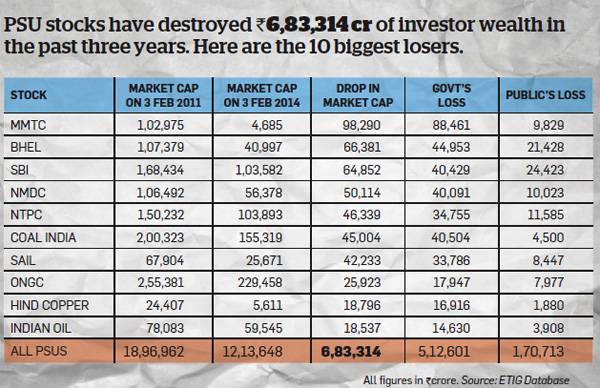

Narendra Nathan cites the example of MMTC whose stock price has plummeted from Rs 1,030 in February 2011 to Rs 48.15 now, a drop of 95%. In the past three years, PSU stocks have lost wealth to the tune of Rs 6,83,314 crore, he says. This amount is more than three times the total equity investment of the mutual fund industry, he points out.

Nathan has systematically identified four reasons for the terrible debacle in PSU stocks. These are:

(i) National interest vs. shareholders’ interest: Nathan cites the example of the PSU OMCs like Indian Oil, BPCL & HPCL which are forced to sell pertroleum products at a price that is not even sufficient to meet their costs of production.

Another example is that of PSU Banks that are forced to lend to the infrastructure sector and to the downtrodden sectors even where there is no hope of recovery.

(ii) Policy paralysis: This reason affects all companies but PSUs are more affected owing to their involvement in major sectors requiring heavy capital investment.

(iii) Frequent disinvestment at throw-away prices: Nathan points out that because the Government is desperate to bridge the fiscal defecit, it is trying to raise funds by heavy disinvestment of PSU stocks at discounted prices.

Another angle to this is that profit making companies like ONGC and Oil India are being told to buy from the Government shares in loss-making Indian Oil Corporation.

(iv) End of monopolies: Another reason for the PSU’s losing favour is the fact that companies like BHEL, BEML, MTNL, PSU Banks etc are no longer the monopolies that they were about a decade back.

What investors should do now:

Nathan points out that all may not be lost for the beleaguered investors in PSU stocks. The valuations of PSU counters are at rock bottom prices and most of the negatives are already in the price. The dividend yield of these stocks is also high which means that further downside is limited. Also, the concept of cross holdings within the PSUs will mean that fresh supply of paper may not come into the market.

A fall in the interest rates coupled with new policy initiatives from the Government can send the PSU stocks shooting up. So, at this stage, it is best to wait and watch rather than to sell, Nathan says.