Sensex, Nifty Surge; But Mid & Small-cap stocks plunge

One aspect which is baffling is that though the Sensex and Nifty are surging to All Time Highs, mid-cap and small-cap stocks are sinking to new lows.

According to Shraddha Babla, the charming research analyst with Bloomberg, the Sensex has breached the ATH of 37,000 while Mid-cap and Small-cap Indices are still languishing at a great depth from their ATHs.

.@NSE_NIFTY at New high

Sensex Breaches 37000-Mark For The First Time

But midcaps and smallcaps left behind

Nifty Midcap 15% away from all-time high

Nifty Smallcap 24% away from all-time high#Markets— Shraddha Babla (@shraddha_babla) July 26, 2018

This is corroborated by Ekta Batra, the associate editor of CNBC TV18.

Nifty, Sensex @ record high reminds of cleaning your room by stuffing everything in your cupboard. Looks good on the outside but the real story is inside. #Nifty#Sensex

— Ekta Batra (@ekta_batra) July 26, 2018

As Indian television channels go all out on celebrating Sensex and Nifty hitting all-time highs, one must note that the mid-cap index is down 11 pct, and small-cap index is down 15 pct YTD. Most mutual funds are way away from their January peak. So, not quite a celebration

— Aditya Kalra (@adityakalra) July 26, 2018

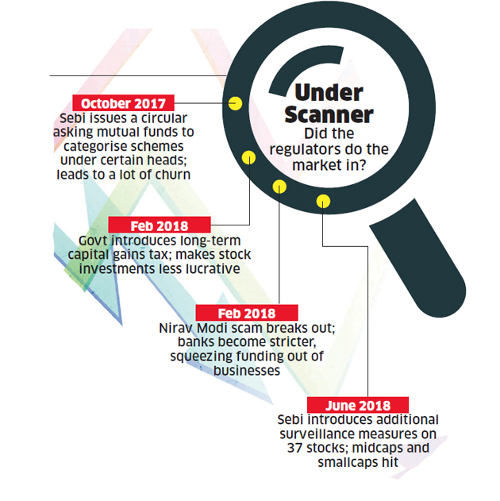

Suman Layak & Shailesh Menon of ET Now have investigated into the reasons for this bizarre paradox.

According to the duo, the blame deserves to be pinned on SEBI for its hare-brained policies relating to Mutual Fund classifications and the dreaded Additional Surveillance Mechanism (ASM) regulations.

(Image credit: ET)

Shankar Sharma is understandably furious at the sorry state of affairs.

The meltdown in mid-cap and small-cap stocks is caused by “forced selling into illiquidity, leading to a domino effect collapse on entire segment,” he fumed.

Two types of bear markets: fundamental & technical. Fundamentals in small caps are intact. So what's caused the meltdown?Technical factors ie, trading curbs, hence low liquidity, hence forced selling into illiquidity, leading to a domino effect collapse on entire segment

— Shankar Sharma (@1shankarsharma) July 23, 2018

Time is ripe to aggressively buy mid-cap stocks

However, while the academicians are scratching their heads at the baffling state of affairs, the practitioners are busy taking advantage of the bargain-basement prices and buying stocks.

Shankar Sharma himself gave the buy call by declaring that “Fundamentals in small caps are intact” and that it is “technical factors” which has caused the mayhem.

Porinju Veliyath needs no excuse to be bullish.

“Mid & small-cap carnage seems overdone. Paranoia will vanish soon,” he thundered, implying that we do not have much time to take advantage of the fire sale.

Mid & small-cap carnage seems overdone. Paranoia will vanish soon. Money hiding behind top 15-20 stocks will soon start looking for rational valuations.

— Porinju Veliyath (@porinju) July 19, 2018

Sunil Singhania and Sandip Sabharwal have also come out with all guns blazing and recommended an aggressive buy.

This is the time to go out and buy

Strong Established Mid Cap Cos

Fallen 25-50% from the top

Have improving business outlookDownside in many such companies is limited now and upside potential higher.

Remember ACTUAL RISK & PERCEPTION OF RISK move inversely.— sandip sabharwal (@sandipsabharwal) June 28, 2018

Had mentioned on May 19, 2018 to get wallets ready for big opportunity coming in 2-4 months. Exactly in two months we have this “stocks on sale” opp. Build positions over next two months for super returns. BE POSITIVE! https://t.co/nYFRJdxDbH

— Sunil Singhania (@SunilBSinghania) June 28, 2018

Five high-quality mid-cap stocks to buy now

The mandarins at Outlook Business know that novices need more than theoretical advice to buy stocks. We need specific and tangible stock ideas.

So, they have collated the following five stock ideas after consulting numerous renowned experts.

(i) Indraprastha Gas – Monopolistic safe-haven with stable business

Indraprastha Gas ticks all the boxes required of a sensible investment candidate.

It boasts of a monopoly in the gas distribution business coupled with high RoE and RoCE. The P/E is quite reasonable at 19xFY20.

“IGL offers investors a rare mix of volume growth and healthy margins, which is a sweet combination,” an expert is quoted as advising.

SP Tulsian is also gung-ho about Indraprastha Gas. “I am very much positive about the Co,” he said, reeling out impressive facts and figures as to why the stock is an irresistible investment opportunity.

(ii) East India Hotels – revenue to grow at 15% CAGR in the next three years

Porinju Veliyath and Ashish Chugh were amongst the first to predict that the hotel sector is emerging out a Bear phase and is poised to shower multibagger gains upon investors.

3&4 Star hotel operators are in a sweet spot. F&B at 5% GST. Room rates are mostly below Rs.7500 (18% GST). Margins to go up. Advantage at the expense of 5 Stars. Few listed companies in the space look attractive. Am I missing something?

— Porinju Veliyath (@porinju) November 10, 2017

Industry has seen a down cycle followed by multi year consolidation – leading to a a leaner structure & cost rationalisation. Case of operating leverage with higher occupancy. https://t.co/4pjbmrkSOW

— Ashish Chugh (@hiddengemsindia) November 11, 2017

Based on this theory, Royal Orchid Hotels, which boasts of an “asset light business model”, has been recommended as a “strong buy” by leading experts.

Indian Hotels, the blue-chip five star hotels chain of the reputed Tata group, is also a strong contender for our money.

East India Hotels, another fail-safe mid-cap blue-chip, is also a worthy candidate in the fray.

“Given that the major chunk of room supply will only come post 2022, EIH is well placed to take benefit of low supply and high demand,” a leading expert said.

“The properties of EIH are strategically located in business as well as leisure hubs. The rise in the occupancy levels supported by healthy demand would lead to rise in room rates going forward, thus, leading to robust margin expansion,” another opined.

EIH is also a favourite of mega Billionaire Mukesh Ambani which implies that his good luck magic charm will take the stock to new heights.

(iii) to (v) TVS Motor, Natco Pharma & Mahindra Cie Automotive

The other three stocks which have been given a clean chit and ushered into the coveted buy list are TVS Motor, Natco Pharma & Mahindra Cie Automotive.

All three stocks are fail-safe powerhouses and the logic given in respect of the buy recommendation for each is flawless!

Stay in Good Quality consumer centric leadership position stocks , top pvt banks and nbfc , pvt insurance, fmcg , RIL , Asian paints , Maruti , L&T etc , forget these market Gurus , many are trapped in D grade stocks now searching for exit opportunities ,although they were praising Modi third grade budget with LTCG tax as major gif with our knowing what has changed with budget.No recommendations just for discussion.

Good advice for market returns. For superior returns, look for anomolies

Suggest few

Anomaly occurres when there is no synergy between value and price.To find those opportunities,some time it is apparent in objective assessment but many times one has to use subjective assessment. These type of situations are largely found in mid caps or small caps. We find such opportunities in large caps only during panic situations. I also intend to stress upon the fact all mid cap or small caps are not katchra stocks albeit volatility is their inherent trait. This anomaly combined with volatility beget capital appreciation.

Sir,as regards your penchant for Blue Chip stocks,I suggest that who does not know those are the stocks of companies of highest quality? In such condition, where is your edge? In stock market you make money by knowing what is not known or apparent to others.

There is no harm in buying even small or mid cap if they are market leader or challenging market leader successfully as second player or showing Secular high growth, but what I see is many of Gurus recommending third grade stocks which are being traded in market for many decades and has done nothing but are like Barsati mendak appears and start showing results in bull run and than again start showing poor results after as usual. This I call as manipulation.

no Kharb my dear fellow investor I agree with you…this time of crisis is the time to show these market gurus who is the real boss …who has the mettle…who is both the short and long distance horse ….who is true bull…c’mon you and your dear friend darth can lead the way…show us the true gems in this market..

Of course, Kharb has the mettle to show and convince you about the “true gems” which he holds/going to hold. Kharb will not let you down on this. He has a time tested machine to target such “true hidden gems”.

Personally I feel none of them are good to expect returns.