Warren Buffett & other Pundits miss out on mega gains handed over on a platter

One of the most surprising aspects is that Warren Buffett neglected to follow his own timeless advice to us to “Buy stocks when there is blood on the Streets“.

He implemented this advice in a masterful manner during the depths of the 2008 crash in the stock markets.

“Buy Stocks, I am. If you wait for robins, spring will be gone,” he said, in a rousing battle cry to all the Bulls of the World.

This led to the Mother of all Bull Runs which continued for a decade and even novice investors became Millionaires.

Underperforming S&P 500 for 10 years

However, after his rousing battle cry of 2008, Warren has been highly diffident, missing one golden opportunity after the other.

This has caused his Berkshire Hathaway Fund to under-perform the S&P 500 over a long period of 10 years, frustrating devoted followers and shareholders.

Ouch! Buffett’s Berkshire Hathaway has underperformed S&P 500 for past decade. Berkshire CEO laments “sky-high” prices for acquisitions. An eye-popping $25bn net loss in the quarter was driven by $27.6bn in unrealized losses from the investment portfolio. https://t.co/1TsFtGr5RO pic.twitter.com/JXYfYa48xP

— Holger Zschaepitz (@Schuldensuehner) February 23, 2019

Warren Buffett's 'chronic underperformance' is frustrating investors and analysts https://t.co/oCztNlruYB

— Business Insider (@businessinsider) June 16, 2020

In fact, the sorry state of affairs led Prof Ashwath Damodaran, also a Pundit, to issue the Fatwa that Warren “should no longer be put on a pedestal and worshipped like a Deity“.

CoronaVirus gains also missed out

Even in the present crisis, Warren’s attitude has been highly diffident and counter-intuitive.

He dumped his entire portfolio of airline stocks at their lowest point and suffered a crippling loss.

He also sold several other stocks and raised his cash holdings to a massive $136 Billion.

This means that he totally missed out on the spectacular gains of nearly 40% given by the Dow Jones since the low point of March 2020.

Victim of potshots

Naturally, this sorry state of affairs has made Warren Buffett the target of potshots from all and sundry.

Dave Portnoy, who is regarded as the leader of the Punters on Wall Street, ridiculed the Sage of Omaha as having “lost his fastball” and and called him “washed out“.

The old man lost his fastball. Tell him to get off the tracks or he’ll get run over. I don’t want to hurt him. https://t.co/efnXRA0Cox

— Dave Portnoy (@stoolpresidente) June 5, 2020

I’m sure Warren Buffett is a great guy but when it comes to stocks he’s washed up. I’m the captain now. #DDTG pic.twitter.com/WqMR89c7kt

— Dave Portnoy (@stoolpresidente) June 9, 2020

The airlines are now up 65% since Buffett sold all of them a month ago and wished them well.

Meanwhile the Robinhoodies tripled their holdings in the ETF "JETS" at the same time.

Who is the smart money? pic.twitter.com/2ojYoTFgJc

— Jim Bianco (@biancoresearch) June 5, 2020

Even President Donald Trump called out the legendary investor for having made a “mistake“.

Warren Buffett “should have kept the airline stocks,” President Trump says. https://t.co/3p4dSNyGzb pic.twitter.com/EkAif4pqSy

— CNBC (@CNBC) June 5, 2020

The contagion has also spread to Dalal Street.

Sanjiv Bhasin politely described him as “no longer an icon“.

“Warren Buffett is no longer the icon that he was. In fact, he was most bearish and still is and he has missed the greatest rally in history. So I will make no bones about it,” the veteran said.

Warren Buffett no longer an icon; he missed the greatest rally in history: Sanjiv Bhasin https://t.co/TB7wdFGxXc via @economictimes

— sanjiv (@sanjiv_bhasin) July 3, 2020

Anyway, the bottom-line of the entire episode is that we can no longer look to Warren Buffett for guidance on what stocks to buy and when to buy them.

We have to find our own path.

Defense stocks surge

In the last interaction, Sanjiv Bhasin had correctly predicted that the mega reforms unleashed by NAMO coupled with the atrocities committed by the Chinese Vermin in Ladakh would give a boost to Defense stocks and that we should grab them with both hands.

He recommended that we buy Bharat Electronics and Bharat Forge, because these will be the prime beneficiaries of Defense contracts.

Sanjiv Ji,

BEL is the best bet on Defense. No competition in Defense Electronics.

Debt free & order backlog of 4 years.— Kishore Vaid ?? (@KishoreVaid) May 16, 2020

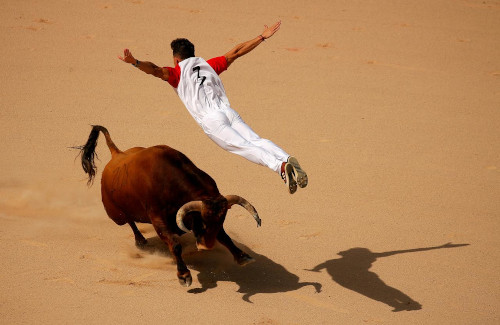

Needless to say, all Defense related stocks are flying like supersonic rockets and delivering massive gains to their lucky investors.

Greatest bull market ever is coming

Sanjiv Bhasin made it clear that he is very gung-ho about the state of the stock market.

“I am very-very positive after September. I can actually stick my neck out. Maybe after September, we will see the greatest bull market ever,” he confidently declared.

“A vaccine could be the silver edge but I am very-very optimistic given that the broader market is outperforming,” he added.

Stick to top-quality stocks which are underperformers

On the important question as to which stocks we should buy, Sanjiv Bhasin offered sensible advice that we should stick to trusted warhorses which have underperformed so far for one reason or the other.

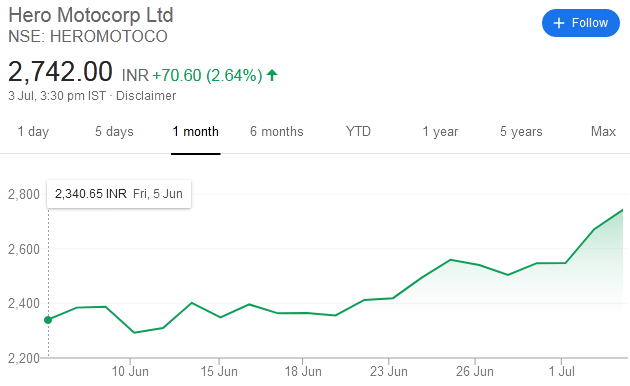

Blue-chip two-wheeler stocks are a prime example of this.

“Look at the underperformance you have seen from Hero Moto and Mahindra in the last two years. And that was all because of the BSIV-BSVI and some slowdown on the rural side and so on. Now the rural market is up and running. It is the best place to be. The crop has been good, the rural incomes have risen and you have got the lowest cost of subsidy and I think food is now going to be a huge supply given the government’s prerogatives. So I see no letup there,” he said.

He advised investors to do a SIP of top-notch auto and auto ancillary stocks like Hero Moto, Mahindra, Eicher Motors, Exide, Motherson Sumi etc.

Other sectors that qualify for our money include the Cement, Telecom, FMCG and Hotel sectors.

“Buying a basket of stocks even at expensive valuations may play out well because the market senses what is going to do well but you can always catch that through a good mutual fund,” he said.

“There is a whole host of ideas. All you have to do is stick your neck out and start doing an SIP for the next 12-16 weeks,” he added.

“After September, if we are correct, then we could see a very-very good upside in the stock market over the next one or two years,” the veteran investor concluded.

Well, I don’t see any blood on the streets (Dalal street). Blood is in the economy. Relatives and friends (including the office boy and driver)who have no idea about the market are jumping in and buying random stocks. Dumb fools. And mind you, currently, the market is not the reflection of the economy. The market is pumped by printed money by the governments across the world. It’s a greedy market. And ignore Warren Buffet and Charlie Munger?! Everyone thinks their playing in God level now. Bunch of IDIOTS.

It has just become fashionable to ridicule WB. Achieve 20-25% CAGR over 20+ years then talk about him. There are tons of strategies of making money. But instead of talking about their strategies some are just bad-mouthing. Only those who want to sell their services are targetting him to gain more customers.