Mohnish Pabrai pledges undying love for Indian stocks after surge

Today, Mohnish was spotted on Dalal Street exchanging high-fives with the local punters even as he sipped cutting chai and munched Gutka.

Mohnish had a big smile on his lips and a spring in his step.

There were two reasons for his joy.

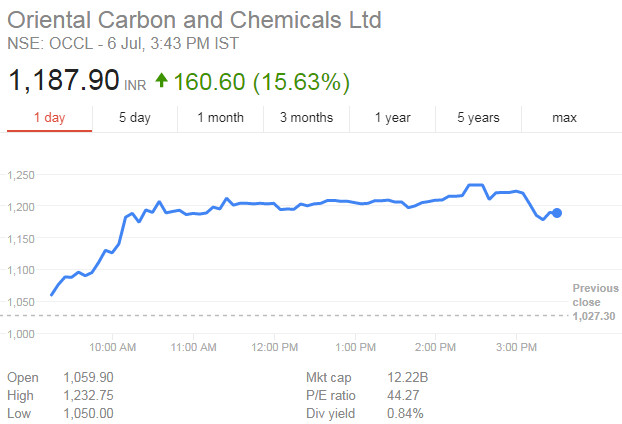

The first was that Oriental Carbon & Chemicals, his latest stock pick, surged a massive 16% to rest at Rs. 1188.

Mohnish is understandably thrilled with the manner in which his stock picks are behaving.

Mohnish candidly admitted that there have been very few occasions in his long and distinguished career as an investor that stocks have effortlessly given such massive gains.

“I love what we own in India. We’ll make a lot of hay from our Indian holdings in the years ahead,” he declared with a smitten look on his face even as the punters gazed at him with admiration.

Dolly Khanna sends Rain Industries flying by buying a big chunk

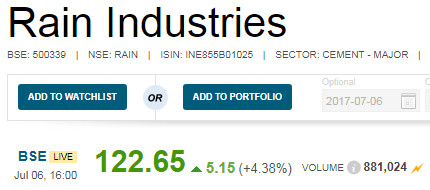

The other reason for Mohnish’s joy is the fact that Dolly Khanna has given a vote of confidence to Rain Industries.

The news came out in the early hours of the morning that Dolly holds 42,68,092 shares as of 30th June 2017.

Understandably, the news generated great excitement on Dalal Street.

The stock surged like a rocket to Rs. 123 even as the punters made a beeline for it, their eyes wild with excitement.

It may be recalled that Rain Industries is already a high conviction pick for Mohnish.

He holds a colossal quantity of 290,12,715 shares spread across two of his funds.

The investment is worth Rs. 357 crore at the CMP of Rs. 123 and is obviously the flagship of the portfolio.

Dolly’s investment is worth Rs. 52.49 crore. It is a high conviction pick for her as well.

Mohnish has already pocketed 231% gain on a YoY basis from Rain Industries.

Why is Rain Industries so alluring to the ace investors?

In the past, I have drawn attention to the research report by Parry Pascricha and IDBI Capital which have explained all the nuances of the stock and the investment rationale.

The merits of the stock have also been meticulously explained by Darshan Mehta of ETNow.

More secrets are to be found in the latest investors’ presentation released by the Company.

Completed Capital Projects

The essence is that Rain Industries has not only completed five capital projects but the same are stabilized and are ready to start contributing to the kitty.

The five completed capital projects are the following:

(i) 300,000 Tons per annum Coal Tar Pitch Facility in Russia during Feb.’16

(ii) Flue Gas Desulfurization Plant in Chalmette, Louisiana, U.S.A. during Dec.’15

(iii) 1,000,000 Tons per annum Calcined Petroleum Coke Blending Facility in Vizag, Andhra Pradesh, India during Dec.’16

(iv) 7MW Waste Heat Recovery Power Generation Facility in Cement Plant at Kurnool, Andhra Pradesh, India during Sept.’16

(v) 17,000 Tons per annum Carbores III reactor in Castrop-Rauxel, Germany during Dec.’16

Prima facie, it appears that Rain Industries will now enjoy operating leverage as a result of the completed capex because the top-line and bottom-line will surge.

Planned Capital Projects

Rain Industries has planned two capital projects. One is the ‘Hydrogenated Hydrocarbon Resins Plant (“HHCR Project”)’ while the other is the ‘Packing Material Plant’.

It is stated that the HHCR Project will enable RAIN to take advantage of increasing demand for water white resins.

The ‘Packing Material Plant’ will probably help in operations and result in cost savings.

Performance of the three business verticals

The presentation provides important information relating to the key market factors, performance in Q1CY17 of the three verticals, namely, carbon, chemicals and cement business.

It also appears that the Company is taking active steps to manage its debt liability by refinancing at lower interest rate.

There is also a lot of figure-work given much of which is mumbo-jumbo and beyond my comprehension.

More multibagger gains are expected

Mohnish himself made it clear that Rain Industries is expected to shower more gains on investors.

“The stock has tripled and it will keep going for a while,” he said, leaving no room for doubt about his bullishness for the stock.

Conclusion

In hindsight, we ought to have rushed into Rain Industries as soon as the news came out about Mohnish’s entry into it. Now, we have a second chance with Dolly’s entry into it. Hopefully, there will be a significant correction and we will get the opportunity to sneak into the stock!

A must have stock in your portfolio for long term. Use all dips to buy…

I am observing since a long time dolly does not care about the debt levels of most of the onvestments that she has made unlike many of top value investors who gives a lot of emphasis for the debt levels, rain industries der is 2+ ….

Dolly Khanna also buys Akshar Chemicals in June quarter.. As per lates shareholding pattern of Aksharchem Dolly Khanna holds more than 60,000 stocks.. Does this mean there is stillnot lof steam left in Aksharchem?