Dolly Khanna’s latest stock pick: Tata Metaliks

A few days ago, I was lounging in the plush office of the RJ Fan Club indulging in my favourite pastime of dozing and daydreaming of riches.

Suddenly, the alarm bells started clanging.

I instinctively knew from the persistence and loudness of the clanging that a big-ticket stock wizard had been spotted with a big-ticket multibagger.

I was right. It was none other than Dolly Khanna, one of our all-time favourite stock wizards.

Dolly had come to Dalal Street for a shopping expedition and had scooped up a massive truckload of 2,67,108 shares of Tata Metaliks, the blue-chip small cap stock.

Dolly had a pleasant smile on her face as she made her way through Dalal Street.

The reason for her joy was the fact that several stocks in her illustrious portfolio are surging like rockets and breaking records.

Today, for instance, ADF Foods, a micro-cap in which Dolly shares the center stage with Porinju Veliyath, Lashit Sanghavi, Ashwin Kedia, Nirmal Arora etc surged a massive 14% to rest at Rs. 202.

When I had first covered the stock, I had confidently and rightly predicted that a confluence of such eminent investors coupled with the hike in promoters’ stake and buy-back has to translate into big bucks for the shareholders.

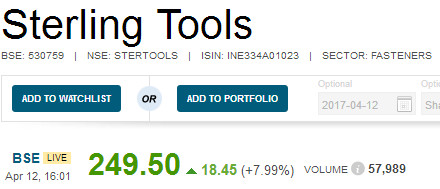

Sterling Tools, a stock in which Dolly Khanna is well entrenched in the illustrious company of Anil Kumar Goel and Vallabh Bhanshali, jumped 8% over news that it has entered into a technical collaboration agreement with Meidoh Co, a Japanese company.

Sterling Tools is still a micro-cap with a market capitalisation of Rs. 854 crore and is said to be the poor man’s Sundaram Fasteners, implying that it has a long way to go.

Why did Dolly Khanna buy Tata Metaliks?

It is obvious that questions of such seminal importance cannot be answered by novice investors like you and me. We have to take the assistance of eminent experts, of which there is fortunately no dearth.

| TATA METALIKS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 1,725 | |

| EPS – TTM | (Rs) | [*C] | 47.71 |

| P/E RATIO | (X) | [*C] | 14.29 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 20.00 | |

| LATEST DIVIDEND DATE | 21 JUN 2016 | ||

| DIVIDEND YIELD | (%) | 0.29 | |

| BOOK VALUE / SHARE | (Rs) | [*C] | 59.03 |

| P/B RATIO | (Rs) | [*C] | 11.55 |

[*C] Consolidated [*S] Standalone

| TATA METALIKS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2016 | DEC 2015 | % CHG |

| NET SALES | 300.17 | 293.24 | 2.36 |

| OTHER INCOME | 0.15 | 0.52 | -71.15 |

| TOTAL INCOME | 300.32 | 293.76 | 2.23 |

| TOTAL EXPENSES | 257.24 | 246.72 | 4.26 |

| OPERATING PROFIT | 43.08 | 47.04 | -8.42 |

| NET PROFIT | 19.52 | 26.04 | -25.04 |

| EQUITY CAPITAL | 25.29 | 25.29 | – |

(Source: Business Standard)

Six reasons Tata Metaliks will be a multibagger: Mudar Patherya

Mudar Patherya, who has now emerged as a stock wizard in his own right after his recent recommendations became blockbuster multibaggers, had recommended a buy of Tata Metaliks as far back as in June 2016 in an article titled Six solid reasons to be bullish on Tata Metaliks.

The stock has given an eye-popping gain of 524% on a YoY basis and 175% gain since Mudar’s recommendation.

However, the points made by Mudar are valid even as of date:

He made the key point that Tata Metaliks has been able to successfully transform its low-value pig iron hot metal into high-value ductile iron (DI) pipes.

He also emphasized that the company is at the cusp of a significant expansion – even as pig iron capacity will remain the same, the company has selected to expand it coke oven capacity (to reduce costs), commission a 10 Mw waste heat recovery system (to reduce costs) and increase its ductile iron pipe capacity nearly 50 per cent to 200,000 tonnes per annum.

It is obvious from Mudar’s analysis that the benefits of this expansion in capacity will continue to flow into the coffers of the Company in the future as well.

Tata Metaliks has exciting future growth prospects: Centrum

Centrum has issued an initiating coverage report in which it has heaped rich praise on Tata Metaliks. One can do no better than to reproduce the salient parts of the report:

“Exciting future growth prospects await TML’s fast growing business of ductile iron (DI) pipes which faces limited competition, has solid demand drivers and strong entry barriers. With recent commissioning of growth-accretive and cost efficient projects offering quick paybacks, TML is set to take the next leap in profitability and deliver EBITDA/PAT CAGR of 18%/19.2% over FY16-19E. TML’s cash flow yield stands at attractive levels of 12.0%/17.5% on FY18E/19E basis, meriting a re-rating.”

Centrum also pointed out that Tata Metaliks is a “financially sound, cost efficient and fast growing niche product franchise” and that the “paradigm shift in fortunes” is “an unparalleled “Metamorphosis” which has been driven by superior management actions and prudent capital allocation”.

The buy recommendation has also worked out well because the stock breached the target price effortlessly in just a few days.

Tata Metaliks is a must-buy: DD Sharma

DD Sharma, the veteran stock picker, has not received the due respect that he is entitled to from us for his stellar stock recommendations.

He recommended Tata Metaliks on two occasions, once in July 2016 and the other in January 2017.

On both occasions, DD Sharma provided a masterful analysis of the prospects of Tata Metaliks and urged us to buy the stock with the confident assurance that we cannot go wrong with a blue chip of the caliber of Tata Metaliks.

Needless to say, Tata Metaliks has not only met DD Sharma’s projections but far exceeded them.

Tata Metaliks has a lot going for it: ET

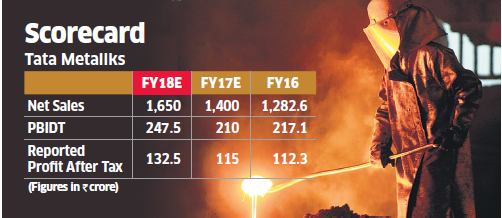

Jwalit Vyas of ET also provided a brilliant analysis of why Tata Metaliks is an excellent investment opportunity. He explained that the ductile iron pipes business would see a sharp jump in earnings in the coming quarters owing to the high demand for the product and the high margins.

He also emphasized that Tata Metaliks would prosper because its arch rivals Electrotherm, Electrosteel Castings, Jai Balaji Industries, Jindal Saw and Srikalahasthi Pipes had various disadvantages such as high debt etc.

(Image Credit: ET)

He also pointed out that the stock, then quoting at Rs. 408, was trading at a bare 7.5x FY18 earnings, which was cheap in comparison to other pipe manufacturers such as APL Apollo and Finolex Industries which are demanding stiff valuations of upto 18x.

Are we too late to the party?

Now, the million dollar question is whether there is any juice left in Tata Metaliks for us to feast on.

Prima facie, the fact that the stock is up 525% on a YoY basis and 95% over the past three months suggests that much of the gains have already been pocketed by the early investors in the stock. However, the fact that Dolly has retained her stake even as of 31st March 2017 is a clear indication that she regards the stock as being undervalued and as having the potential to shower mega gains in the future as well.

So, the optimum strategy for us is to keep a hawk eye on the stock and pounce on it whenever there is a meaningful correction!

Hi,

how can we access the coverage reports of brokerage houses?

Hey, admin. I love love love your blog. Your coverage is EPIC and always a delight to read.

However, is there a way where we can learn about the latest acquisitions by the great investors and not after it’s too late.

I guess you can do that ! Thanks BTW

MEGA TURNAROUND STORY :::::::::::: EON ELECTRIC LIMITED (POTENTIAL 3X)

Eon Electric started operation in 1958 with LT switchgear as Indo Asian Fusegear. The company name was changed to “Eon Electric Limited” in 2011. After the sale of switchgear division, company acquired two factories at Haridwar for setting up plants for LED lighting, mobile phone accessories, lithium – ion batteries, electrical fans and Geysers.

Company Profile

Eon Electric specializes in manufacturing and marketing a wide range of best high-tech electrical products, such as Lighting & Luminaires, world-class Fans, Modular Switches, Wires & Cables, Geysers and Mobile Accessories. It has state-of-the-art manufacturing plants in Haridwar, using world-class technology and quality checks. With a deep understanding of economic stimuli and customer needs, EON is determined to not only repeat its history of achievements. But also scale new heights of growth to become the nation’s most preferred brand. And the energy behind people’s smile.

Diversification of Business:

Batteries/Chargers

LED Lightings

Wires and Cables

Fans

Geysers

Eon was successful in securing government orders to replace conventional street lights in Aligarh and Jodhpur worth Rs.51 Crores. Further to completion of these orders EON got extended orders for 33K street lights in Jodhpur and also in Aligarh. Besides this, EON has also won the contract in Varanasi. The latest order they have got from the Rajasthan Governement which is worth Rs.40 crores to install LED street lights in other cities including Gangapur, Jaisalmer, Sri Ganga Nagar etc.

As per the management, in next 3 years, there will be government contracts to replace 20 million street lights and Eon is expecting a bigger pie of that.

Retail Business

Eon’s retail business is also doing very well. They have dealers and retails outlets in every state of India.

Retail Outlets 1,25,000+

Channel Partners 900+

Eon has tied up with Flipkart, Snapdeal, Amazon etc. for selling their products online. Retail LED business is also doing exceptionally well.

Export

Eon has tied up with European LED makers OMS with whom they have also started a company in India which manufactures high quality light fixtures in India and other Asian countries. If management commentary to be believed Eon is going to start exporting their LED lights in Europe through their partner.

FINANCIAL ANALYSIS

RESERVES 107Cr

INVESTMENTS IN MF 62 Cr

MCAP 117 Cr

BOOK VALUE Rs.72

EPS Rs.2.30

**** BEST PART RESERVES + MF INVESTMENTS COMES 160 Cr …….. That Means You getting Electrical business Free of Cost at Current Valuations.

RECENTLY

Promoters have allotted convertible warrants (~8 lakh shares) to themselves at exercise price of Rs.66.5

UP GOVERNMENT AGGRESSIVELY WORKING TO PROVIDE 24 Hrs ELECTRICITY

We See 100% UPSIDE from Current Price in 6 Months

What is EON doing in this blog?? No Promotional messages please..!

Ganesh Benzoplast also added by Dolly Khanna

bse nse does not reflect dolly khanna buying Ganesh Benzoplast . What is your source of this information?

where did you get the info that dolly khanna has bought ganesh benzo?