.97 | 20.2 |

| EQUITY CAPITAL | 14 | 14 | – |

(Source: Business Standard)

As of 30th June 2016, Dolly Khanna lords over 1,49,262 shares of PPAP Automotive while Anil Kumar Goel is sitting pretty over 3,64,000 shares.

Rajasthan Global Securities, which is also highly renowned for its stock picking skill, holds 57,285 shares as of 31st March 2016.

It is interesting to note that unlike other stock wizards who buy in a bulk deal, Dolly prefers to keep her buying action stealthy. Of course, nothing escapes our eagle eye. We have ferreted out details of her purchases of the PPAS Automotive stock which are as follows:

| Date | Nos of shares bought |

| 13-Nov-15 | 38,220 |

| 20-Nov-15 | 1,000 |

| 27-Nov-15 | 32,375 |

| 4-Dec-15 | 13,370 |

| 11-Dec-15 | 2,200 |

| 18-Dec-15 | 2,000 |

| 29-Jan-16 | 2,000 |

| 5-Feb-16 | 1,800 |

| 11-Mar-16 | 1,838 |

| 18-Mar-16 | 17,050 |

| 25-Mar-16 | 3,000 |

| 31-Mar-16 | 8,800 |

Now the all important question is as to what it is about PPAS Automotive that has attracted the wizards.

This seminal question is answered by ICICI-Direct in its management meet note.

PPAP Automotive is “offering a tempting ride…” ICICI-Direct says. It points out that PPAP is one of the leading manufacturers of automotive sealing systems (~55% of revenue) and injection moulded products (~45%). The company has a technical partnership with Tokai Kogyo, Japan for its sealing systems & with Nissen Chemitec Corp,

Japan, for its injection moulded division. Maruti Suzuki (MSIL), Honda Cars India (HCL) are its biggest clients accounting for 43%, 39% of its revenue. It has five manufacturing plants (three in Noida, one each in Rajasthan and Chennai) with aggregate strength of 1517 employees.

ICICI-Direct has emphasized that during FY13-15, PPAP has seen significant improvement with revenue, EBITDA, PAT witnessing CAGR of 21.6%, 49.7%, and 179%, respectively.

More clarity emerges when one peruses the investors’ presentation furnished by the Company. The presentation coupled with the conference call transcript reveals that all of PPAP’s plants are TS16949, ISO 14001 and OHSAS 18001 certified. PPAP has technology transfer agreements with three Japanese companies. PPAP can cater to the requirements of the entire Automotive Sealing System of its customers. Presently, PPAP manufactures over 500 different products for its customers and continuously targets to achieve Zero Defect and Zero PPM in Quality and Delivery Performance for all its Customers.

So, based on the above data, one can confidently say that PPAP Automotive is a well managed company with a healthy future ahead of it. The Company can be expected to enrich the portfolios of Dolly Khanna and Anil Kumar Goel with steady gains year after year!

Though the comment is not related to this article… the stock picks of ashish kacholia of late have not been performing well… MT Educare..AYM Syntex..Royal orchid hotels..Genus powe infra..I guess he exited Vishnu chemicals..man industries..axiscades..which have underperformed the broader market

I wish the wizard get backs to form soon…All the best Ashish Bhaiyya

Dear Arjun,

Where you found details of buying stock on specific date of PPAP, Bulk deal is available in bse only. Can you tell the details.

T&R

maybe annual report

Thanks

Yes, its there in the AR on page 14.

Thanks

Well looks strong on fundamental side though.