Kshitij Anand of ET has spoken to well-known experts like Dr. Tirthankar Patnaik, Anand Tandon, Avinnash Gorakssakar, Gaurang Shah, etc about the state of the market and the stocks to buy. The experts have suggested that the correction in the market should be used to buy top-quality stocks.

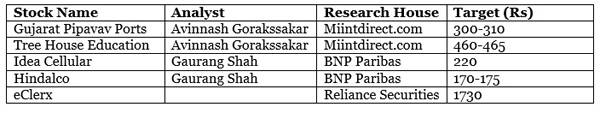

The experts have suggested an investment in the following five stocks:

(i) Gujarat Pipavav Ports Limited (Target price Rs 300-310):

The company runs a port called Pipavav, which is the third largest in India and has been showing consistently good performance, considering the kind of container traffic growth which the country has seen.

(Image Credit: ET)

The company is actually run by very strong promoters. AP Moller Maersk owns 43% equity. Other large institutional investors include Bajaj Allianz, which holds 3% since the company went public.

Coming to the financials, the company has shown a remarkably strong profit growth on a top line of Rs 627 crore last year. They recorded a PAT of Rs 320 crore. Considering the kind of growth in container traffic and the kind of healthy cash flows the company is throwing, we could be seeing profitability in excess of Rs 400 crore for the next year and thereafter around Rs 480-485 crore.

So over the next 12 months, this could be a good price where investor could get a target of around 300-310 odd levels.

(2) Tree House Education and Accessories Limited (Target price Rs 460-465):

Tree House is amongst India’s largest branded pre-school player in the country. It runs about 590 odd franchise centres. It also has now moved into forward integration by moving up the value chain by actually managing schools across two states, that is Maharashtra and Gujarat. It manages 24 schools there.

Coming to the business model, we have seen very strong EBITDA margins for the last two to three years, almost 50% to 55%, and last year was a very good year for the company on a top line of about Rs 157 crore. We saw a profit of almost Rs 43 crore.

The next two years would see very strong earnings traction of almost 25% to 30% and given the kind of opportunity in the education market, especially the pre-school market, Tree House has a very strong brand and a pan-India presence. So it should do remarkably well. Over the next 12 to 15 months, we are looking at a target price of around Rs 460-465.

(3) Idea Cellular Ltd (Target price Rs 220):

Idea Cellular is a stock wherein we had a positive coverage with a price target of 175. Just last week itself, we have upgraded the target to 220, on fallback of a couple of possibilities that have emerged.

First of all with the current auction that has gone by, Idea has retained 900 megahertz circles and has retained all the nine circles in the 900 megahertz. It is the third largest player in the country offering on a GSM platform and services offered are 2G and 3G.

There is going to be strains on balance sheet in terms of cash flows, but given the kind of penetration that Idea has and of course likely possibility of an M&A activity happening, there is a case and point wherein weak players would be merging with the larger boys.

Given the fact that tariffs are not going to be changing anytime soon, we believe that the volume game is going to really play out to a great extent and that is where we believe the contribution from data and broadband services will contribute significantly.

(4) Hindalco Ltd (Target price Rs 175):

The recent correction is a very fantastic opportunity for long-term players to get into Hindalco. From current levels, the downside is extremely protected, operates in three business verticals, has a captive bauxite and aluminium business.

The international commodity price in terms of dollars or aluminium is bottoming out and by the virtue of this presence, we believe Hindalco is definitely going to be a one big beneficiary.

The near-term hangover remains in terms of the issues which the company has to deal with in terms of negative news flow, but that is a short-term reaction. 175 is the price target that we are working with, but one should have at least 16 to 18-month kind of time horizon and all dips closer to 130 or sub-130 levels should be used as an accumulation point.

(5) eClerx (Target price revised to Rs 1730, from Rs 1555):

eClerx has announced 100% acquisition of CLX Europe SPA (CLX) for Euro25mn in an all-cash deal, at a valuation of 1.3x EV/Sales and 5.5x EV/EBITDA and it is expected to be EPS accretive.

CLX creates, manages and delivers creative assets globally to the multi-channel market for luxury brands and major retailers. eClerx will fund the deal from internal accruals with balance sheet cash at Rs4.17bn.

The deal provides sectoral diversification and digital augmentation opportunity along with an enhanced foothold in Europe. We revise our FY16E/FY17E earnings estimate by 3.9%/4.2%; maintain BUY with revised target price of Rs1,730 (Rs1,555 earlier).