Nifty is in “deeply oversold zone” and chance of bounce back is high

Apurva Sheth of EquityMaster appears to be an expert in technical analysis.

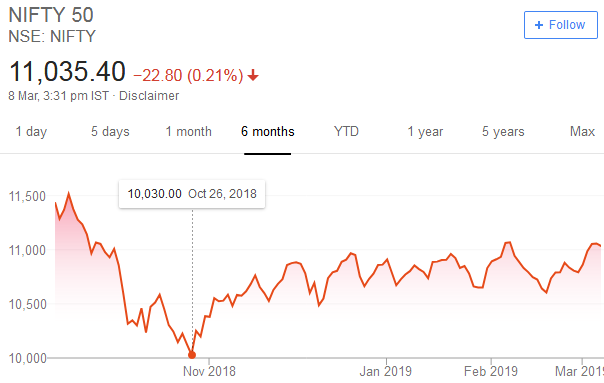

In October 2018, when the Nifty had plunged like a stone and touched a bottom of 10,300, he expressed the opinion that “we are in deeply oversold zones and chances of a bounce back are high“.

The opinion was based on two rationale:

The first was that the Nifty was trading above the important psychological support level of 10,000.

It was pointed out that the correction which began in January 2018 found support around the same levels in March 2018.

This implied that the same level could act as a support in the immediate term.

The second was that the daily RSI had formed a bullish divergence with price after hitting a 10-year low.

It was emphasised that the last time daily RSI dropped below recent levels was in 2008.

It was also pointed out that the Nifty had formed a “double bottom” pattern which indicated that “the market has flushed out the aggressive sellers and it is ready to move higher“.

Apparently, a “double bottom” occurs when a security drops, pulls back, falls back to its previous lows, then finally breaks out higher. The pattern often resembles the letter “W”.

Nifty fulfils prophecy & surges

The prophecy that the Nifty is in deeply oversold zone and chance of bounce back is high has come true because the Nifty surged from a bottom of 10,030 on 26th October 2018 to a high of 11,069 on 7th February 2019.

Presently, the Nifty is resting at 11,035.

According to data produced by Surabhi Upadhyay, the Nifty Small-cap Index is up 12.7%, while the Mid-cap Index is up 10.5%, from the 52-week lows.

Individual stocks have posted stunning gains, of as much as 227%.

IN 2019#Nifty : 1.9%

Nifty #Midcap: -2.3%

Nifty #smallcap : -1.1%THE MIDCAP PARTY

So Far In March

•Midcap Index up 4.4%

•Nifty Junior Up 3.9%

•Smallcap Index up 7.5%

•Nifty Up 2.6%#StockMarket #Bulls— Surabhi Upadhyay (@SurabhiUpadhyay) March 7, 2019

Example of some fast movers#midcaps #smallcaps #stockstowatch #StockMarket #Sugar

RALLYING FROM 1 YEAR LOWS

Dhampur: +227%

Balrampur: +135%

Praj: 124%

Dish TV: +107%

Dilip Buildcon: +86%

CG Power: +81%

BEML: +71%

PFC: +67%

OBC: +65%

Allahabad Bank: +64%— Surabhi Upadhyay (@SurabhiUpadhyay) March 7, 2019

Nifty likely to move more than 5% by March or April 2019, perhaps plunge

Now, Apurva Sheth has sent the chilling warning that the Nifty is likely to make a major move of more than 5% in the expiries of March or April 2019.

The logic is based on the fact that the Nifty has witnessed a “dull and boring” expiry in the three consecutive months of December 2018, January 2019 and February 2019.

The Nifty closed December, January and February with changes of -0.73%, 0.47% and -0.36% respectively.

This is corroborated by other experts.

November expiry 10860.

December expiry 10780.

January expiry 10830.

February expiry?If there is no further geo political tension, Nifty is likely to expire between 10780 and 10860.

Four months of consolidation.

— P R Sundar (@PRSundar64) February 27, 2019

“Markets are not used to such lackluster movement. The Nifty moves sharply whenever it ends two or more consecutive expiries within a range of +2% or -2%,” Apurva Sheth has opined.

To make good his proposition, he has produced data from May 1995 onwards.

| Month | Date | Nifty | % change |

|---|---|---|---|

| 1 | May-95 | 960 | -0.37% |

| 2 | Jun-95 | 973 | 1.38% |

| 3 | Jul-95 | 1,039 | 6.79% |

| 1 | Aug-02 | 987 | -1.43% |

| 2 | Sep-02 | 970 | -1.76% |

| 3 | Oct-02 | 951 | -1.91% |

| 4 | Nov-02 | 1,050 | 10.33% |

| 1 | Jul-10 | 5,409 | 1.66% |

| 2 | Aug-10 | 5,478 | 1.28% |

| 3 | Sep-10 | 6,030 | 10.08% |

| 1 | Apr-15 | 8,182 | -1.93% |

| 2 | May-15 | 8,319 | 1.68% |

| 3 | Jun-15 | 8,398 | 0.95% |

| 4 | Jul-15 | 8,422 | 0.28% |

| 5 | Aug-15 | 7,949 | -5.61% |

| 1 | Aug-16 | 8,592 | -0.86% |

| 2 | Sep-16 | 8,591 | -0.01% |

| 3 | Oct-16 | 8,615 | 0.28% |

| 4 | Nov-16 | 7,966 | -7.54% |

| 1 | Apr-17 | 9,342 | 1.84% |

| 2 | May-17 | 9,510 | 1.79% |

| 3 | Jun-17 | 9,504 | -0.06% |

| 4 | Jul-17 | 10,021 | 5.43% |

| 1 | May-18 | 10,736 | 1.11% |

| 2 | Jun-18 | 10,589 | -1.37% |

| 3 | Jul-18 | 11,167 | 5.46% |

| 1 | Dec-18 | 10,780 | -0.73% |

| 2 | Jan-19 | 10,831 | 0.47% |

| 3 | Feb-19 | 10,793 | -0.36% |

| 4 | Mar-19 | ?? | ?? |

The data does show that after long periods of consolidation, there are spikes in the Nifty.

In November 2016, the Nifty plunged a mammoth 7.54% after three months of sluggishness while in July 2017 and July 2018, it surged a massive 5.43% & 5.46% respectively after three months of consolidation.

Based on this analysis, it is stated that the “chances of a big move more than 5% could be possible during the March or April expiry“.

He has also warned that going by “price action“, the chances of a fall could be higher.

Markets moved significantly after 4 months of consolidation. Will there be a clear break out this time?

— P R Sundar (@PRSundar64) March 6, 2019

World markets bleeding.

China down 4.4%.

Hong Kong down 2%.

Dow is down by > 200 points.

This is the 5th straight fall in US.

But Nifty closed just 20 points lower.

11th consecutive day of FII buying in Cash market.

Market believes that there will be a stable Govt. after election— P R Sundar (@PRSundar64) March 8, 2019

Also, election fever is likely to grip the markets soon.

Election Commission of India to announce dates for General Elections 2019 today. ECI calls a press conference at 5PM this evening @CNBCTV18News @ShereenBhan #GeneralElections2019

— Parikshit Luthra (@Parikshitl) March 10, 2019

Conclusion

Common sense dictates that every sharp up move in the markets is accompanied by a sharp correction. As the Indices have indeed surged between 10% to 12% from the lows, a sharp move to the downside should not come as a surprise.

Accordingly, it is better if we heed Apurva Sheth’s advice, book profits and take shelter in the bunkers till the correction is over.

There is no point in being adventurous or defiant in these matters!

Don’t understand while every body is talking about recovery in all indices including Nifty, Mid Cap and Small Cap from now onwards and see a solid recovery in the months to come jinxing the bad days of last more than a year and this post is giving a chilling warning of further 5% loss in Nifty during March and April 2019.

Is 5% plunge a big deal to warn about. It is written as if it is crashing 50%.

5% plunge? 28 PE, GDP growth 6.7-7.3%, earnings growth can’t beat more than 12-15%, P/B is too high, and do you think 5% will adjust this? At least 20-25% hit will restore,