At inflection point with increasing capacity and improving demand

APL Apollo Tubes (APAT) is India’s undisputed market leader in structural steel tubes with a 55% market share and 4.5 MTPA capacity spread across 11 manufacturing facilities. It has delivered consistent volume growth in the last eight quarters, with sales rising to a record ~917KT in 3QFY26 (+11% YoY). In 3Q, HRC prices have declined by 4% QoQ and 8% vs. 1Q, though they have increased 8% in the last 20 days after the imposition of safeguard duty on steel imports. HRC price drop in 3Q could lead to inventory losses, and consequently, we have projected EBITDA/MT of INR5,000 for 3Q vs. INR5,228 in 2Q.

Despite persistent softness in the industry, APAT registered 11% YoY volume growth in 9MFY26 and maintains FY26 volume growth guidance of 10-15%, supported by capacity expansion in the high-growth region (Dubai), new strategy of launching a sub-premium brand ‘SG Premium’ and healthy private-sector demand across infrastructure, solar, and manufacturing.

APAT plans to incur a capex of INR15b – fully internally funded – to scale up its capacity from 4.5 MTPA in Sep’25 to 6.8 MTPA by FY28 and 10 MTPA by FY30 through ~1.0 MTPA greenfield and ~0.8 MTPA brownfield additions across India and Dubai, including specialty tubes. New plants address regional gaps, while Dubai and Bhuj SEZ-led exports boost international volumes above 1 MTPA (20% of sales) in the long term, structurally improving realizations and margins.

India’s 500 GW renewable target by 2030 unlocks an ~830 KT opportunity in solar mounting structures. APAT targets a 15% share (~125 KT), translating into INR3- 5b incremental revenue from solar mounting structures, supported by superior tube economics, premium pricing (INR5,000-6,000/MT), and plant proximity to solar-rich states.

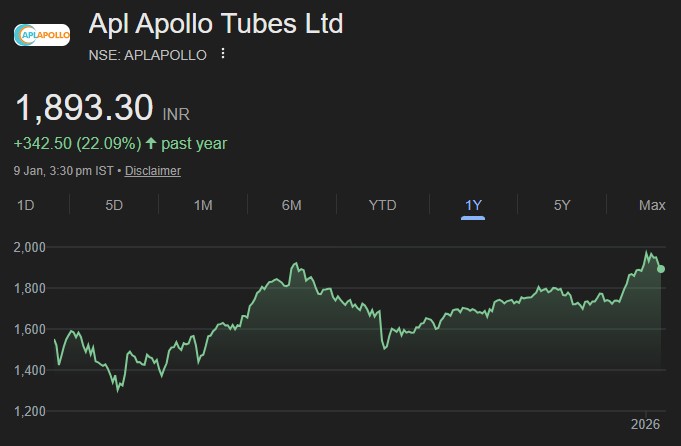

We expect APAT to report a CAGR of 14%/29%/33% in revenue/EBITDA/PAT over FY25-28. We value the stock at 35x FY27E EPS to arrive at our TP of INR2,260. Reiterate BUY.

Valuation and view

APAT is India’s most compelling structural steel tube operator with commanding market dominance (55% share), strong balance sheet (net cash), and strategic clarity on capacity expansion and product mix improvement. The company’s systematic approach to margin expansion, driven by VAP mix improvement toward 70%, cost optimization, and geographic diversification through greenfield plants, positions it to achieve EBITDA/ton of INR5,000+ and RoCE of more than 30% by FY28.

The emerging opportunity landscape is equally compelling – solar mounting structures present an 830,000-ton market opportunity by 2030. Specialty tubes for automotive, oil & gas, and water infrastructure segments open up highmargin revenue pools for APAT, historically untapped by commodity tube manufacturers.

With HRC prices reversing supported by improving demand, FY26 volume growth guidance demonstrates management’s operational execution. The convergence of structural market tailwinds, execution risk mitigation through a proven supply chain, and financial capacity to fund INR15b expansion from internal accruals suggests the company is well-positioned to double its capacity over the FY26-30 period.

We expect APAT to report a CAGR of 14%/29%/33% in revenue/EBITDA/PAT over FY25-28. We value the stock at 35x FY27E EPS to arrive at our TP of INR2,260. Reiterate BUY.