Tanvir Gill charms Warren Buffett

Tanvir Gill, the young-looking and ultra charming editor of ET Now, has formidable interviewing skills. Unlike some of her peers who prefer to ask academic questions and beat around the bush, Tanvir goes for the jugular of the interviewee and extracts important and actionable information from him or her.

We saw a glimpse of this when Tanvir interviewed Mark Mobius, the legendary fund manager of Templeton Mutual Fund.

Mark Mobius has never offered a stock tip in his entire lifetime because he is prohibited from doing so under international SEC laws.

Yet, Tanvir boldly asked him for a stock tip in the form of a “Diwali gift” and Mark Mobius obliged by recommending Federal Bank as the ideal investment (see Mark Mobius Reveals Strategy For Picking Small-Cap Multibagger Stocks & Also Offers Stock Tip As Diwali Gift).

Needless to say, Federal Bank is surging like a rocket and has posted hefty gains since Mark Mobius’ recommendation.

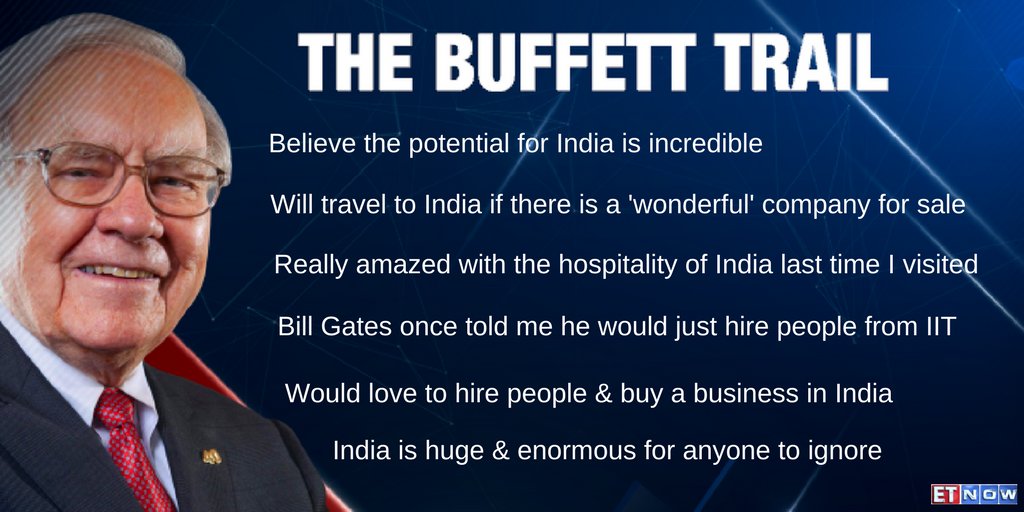

“Why haven’t you come back to India since 2011,” Tanvir asked Warren Buffett point blank, taking him by surprise.

Warren, who is normally very articulate, was at a loss for words.

“I do not like to travel …,” he mumbled, trying desperately to think of an appropriate answer, even as he glanced at Tanvir with grudging admiration.

“If you will tell me a wonderful company in India, I will hop on a plane,” he added quickly.

India has incredible potential

Warren Buffett is well versed with all that is happening in India. He opined that the numerous reforms passed by NAMO such as demonetisation, GST, bankruptcy code etc augers well for the Country.

“A lot is happening and that is good and I think the potential for India is incredible,” he said with a big smile on his lips.

Indian engineers are the best in the World

Warren Buffett made the astonishing revelation that when he asked Billionaire Bill Gates (the founder of Microsoft Corp) in 1991 that if he could only hire from one university in the world which would it be, Bill Gates unhesitatingly replied that he would hire an engineer from the IIT.

“It is astounding the number of brilliant people that I know from India. I would love to hire people from there, I would love to buy a business,” Warren said making it clear that he is very impressed with the Country.

Forget stocks, buy businesses

Warren took advantage of the occasion to drill some investing sense into us.

“What I really pay attention to is the businesses that we own. When we own shares or stocks, we do not think we own little stocks certificates, we think of owning parts of businesses,” Warren said, echoing the immortal words of Benjamin Graham, the author of the timeless treatise “The Intelligent Investor”.

Markets are not frothy or overvalued

Tanvir sensibly asked Warren whether the fact that the market cap of the US stock markets is trading at 1.5x the GDP makes it look frothy.

Warren’s answer is soothing. He explained that the valuations are not frothy or expensive because the interest rates are not high.

“If interest rates were say 6% for the long bond and 4% for short, I would say that the valuation would look quite high but against these interest rates, I would own stocks,” Warren said.

He added that low interest rates mean that investors have to choose between putting their money out at very low rates or buying common equities.

This implies that so long as the interest rates remain benign, there is no need for us to be anxious that the stock markets are overvalued.

Forget short-term, think long-term

Warren advocated his pet theory that one should buy and hold stocks forever.

“I buy wonderful businesses at a fair price. I do not pay attention to day to day markets, week to week markets. I do not know whether the price would go up or down. I never have had any ability to predict short-term market moves. But I do know over 10 years or 20 years we will do very well by owning those stocks”.

Never sell a wonderful business with the hope of buying it back cheaper

Warren touched upon the important question of when investors should sell a stock. He explained that if investors know the business well and think it has a wonderful future, it is better to be very slow about selling.

“If you are in a wonderful business, if you are in a wonderful marriage, you do not want to think too much about changing your partner,” he emphasized.

He also pointed out that investors sell their favourite stocks in the misconception that they can buy it back later at a cheaper price.

“You do not want to sell a stock just because you are going to think it is going to go down a little bit and you buy it back cheap. Maybe that works three times out of four but the fourth time you miss a long ride,” he said.

“I want a pretty compelling reason to move from one business to another. I would be slow to sell and very slow to sell very good business. I would not sell it just because it went up some,” he added.

Warren Buffett’s endorsement is in line with the views of other eminent luminaries

In my earlier piece (Forget Foreign Stocks; Buy Indian Stocks For Multibagger Gains) I pointed out how Mohnish Pabrai, who was at one time estranged from India, has become a champion for Indian stocks.

“I love what we own in India. We’ll make a lot of hay from our Indian holdings in the years ahead … We also have the highest exposure we’ve ever had to companies based in India (over $100 million or over 18 percent of the pie),” Mohnish has stated in his letter to the influential investors of Pabrai Funds.

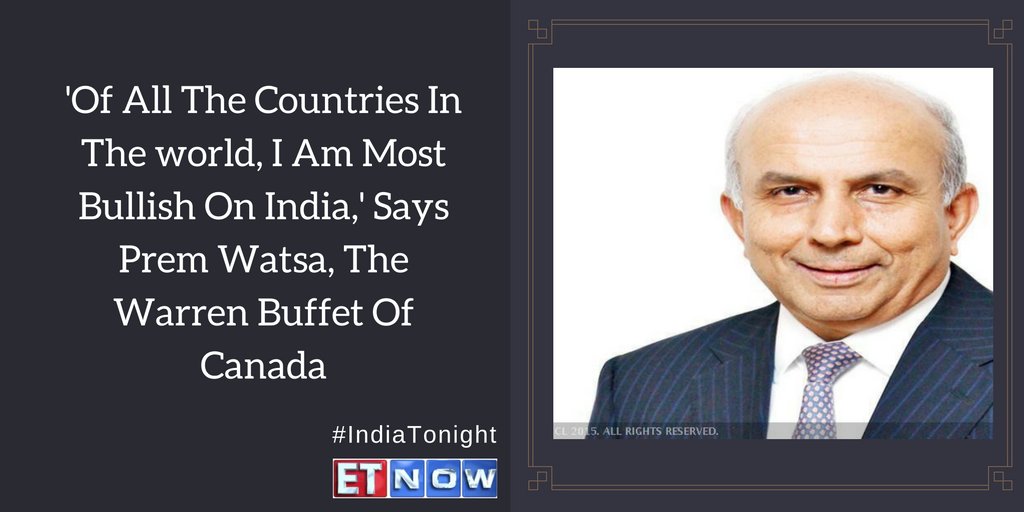

A similar opinion has been expressed by other illustrious investors such as Prem Watsa, Mark Mobius of Templeton, Hugh Young of Aberdeen, Bruce Flatt of Brookfield, Jamie Dimon of JP Morgan etc.

Conclusion

Warren Buffett’s endorsement of India as an investment destination will soothe the nerves of the foreign investors who were so far jittery about investing here. We can soon expect a massive inflow of funds to gush into the Indian stock markets. We have to be properly positioned to cash in on the impending bonanza!

If a lot of funds do gush in then I wonder what will they buy. Most midcaps are discounting even 2019 earnings by a hefty multiple. Only large caps can absorb such money. May be a Reliance.

As Buffet’s if interest rate is high then stock valuations at the current level is high. In India interest rates are high.

However, in a country like India cash flow from domestic saving to Equity market is very low. Currently flow in a increasing trend. So, a lot of IPOs are getting observed. In past it was observed that the flow increased before a crash as in 2008. Should one not invest?

Investing in equity market is always a calculated risk. One has to consider spare cash, duration of expected return, how well they understand a business and it’s prospect etc and take a informed decision. There is no denial that wise investment in Equity returns are the best for small investors over a period of time.