Strong core | strategic diversification | superior profitability

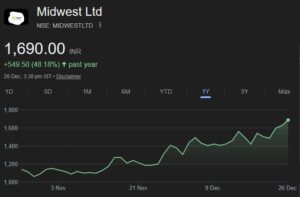

Midwest Ltd. (MIDWESTL) is India’s largest producer and exporter of premium Black Galaxy Granite. It holds over 60% of India’s export market share and is a leading player in Absolute Black Granite. The company is vertically integrated across the granite supply chain, operating 20 mines, and has generated ~INR6.3b in revenue during FY25, with a CAGR exceeding 21% over the past five years. MIDWESTL boasts a best-in-class EBITDA margin of 27.4%, with a CAGR of more than 44% during the same period, outperforming its granite industry peers.

MIDWESTL offers a unique combination of a nearmonopoly cash cow (Black Galaxy/ Absolute) that funds two new high-growth, high-margin businesses (Quartz and HMS) with minimal balance-sheet strain. These expansions will diversify revenue reducing concentration risk from ~96-98% granite share in FY25 to ~50% by FY28E. Its overall revenue and EBITDA are likely to post a 36% and 47% CAGR (vs. ~12% CAGR each for Granite) over FY25-28E, respectively, supported by the Quartz and HMS. Adj PAT to see 56% CAGR growth over FY25-28E.

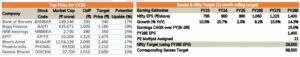

MIDWESTL’s net debt stood at INR2.2b, translating into a Net Debt/EBITDA of 1.3x as of FY25. The ratio is expected to dip to less than 1x due to the rising operating profit going forward. As quartz and HMS operations scale up by FY27- 28, OCF is likely to exceed INR2b annually, turning FCF structurally positive. We initiate coverage on MIDWESTL with a BUY rating. We value the company at 13x FY28E EV/EBITDA to arrive at our TP of INR2,000