(Image credit: Chennai Angels)

Lincoln Pharma, a micro-cap with a market capitalisation of only Rs. 255 crore, would have never come into our radar had it not been for the fact that Mr. Motilal Oswal, Raamdeo Agarwal’s business partner and co-founder of MOFSL, recommended it as a “multibagger” stock idea for 2016.

Unfortunately, Lincoln Pharma ran into heavy turbulence soon thereafter. The Tanzanian FDA cancelled Lincoln’s registration and banned one of its best-selling products called ‘Chloramphenicol Sodium Succinate Injections’ over quality-control issues. This led to heavy losses because the Company had heavily stockpiled the product and was dependent on exports to Tanzania.

The Company downplayed the incident as an “administrative lapse” in not renewing the registration in time. However, investors were not convinced. There was a massive sell-off and Lincoln Pharma’s stock price fell nearly 50% since Motilal Oswal’s recommendation.

Investors were particularly upset at the fact that the Country doing the banning is a fourth-World Country, already notorious for low quality standards. Some also alleged that the ban was a year old and that the Company delayed making the news public. Doubts were raised about the Company’s standards of corporate governance that it chose to keep something so critical under wraps for such a long time.

Dolly Khanna appears to have been caught in the crossfire because she is seen to have bought 62,463 shares of Lincoln Pharma in the Quarter ended 31st December 2015. She would have also suffered MTM losses from the meltdown in the stock price.

Dolly is in the distinguished company of Kishore M Bang, a co-founder of M/s Nirmal Bang. Kishore Bang has bought 60,000 shares of Lincoln Pharma in the same period.

Prima facie, the trio of Dolly Khanna, Motilal Oswal and Kishore Bang appear to have been enamoured by Lincoln Pharma’s robust financial performance and ambitious expansion plans.

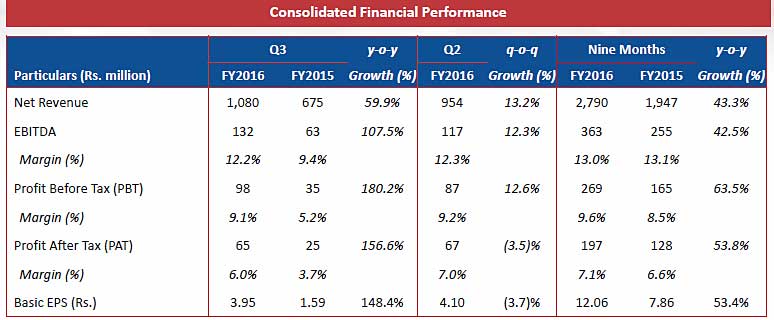

In the 9 months of FY 2016, the net revenue is up 43.3% while the EBITDA is up 42.5%. The EBITDA margin is an impressive 13%. The PBT is up 63.5% while the PAT is up 53.8%. The PAT margin is 7.1%. The debt-equity ratio is comfortable at 0.4x.

Lincoln Pharma’s investors’ presentation reveals the following impressive and ambitious “Strategic Initiatives”:

1. New Launches

•Launched the Dermatology Division with a team of approximately 50 people

•Introduced 15 products under this division

2. Capacity expansion

•Completed the expansion of Unit 1 (Tablet, Capsule & Ointment), which resulted in trebling of the current capacity

•Also upgraded the existing facility to enhance efficiency

3. Expansion of wind mill capacity

•Completed setting up of a new wind mill (capacity: 2.1 MW); 5 million units of electricity for captive consumption

•Significant reduction in fuel cost in the coming quarters

4. New facility to cater to international markets

•Plan for setting up a beta-lactam antibiotics manufacturing plant is on schedule

•Started construction of the facility

5. Field force expansion and entering into new international geographies

•Added approx. 80 members to the field force to increase capacity utilization in the domestic market

•New approvals from Namibia, Sudan, Ethiopia, Zimbabwe, Yemen and Libya to increase international volumes

So, it does look like Lincoln Pharma is on a strong growth trajectory. Hopefully, the Tanzanian episode will prove to be an aberration and a temporary setback for the Company.

Interestingly, Dolly Khanna’s maiden foray into the Pharma space was in the March 2015 quarter when she pumped in about Rs. 2 crore in buying 1,17,865 shares of Venus Remedies, a micro-cap. Unfortunately, the stock has lost 55% since then. Dolly averaged her purchase price by increasing her holding to 135,560 shares as of September 2015. Presently, Dolly appears to have thrown in the towel and booked losses because her name does not appear in the list of major shareholders of Venus Remedies.

One amusing aspect worth noting is that the wake of the collapse of Lincoln Pharma’s stock price, M/s Motilal Oswal rushed to distance itself from Mr. Motilal Oswal’s recommendation. When irate investors demanded to know why the Fund had bought the beleaguered stock, Aashish P Sommaiyaa, the Managing Director & CEO of Motilal Oswal AMC, clarified that Lincoln Pharma was neither held in the PMS nor in the Mutual Fund.

@r_laroia @varinder_bansal Sir Lincoln Pharma is not part of PMS. Doubts on PMS performance feel free to write aashishps@motilaloswal.com

— Aashish P Sommaiyaa (@AashishPS) January 25, 2016

@tarun_wb1991 @NagpalManoj no Lincoln Pharma held by us. Latest performance here. pic.twitter.com/9HjlfOxDV3

— Aashish P Sommaiyaa (@AashishPS) January 25, 2016

So, Lincoln Pharma appears to have become a pariah amongst fund managers. It is obvious that at least Aashish Sommaiyaa regards it as not being investment-worthy presently. We need to keep a watch on whether M/s Motilal Oswal and the other Mutual Funds change their stance about Lincoln Pharma in the near future.

I feel one should not look into identifying new micro cap pharma stocks…rather will suggest to look into the known and big names which are heavily battered…they are ahead in the innovation cycle and would have the ability to withstand adversities that currently the sector is going through…

Granules, Suven, Shilpa, Aarti Drugs, may be Caplin. When you have these , why go for micro caps ? The two industries of the future are IT and Pharma. India is far behind in IT as long as they do not produce product oriented industries like Apple and Tesla. However I think Indian Pharma companies will shine bright in near future. Thoughts ?

Though company growing slowing for now I don’t think Lincon pharma is worth investment. It would be nice to pick it up in 2014 when was trading for 45 rupees.

#Niveza #Review on Lincoln Pharma #Stock::

Lincoln Pharma is dealing with tough time after ban from Tanzanian drug regulatory on ‘Chloramphenicol Sodium Succinate Injections’, the company suffered with heavy losses. Financials of the company are still looking better but the losses in the banned product can’t be ignored. As the company has already dumped the product which was about to export to Tanzania, the company is in huge pressure of recovering the losses. Now it became the multibagger stock. Expansion plans of the company are looking good with launching of new products. But the company required some momentum to gain the investors faith.